Tron’s DeFi Boom: SunSwap Shatters $3B Monthly Swap Volume in 2025

TRON’s DeFi ecosystem just hit warp speed—SunSwap rockets past $3B in monthly swaps as traders flee Ethereum’s gas fees like a bank run.

Why it matters: While Wall Street still debates 'blockchain utility,' TRON’s DEX is quietly eating Ethereum’s lunch—one low-fee swap at a time.

The fine print: That $3B figure isn’t vanity metrics—it’s real volume from yield farmers and arbitrage bots chasing APYs that make traditional savings accounts look like medieval relics.

Bottom line: In a world where 'institutional adoption' moves at glacial speeds, SunSwap proves DeFi’s killer app remains simple: move money fast, cheap, and without asking permission.

Tron DeFi Growth Signals Underlying Strength

Tron is testing critical price levels after months of sideways movement, consolidating between $0.211 and $0.295. This range has acted as a structural base since late 2024, and a clean break in either direction could determine Tron’s next major trend. A breakout above $0.295 WOULD likely trigger fresh momentum toward new local highs, while failure to hold support could expose the asset to deeper corrections.

While the broader crypto market anticipates upward expansion—supported by the rally in US equities and a more stable macro backdrop—Tron remains trapped in this tight band. Volatility persists, and without a decisive breakout, market participants remain cautious. Still, underlying fundamentals suggest TRX may be quietly gathering strength.

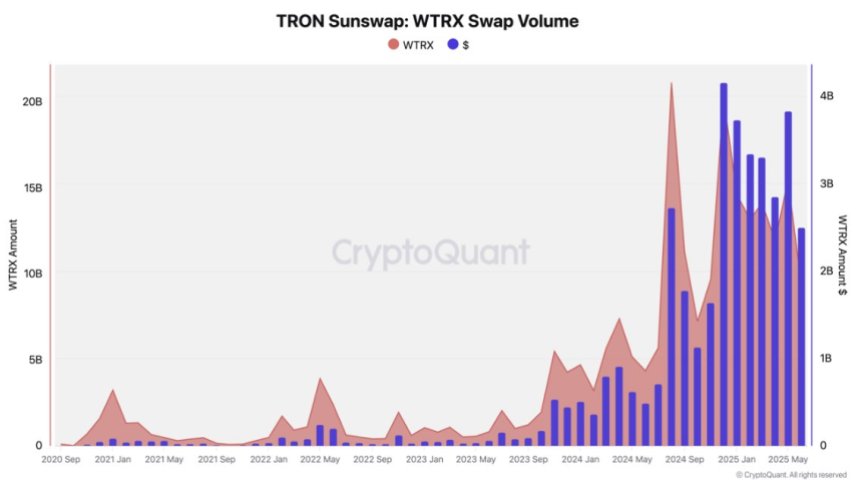

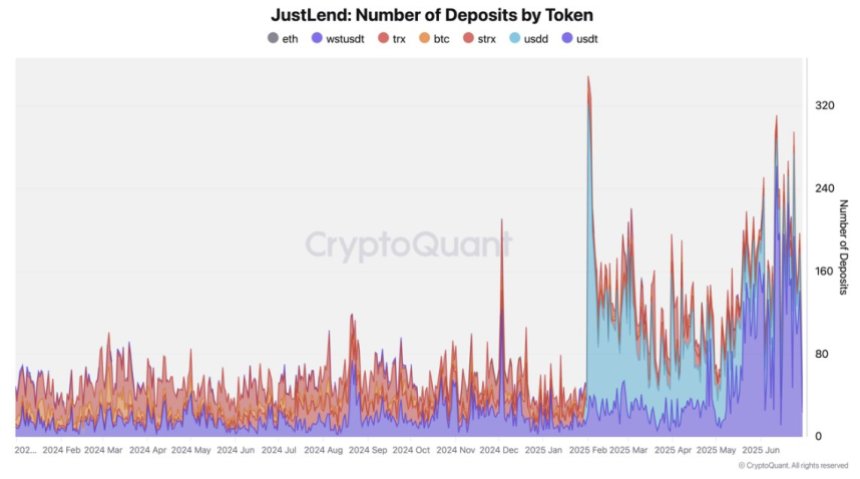

According to CryptoQuant data, DeFi activity on the Tron network is rising rapidly. SunSwap has surpassed $3 billion in monthly swap volume consistently throughout 2025, with May setting a record at $3.8 billion. Meanwhile, JustLend deposits have more than tripled year-to-date, peaking at $740 million. These developments point to deepening liquidity and growing demand across Tron’s DeFi ecosystem.

Stablecoin inflows and increasing borrowing activity further reinforce Tron’s expanding utility, suggesting the network is becoming a robust settlement layer. While the price remains range-bound for now, the fundamentals hint at a strong foundation for future upside, once the technical breakout finally materializes.

TRX Price Consolidates Near Resistance

TRX is currently trading around $0.2813, maintaining its position NEAR the upper boundary of the long-standing consolidation range that began in December 2024. The asset has shown resilience above the 50-day, 100-day, and 200-day moving averages, all of which are trending upward, supporting the bullish outlook. The 50-day SMA at $0.2508 and the 100-day SMA at $0.2289 are providing dynamic support, indicating strong buyer interest on dips.

Price action throughout June remained sideways, with low volatility and volume consistent with a classic consolidation phase. Despite multiple rejections below the $0.295 resistance, TRX has not shown any signs of structural weakness, holding firmly above $0.26–$0.27 and gradually building pressure toward a breakout.

Volume has remained stable, though not yet signaling the kind of breakout momentum that would confirm a MOVE into higher price discovery. Traders are watching closely for a clean candle close above $0.295 to validate a bullish continuation. If successful, TRX could rally toward the $0.32–$0.35 zone, with minimal overhead resistance.

Featured image from Dall-E, chart from TradingView