Pump.fun Token Skyrockets in Pre-Market—Yet Whales Are Betting Against It. What’s the Play?

The Pump.fun token is defying gravity in pre-market trading—but crypto’s big players are quietly stacking short positions. Here’s why the smart money might be hedging against retail frenzy.

### Whale Watching: Contrarian Bets or Insider Play?

While retail traders pile into Pump.fun’s pre-market surge, on-chain data reveals whales accumulating bearish derivatives. Are they seeing something the crowd isn’t—or just playing the greater fool theory to perfection?

### The Meme Coin Paradox

Pump.fun’s 24-hour volume suggests explosive retail interest, but seasoned traders know meme token rallies often end in tears—and leveraged liquidations. The whale activity hints at a classic ‘pump-and-dump’ script playing out in real time.

### The Cynic’s Take

In crypto, the only thing faster than a token’s ascent is the speed at which ‘alpha’ becomes common knowledge—and then a trap. As one degenerate trader put it: ‘The house always wins, especially when it’s rigged with smart contracts.’

Perpetual Market Signals Whale Hedging Strategy

Three prominent wallets have collectively deposited over $11 million in USDC on Hyperliquid to open short positions on the newly listed PUMP perpetual contract. These trades appear to function as hedges against anticipated allocations in the upcoming token generation event.

According to on-chain tracker Lookonchain and explorer Hypurrscan, the structure of these positions, utilizing low leverage and modest open interest compared to margin collateral, suggests a defensive rather than speculative stance.

One wallet, identified as “0xAc72,” allocated $4 million in margin and opened a 2x Leveraged short valued at approximately $1.07 million at an entry price of $0.00504.

This trader’s liquidation point sits at $0.02138, offering a wide buffer that implies the position is less about profit from a downturn and more about offsetting potential downside risk from PUMP exposure in the ICO.

Two additional wallets deployed a combined $7 million in margin to open 1x leveraged shorts. Together, these positions amount to roughly $2.39 million in open interest, a small portion of their posted collateral.

Hyperliquid’s open interest in PUMP has surpassed $43 million since listing the token in the early hours of Thursday’s European session. Binance followed suit by listing a PUMP perpetual contract, which quickly amassed over $12 billion in trading volume, indicating heightened market anticipation.

It is worth noting that the early trading could serve multiple purposes, including valuation locking by whales, arbitrage strategies related to expected airdrops, or speculative profit-taking based on retail momentum.

Pump.fun Token Launch Nears as Pricing Premium Narrows

The PUMP token initially debuted in pre-market trading at a roughly 40% premium to its ICO price of $0.004. It reached a high of $0.0056 on Hyperliquid before retreating to around $0.0047 levels, a level closer to its public sale valuation.

The narrowing premium suggests a recalibration in investor expectations as trading stabilizes ahead of the launch. Pump.fun, a meme-coin launchpad built on Solana, announced the token in June alongside a revenue-sharing initiative for token holders.

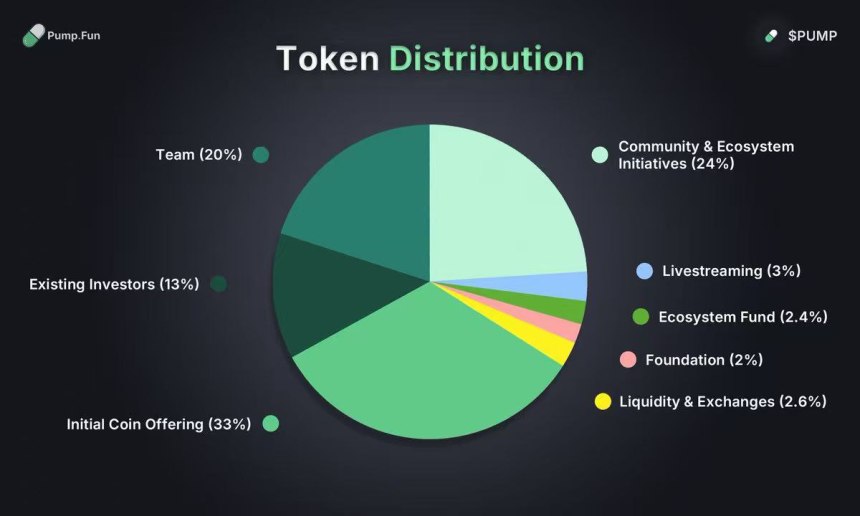

The token has a total supply of 1 trillion, with 33% allocated to early participants via a private sale (18%) and public sale (15%). The ICO will run from July 12 to July 15 on crypto exchange Bybit, providing a limited window for broader participation.

While details of the airdrop mechanics have not been fully disclosed, the ongoing activity suggests that large holders are actively managing their exposure before the distribution phase begins.

Featured image created with DALL-E, Chart from TradingView