Bitcoin Defies Gravity: Holds Firm Above 50-Day SMA as Bulls and Bears Battle for Control

Bitcoin's proving it's got backbone—trading firmly above its 50-day moving average while the market holds its breath. No crystal ball needed to see the tension: this is a knife-edge moment for BTC.

The SMA showdown

That 50-day line isn't just technical poetry—it's become the battleground where short-term traders and long-term believers clash. Break above? Rocket fuel. Breakdown? Cue the 'I told you so' chorus from Wall Street dinosaurs.

Volatility is the only certainty

Price swings wider than a hedge fund's moral compass should surprise nobody. Bitcoin's done this dance before—consolidation before explosive moves, whether up or down. Pro tip: The 'smart money' is usually late to the party anyway.

One thing's clear: While traditional markets obsess over quarterly reports, Bitcoin's writing its own rules—again. Whether that means breakout or breakdown, grab your popcorn. The 50-day SMA is just the opening act.

RSI Holds Neutral As Bitcoin Awaits A Clearer Signal

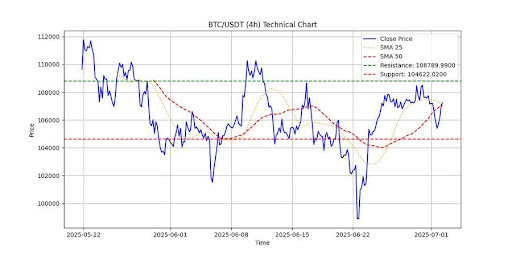

According to Shaco AI, in a recent update on X, Bitcoin is currently hovering around $107,264.17, positioning itself just above two key moving averages. It’s nudging the 25-day SMA at $107,229.82 and holding slightly above the 50-day SMA, which sits at $107,040.81. This positioning reflects a mild bullish bias in recent sessions, keeping both bulls and bears on alert.

Looking at momentum indicators, the Relative Strength Index (RSI) is resting at 53.36—firmly in neutral territory. This suggests that bitcoin is neither overbought nor oversold at the moment, offering no strong directional clues as it keeps the market guessing.

Furthermore, the Average Directional Index (ADX) adds to this indecisive mood, coming in at a soft 20.44. This low reading signals a weak trend, meaning there’s not enough force from bulls or bears to drive a clear breakout just yet. In other words, the market isn’t leaning heavily in either direction.

Meanwhile, the Moving Average Convergence Divergence (MACD) remains in negative territory at -137.33. Although it isn’t signaling any strong downward momentum, traders may want to stay cautious and alert for any sudden shift in the current tone.

Despite the technical indecision, market activity is picking up. Bitcoin’s recent trading volume has surged to 1903.51, well above the average of 1522.43. This uptick signals a rise in interest and participation, indicating that traders are actively positioning themselves in anticipation of Bitcoin’s next move.

Critical Zones At Play As Market Prepares For A Directional Push

Looking at key levels, Shaco AI highlighted that resistance is at $108,789.99, which seems to be a strong level to overcome. The level marks a significant ceiling for Bitcoin, and any attempt to push higher will need solid momentum to break through. On the other hand, support lies at $104,622.02. This support level will be critical in case the price begins to retreat, as a breakdown here could open the door for further downside.

Based on current indicators, the analyst suggests it’s wise to keep an eye out for potential movement in either direction. With volume picking up, Bitcoin may soon test either the resistance above or fall back to support, depending on how momentum develops in the coming sessions.