SharpLink Gaming Goes All-In: $73M Ethereum Purchase Signals Big Money Betting on the Dip

Smart money isn't just watching—it's loading up. SharpLink Gaming just dropped a $73 million vote of confidence in Ethereum, proving once again that the big players buy when retail panics.

Why This Move Matters

While crypto Twitter debates 'the bottom,' institutional whales are quietly accumulating. This isn't some speculative altcoin gamble—it's a nine-figure bet on Ethereum's infrastructure dominance.

The Cynical Take

Of course they bought the dip—they probably helped create it. Nothing moves markets like nine zeros hitting an order book. Meanwhile, your portfolio still hurts from last week's leverage play.

SharpLink Becomes Largest Public ETH Holder With $611M in Ethereum

SharpLink Gaming has officially become the largest publicly known holder of Ethereum, with total holdings now reaching 205,634 ETH, valued at approximately $611 million. This milestone positions the Nasdaq-listed company at the forefront of institutional ethereum adoption, setting a new benchmark for corporate treasury strategies in the crypto space.

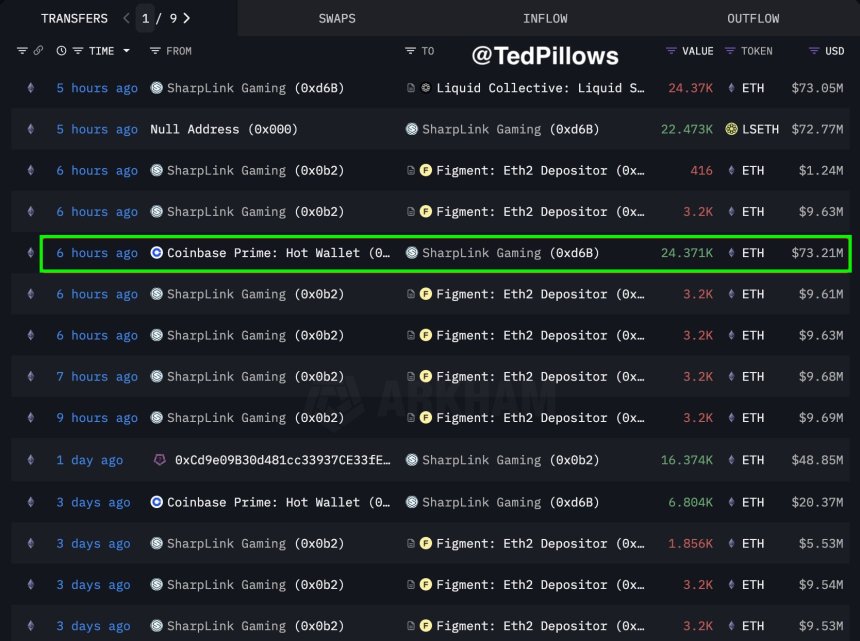

Top analyst Ted Pillows confirmed the latest purchase through on-chain data, revealing that the transaction originated from a Coinbase Prime hot wallet, commonly used by institutions for large-scale acquisitions. This move signals increasing confidence in Ethereum’s long-term value, particularly as companies begin diversifying beyond Bitcoin to gain exposure to smart contract infrastructure.

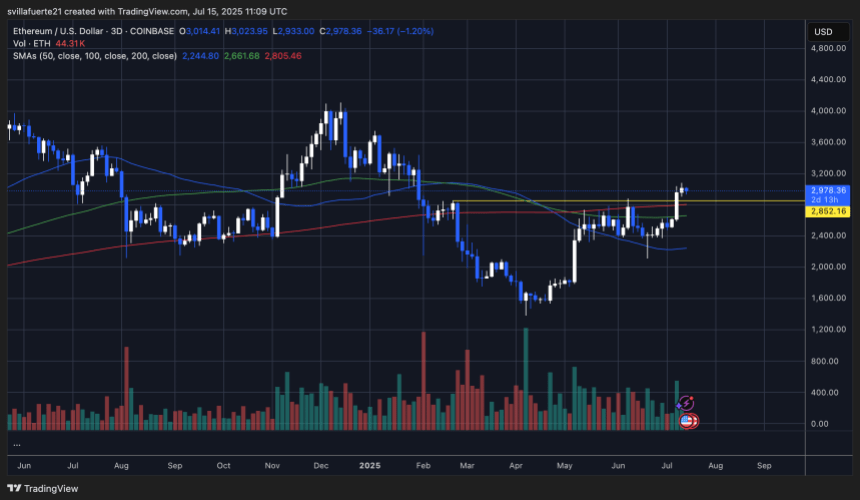

Ethereum’s technical setup remains strong, with price holding well above the $2,850 support zone following its recent move to $3,080. At the same time, fundamentals continue to improve. The ETH supply staked has reached new all-time highs, indicating that more long-term holders are locking up their assets rather than selling into strength. Combined with increased institutional interest, this reflects growing conviction in Ethereum’s role as a foundational LAYER for Web3.

The coming weeks promise to be pivotal. With market sentiment turning bullish and Ethereum gaining traction in corporate circles, the stage is set for a sustained upward move, especially if broader macro and regulatory conditions remain favorable.

ETH Holds Above Key Breakout Zone

Ethereum’s 3-day chart shows a bullish continuation pattern, with price currently holding at $2,978 after recently breaking through a critical resistance zone at $2,850. The breakout marked a shift in momentum following a prolonged consolidation phase and pushed ETH to a local high of $3,041.41. Although a slight retracement followed, the current structure remains strong as bulls successfully defend the $2,850–$2,900 area.

This level is particularly important as it aligns with multiple technical indicators. The 200-day simple moving average (SMA) sits at $2,805.46, now acting as dynamic support. ETH also remains well above the 50-day and 100-day SMAs, currently at $2,244.80 and $2,661.68, confirming that the broader trend has turned bullish.

Volume remains elevated, suggesting continued buying interest on dips. If ETH holds above $2,850 in the coming sessions, the next logical target is the $3,300–$3,500 zone, where previous highs and psychological resistance converge.

Featured image from Dall-E, chart from TradingView