Bitcoin’s Delayed Bull Run Could Skyrocket Prices Beyond Predictions

Hold onto your wallets—Bitcoin's bull market is playing hard to get, and that might just be the rocket fuel it needs.

Why the delay equals bigger gains

When markets take their sweet time, they often build pressure like a coiled spring. Traders sidelined by FOMO now face a brutal choice: chase at higher levels or watch the train leave the station.

The institutional wildcard

Wall Street's latecomers—always fashionably tardy to the crypto party—could dump billions into BTC just as retail investors start paper-handing. Classic hedge fund move: arrive late, overpay, and call it 'strategic allocation.'

Technical breakout territory

Every week of consolidation above key support levels turns former resistance into launchpads. The longer this drags on, the more violent the upside breakout when it finally comes.

Remember: in crypto, the market takes the stairs down and the elevator up. This elevator's just making extra stops before the moon shot.

Why The Bull Market Delay Might Be Good News

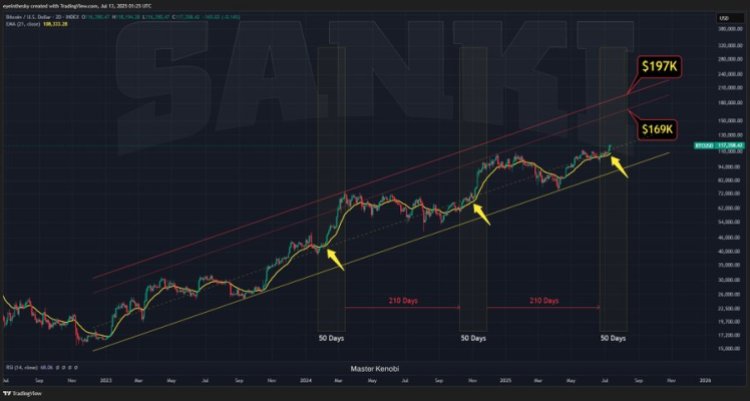

Global uncertainties have delayed the second and possibly final phase of the current bull market in cryptocurrencies. According to master kenobi’s post on X, he noted that these delays may end up working in our favor.

While Bitcoin and altcoins have remained within the boundaries of an ascending trend channel, the upper and lower limits of this channel are steadily rising, and showing resilience in market structure despite the external hesitation. If the second phase of the bull market ignited in April, projections suggest that the BTC upper limit might have topped out between $134,000 and $155,000.

However, as this didn’t happen, the upper limit has continued to climb, and if the 50-day pump pattern holds, the upper limit could be reached around August 11, at a range of $169,000 and $197,000. Naturally, this requires relative global stability. “Let’s hope for another 30 days of calm, as 20 days have already passed,” the analyst added.

Why Bitcoin Surge Is A Market-Wide Trigger

In an X post, Davie Satoshi also mentioned that bitcoin is on the verge of something big, that BTC is hovering in the middle of a multi-year bullish channel. It has been marked by long-standing green trendlines, and has just broken through the resistance level, which is indicated by a blue dotted horizontal line that has capped upside momentum until now.

Every time the Stoch Relative Strength Index (RSI) crosses over on the monthly chart, it leads to an explosive rally, and with the crossover freshly triggered, many see this as the start of something big and not just for Bitcoin.

The analyst stated that a rising tide lifts all boats, and that Bitcoin has always been the bellwether of the crypto market. They also suggest that BTC price could surge toward $180,000 to $200,000, with a potential top forming around late August to September, which will be followed by alt season and peaking in Q4 2025 to Q1 2026.

The memecoins and altcoins continue to dominate the narrative in the crypto space this year. The next NFT season two will begin in January 2026, followed by the Bitcoin Ordinals in mid-year 2026. “It’s always a cycle, and Not Financial Advice, so gamble responsibly,” he added.