Bitcoin’s Bull Run Holds Strong—But Binance Whales Signal Impending Dip

Bitcoin keeps defying gravity—until you check the exchange flows.

The Unstoppable vs. The Unstable

BTC’s macro uptrend remains rock-solid, but Binance’s order books flash warning signs. Whale deposits hit a 3-week high—classic profit-taking behavior before a pullback.

Liquidity Games 101

Market makers love this dance: let retail FOMO in, then trigger stop-losses on the way down. Rinse. Repeat. Meanwhile, crypto bros still think ‘this time is different.’

The Cynic’s Corner

Remember: in traditional markets, this would be called ‘market manipulation.’ In crypto? Just another Tuesday.

Bitcoin Remains Bullish But Some Pullback Expected

According to a recent CryptoQuant Quicktake post by contributor BorisVest, early warning signs suggest that BTC may face a brief correction. The analyst noted that if momentum doesn’t pick up soon, Bitcoin could struggle to maintain its bullish trajectory.

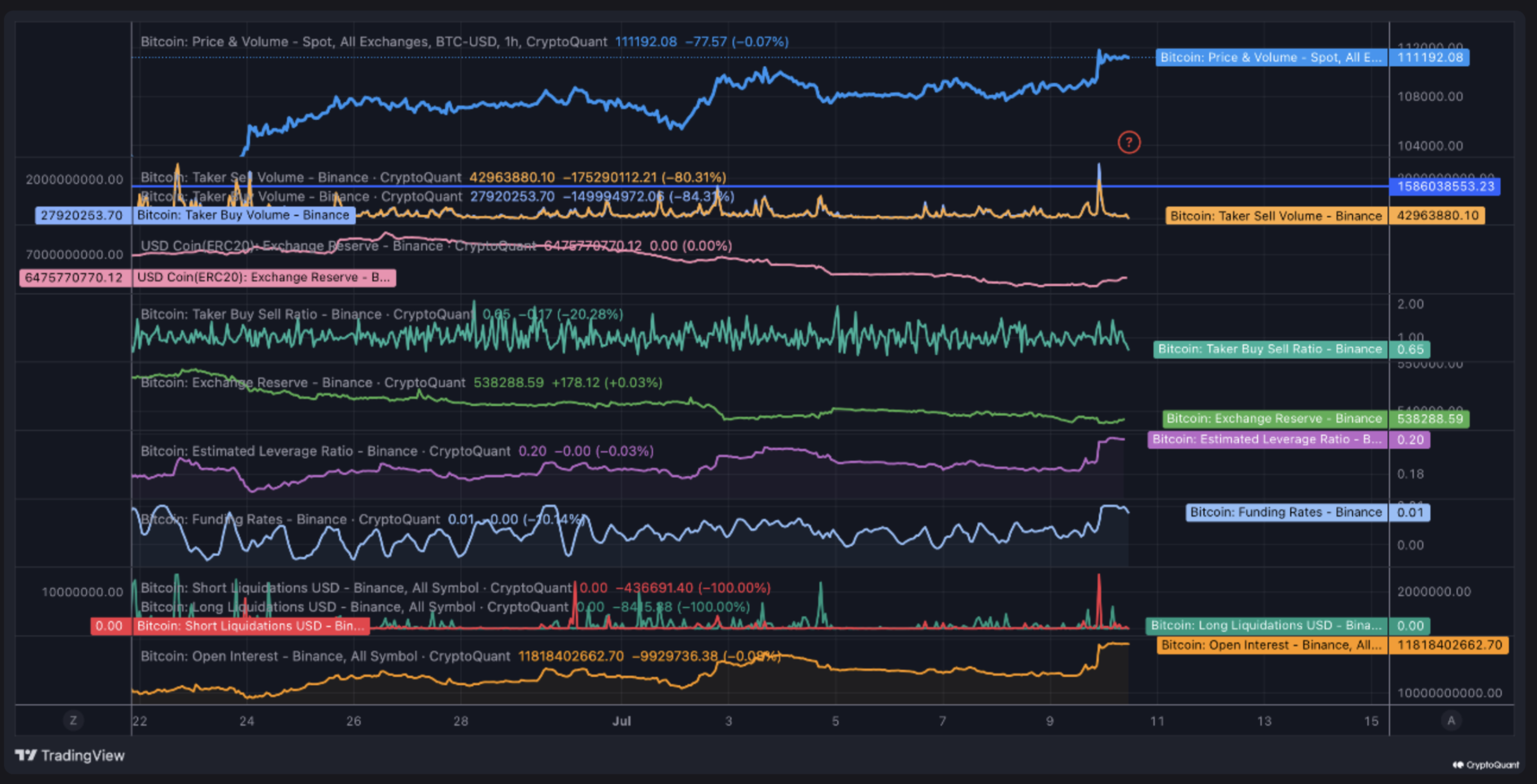

Binance taker buy/sell volume has shown a noticeable spike in aggressive buy orders – usually a bullish signal – but sell volume has also risen in tandem, effectively absorbing most of the demand. Despite this uptick in buy volume, BTC’s price has not responded proportionally, suggesting distribution or selling pressure.

For the uninitiated, Binance taker buy/sell volume measures the amount of aggressive buying versus selling on the exchange using market orders. A higher taker buy volume indicates strong buyer interest, while higher taker sell volume signals stronger selling pressure.

In addition, Binance open interest has surged during the recent price rally, signalling an influx of Leveraged positions. While rising open interest can support further gains, the subdued price reaction raises concerns about Bitcoin’s short-term strength.

Meanwhile, funding rates have stayed mostly neutral throughout the rally. However, the most recent push to a new ATH saw BTC’s funding rates turn slightly positive, hinting at increasing long exposure and renewed bullish sentiment.

The breakout also triggered significant short liquidations, likely fuelling a short squeeze. Data from Coinglass shows that over the past 24 hours, $521 million in positions were liquidated – $448 million of which were shorts.

Market Needs A Breather Before Climbing Higher

Concluding, the CryptoQuant contributor noted that despite the emerging signs of caution, Bitcoin’s overall bullish structure remains intact. However, the market is now seeing the early signs of a potential short-term pullback, especially due to the spike-driven nature of the move.

Other analysts share a similar outlook for BTC. For example, crypto analyst Christian Chifoi suggested that the current price action may be a deceptive move designed to trap bullish traders – potentially pushing BTC down to $97,000 before the final rally begins.

That said, the recent weakness observed in the US Dollar Index (DXY) has fuelled hopes for a capital reallocation to alternative assets, including BTC. At press time, BTC trades at $110,885, up 1.1% in the past 24 hours.