Sei Network Smashes $626M TVL Milestone – Now Gatecrashing Japan’s Crypto Party

Sei just pulled a regulatory judo flip on Japan's notoriously strict crypto market—landing with a $626M TVL thud that's got traders buzzing.

Breaking down the shogunate's barriers

The chain's strategic compliance play bypasses Japan's FSA red tape through a partnership with local exchange heavyweight HashKey—proving once again that in crypto, the house always wins... until the next protocol rewrites the rules.

Why this isn't just another Asian expansion play

Unlike chains that treat regulatory approval like an ICO-era afterthought, Sei's methodical market entry shows institutional-grade maneuvering. That $626M war chest? Suddenly those "stablecoin-friendly infrastructure" claims don't sound like another whitepaper fantasy.

The real test comes when salarymen start trading memecoins between pachinko sessions—that's when we'll know if the TVL stays sticky or gets lost in translation.

Sei Network TVL Rockets

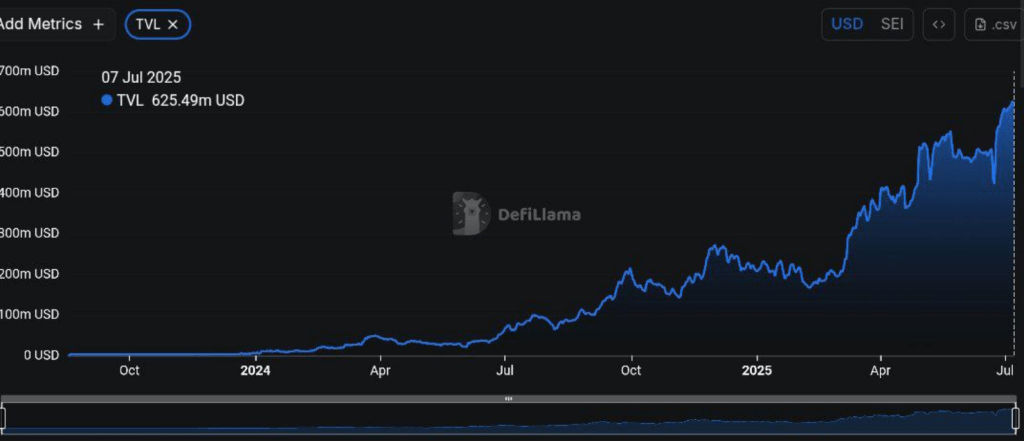

According to DeFiLlama, TVL on Sei surged from roughly $60 million in January 2024 to almost $700 million at its peak. That represents nearly a 10 × gain in just six months—growth most rival chains only manage in single‑digit or low double‑digit jumps of 10–50 % over the same stretch. Based on reports by crypto fans on X, this kind of TVL swing is very rare in today’s tight market.

$SEI just set a new all-time high for Total Value Locked, climbing past $625 million.![]()

More capital flowing in, more on-chain activity picking up – the Sei ecosystem’s clearly pulling in fresh attention. pic.twitter.com/xqruXfoqVn

— Kyledoops (@kyledoops) July 7, 2025

On‑Chain Activity Picks Up

Crypto observer Kyledoops shared that daily transfers and smart‑contract calls on Sei have climbed steadily. “More capital is flowing in and on‑chain actions are rising,” he wrote.

Some market observers say that some parts of the ecosystem saw 10–50 % jumps in TVL, with a few protocols posting even bigger gains. This buzz comes at a time when many DeFi projects are struggling to grow.

Based on reports, a key boost arrived when Sei earned approval from the Japan Financial Services Agency. That nod gives it a regulated path into one of the world’s strictest crypto markets.

Artemis Analytics noted that daily active addresses hit a two‑year high right after the JFSA greenlight. Institutions are said to be taking a closer look at trading and custody options in Tokyo.

$SEI just received approval from Japan’s FSA

It is required in Japan to be listed on exchanges so quite important.

Once XRP received this, it had a HUGE rally![]() @SeiNetwork

@SeiNetwork![]()

— Gordon (@AltcoinGordon) July 4, 2025

Price Swings Test SupportSEI’s token price more than doubled in June after a US government‑backed stablecoin pilot was announced and after SEI Labs proposed SIP‑3, a shift to an EVM‑only chain.

Even with that jump, the coin still sits about 78 % below its March 2024 peak, trading around $0.26 today. Some technical analysts point to a chart floor at $0.25. A breach there could push SEI closer to $0.20, which WOULD put pressure on holders who bought in at higher levels.

Sei Price ForecastAccording to current projections, SEI is set to drop by 25% and reach $0.19 by August 8, 2025. Based on technical indicators, market sentiment remains Bullish while the Fear & Greed Index sits at 66 (Greed).

Over the last 30 days, SEI logged 17/30 (57%) green days and saw 19% price swings in that window. These figures suggest that short‑term dips could be sharp, but buyers may view lower prices as a chance to get in.

Featured image from Unsplash, chart from TradingView