🚀 Altcoin Season Index Surges Past 30 as Bitcoin Clings to Dominance – Is a Crypto Power Shift Coming?

The crypto markets are buzzing as the Altcoin Season Index spikes above 30—a signal that smaller digital assets might be gearing up for a run. But Bitcoin isn’t ready to surrender the throne just yet, with its dominance still towering over the altcoin pack.

So what’s next? A full-blown altcoin rally, or just another false alarm for traders chasing the next moonshot? Here’s the breakdown.

### The Altcoin Awakening

When the Altcoin Season Index cracks 30, history suggests smaller tokens could be primed for explosive growth. Ethereum, Solana, and other major alts are already flexing—but can they sustain momentum?

### Bitcoin’s Iron Grip

Despite altcoins’ bullish signals, Bitcoin’s dominance remains stubbornly high. The king of crypto isn’t yielding ground easily, leaving traders wondering if this is just another head-fake before BTC reasserts control.

### The Big Question: Rotation or Retrace?

If capital starts flooding into altcoins, we could see a historic shift. But with institutional money still laser-focused on Bitcoin, don’t count on Wall Street’s crypto darling fading quietly. After all, when have hedge funds ever missed a chance to overhype an asset class?

One thing’s certain: the next few weeks will separate the diamond hands from the paper-handed gamblers. Buckle up.

Altcoin Season Index Fires Into The Green

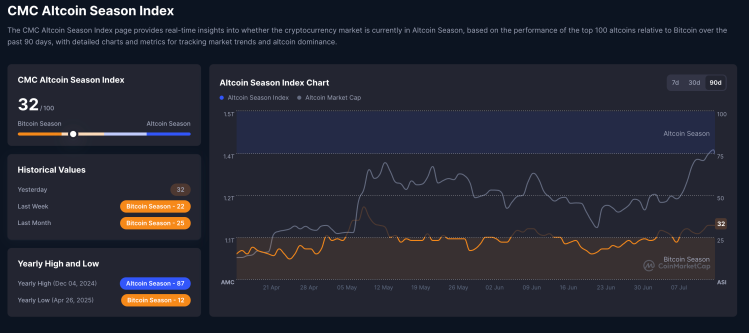

The Altcoin Season Index is an index that charts the performance of the Top 100 altcoins by market cap against the performance of Bitcoin to determine when the altcoin season is in full bloom. This index, which goes from 1-100, is ranked by how many top 100 altcoins are outperforming BTC over a 90-day period, and when this figure rises to the 75% mark, it often signals that the altcoin season has begun.

Over the last few months, altcoins have performed quite terribly in comparison to Bitcoin, and this has led to the Altcoin Season Index dropping toward peak lows. The index hit a score of 12 back in June 2025, showing that only 12 altcoins had outperformed bitcoin over the 90-day timeframe. During this time, the Bitcoin dominance also rose rapidly, reaching as high as 66%, and signaling that most of the attention was on BTC during this time.

However, the month of July has come with good tidings for the altcoin market as the index has seen its score more than double from its June lows. According to data from CoinMarketCap, the Altcoin Season Index has now crossed a score of 30. It also shows that during this time, 32 coins have outperformed Bitcoin’s 40% increase in the last three months.

Interestingly, the meme coins are once again leading the rally with the likes of PENGU and MemeCore rallying over 500% in the 90-day period. HyperLiquid’s HYPE has also performed quite well, with CoinMarketCap data showing it has risen more than 230% in 90 days.

Bitcoin Dominance On The Verge Of Collapse?

So far, the Bitcoin dominance has maintained its position in the 60th percentile, and this has remained so for the last 90 days. However, over the last two weeks, there has been enough decline in the dominance to spark a RAY of hope among investors, and that is a 3% drop toward 63%.

Going by historical performance, though, the Bitcoin dominance WOULD need to drop much more than this for altcoin season to begin in full bloom. For example, back in 2017, the Bitcoin dominance crashed from above 95% to around 50% before the altcoin season began. Again, in 2017, the dominance fell from above 70% to around 41% before the altcoin season began.

Going by this trend, the Bitcoin dominance would need to see a drop back into the 40% region, and possibly the 30% region, for the altcoin season to really take hold. But as long as the dominance remains high, then Bitcoin would continue to lead the market, and altcoins could continue to struggle.