Bitcoin Exodus Accelerates: Are Investors Betting Big on Long-Term Value?

Exchange wallets are bleeding Bitcoin—and the market's taking notice. As outflows hit record highs, a clear signal emerges: hodlers aren't budging.

Why the mass migration? Three theories fueling the frenzy:

1. The ETF effect - Institutions keep stacking sats like there's no tomorrow (because fiat might not be).

2. Halving hype 2.0 - That 2024 supply crunch just got realer.

3. Defiance against traditional finance - Because nothing says 'stick it to the man' like self-custody.

Meanwhile, Wall Street analysts still can't decide if BTC is 'digital gold' or 'a speculative asset'—proving only that suits will hedge even their opinions.

One thing's certain: when coins leave exchanges, price fireworks usually follow. Whether that's sustainable or just another cycle? Even the chart gods won't say.

Bitcoin Exchange Inflow/Outflow Ratio Below 1: On-Chain Analyst

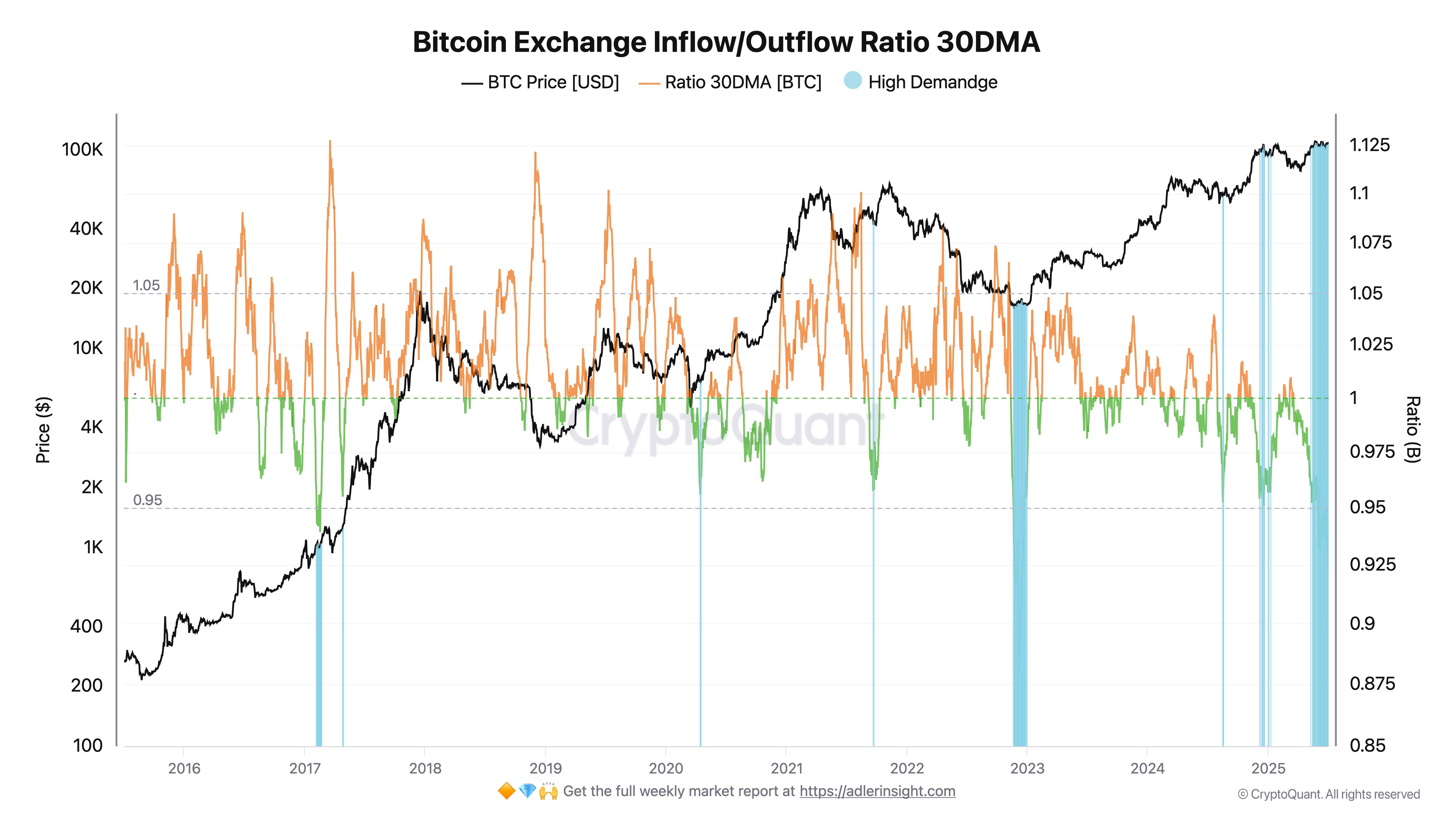

In a July 5 post on the X platform, an on-chain analyst with the pseudonym Darkfost revealed that Bitcoin has continued to flow out of centralized exchanges over the past few months. The online crypto pundit mentioned that this trend reflects the growing confidence of investors in the long term.

This on-chain observation is based on the bitcoin exchange Inflow/Outflow Ratio 30DMA, a metric that measures the volume of BTC flowing in and out of centralized exchanges over a period of 30 days. A high ratio (>1) indicates more inflows than outflows into exchanges, signaling increased selling pressure for the premier cryptocurrency.

On the other hand, a low ratio (

According to Darkfost, the bitcoin monthly outflow/inflow ratio recently fell to around 0.9, its lowest level since the bear market of 2023. With the metric now beneath the 1 threshold, it means that Bitcoin exchange outflows are dominant, reflecting a strong and sustained demand on the spot market.

The on-chain analyst said:

As of today, demand remains present as outflows continue to dominate, with a growing number of long-term holders stepping in.

Ultimately, Darkfost believes that the confidence being shown in Bitcoin’s long-term promise is expected, considering the growing adoption by major corporations and governments, most notably in the United States. “BTC is gradually evolving into a store of value, increasingly used to strengthen treasury strategies,” the crypto analyst added.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $108,103, reflecting a mere 0.3% increase in the past 24 hours.