$6 Billion Floods Ethereum: Institutional Giants Bet Big on Tokenized Funds

Wall Street meets Web3—and this time, they brought their checkbooks. Ethereum just locked in a staggering $6 billion surge in tokenized fund inflows as traditional finance heavyweights dive headfirst into crypto's most lucrative playground.

The institutional stampede is on

BlackRock's digital asset pivot looks prescient now. Hedge funds, pension managers, and—yes—even cautious banks are racing to tokenize real-world assets on Ethereum's blockchain. The smart money's betting that programmable finance will eat Wall Street's lunch.

Tokenization 2.0: No longer just proof-of-concept

Forget the experimental phase. This $6 billion avalanche proves real-world assets—from treasury bonds to private equity—are going chain-native. The killer app? Instant settlements, 24/7 markets, and that sweet, sweet yield even Vanguard can't spin as 'transitory.'

Watch the suits scramble

Goldman's probably drafting a 200-page compliance memo as we speak. Meanwhile, Ethereum's network effects turn vicious—every new tokenized fund makes the next one easier to launch. The old guard can either adapt or watch their fees get arbitraged into oblivion by DeFi's robot armies.

One cynical footnote: Nothing unblocks corporate treasury wallets faster than FOMO and the fear of being outflanked by a 23-year-old crypto degenerate.

Top Firms Drive Token Growth

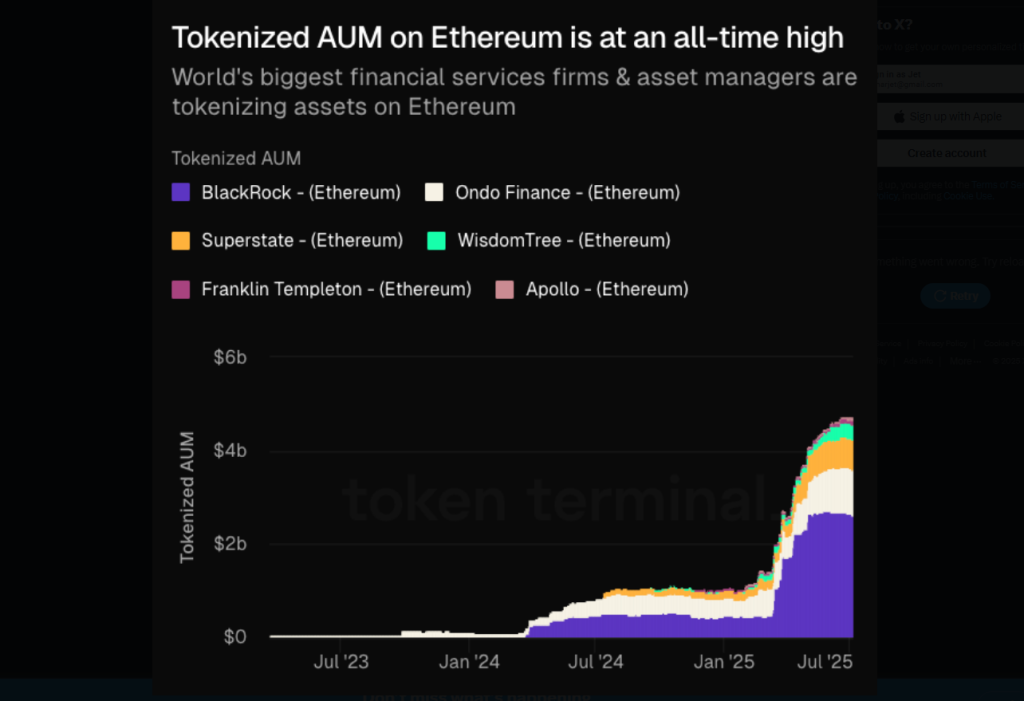

BlackRock leads the pack. The world’s largest asset manager holds the biggest share of tokenized AUM on Ethereum. Close behind are Franklin Templeton, WisdomTree, Superstate, Apollo and ONDO Finance. Franklin Templeton focused on parts of its US Government Money Fund.

WisdomTree launched funds you can buy through a mobile app. Superstate and Apollo each add smaller but steady sums. Based on reports, these six names together make up most of the $6 billion milestone.

Tokenized AUM on @ethereum is at an all-time high

World’s biggest financial services firms & asset managers are tokenizing assets on Ethereum pic.twitter.com/5Xl4XXYQ3O

— Token Terminal![]() (@tokenterminal) July 6, 2025

(@tokenterminal) July 6, 2025

Adoption Speed Since Mid-2023

The climb didn’t happen in a day. Adoption started slowly around mid‑2023. It ROSE further in early 2024. Then by January 2025, the line on the stacked chart shot straight up.

That jump comes as BlackRock and Franklin Templeton pour in fresh tokens. Faster trades and fewer middlemen are big draws. Trades that once took days can now settle in minutes or seconds. That kind of speed appeals to big investors, who want clarity and a clear audit trail.

This push into tokenized finance shows a shift in how big firms manage money. Ethereum still faces questions about scaling. If gas fees jump again, trading costs could rise sharply.

On Rules & New Fund TypesRegulators in the US, Europe and Asia have yet to set clear rules. A clampdown in one region might push firms toward other chains or private blockchains. Competition from Solana, Avalanche and new networks is already heating up.

With $6 billion on‑chain, tokenized assets are past the trial stage. More firms will likely join once rules firm up and scaling solutions roll out. Markets could see new fund types, cross‑border trades and on‑chain yield tools. For now, Ethereum holds the lead. Yet the next hurdles—fee pressure, rule making and rival chains—will test whether it can keep growing.

Featured image from Meta, chart from TradingView