Bitcoin Long-Term Holders Hit Critical Pain Threshold—First Since October 2024

Diamond hands are sweating. Bitcoin's staunchest HODLers now face pressure levels not seen since the pre-bull run days of October 2024—back when Wall Street analysts still thought CBDCs stood a chance.

Key pain points resurface

The same psychological resistance that shook out weak hands nine months ago is back. This time, it's testing the resolve of veterans who survived the last 30% correction. On-chain data shows long-term holders (LTHs) now sit on paper losses that could trigger another wave of capitulation.

Market makers smell blood

Liquidity sharks are circling as LTH supply tightens to October 2024 levels. The last time this happened, BTC bounced 150% in four months—but not before liquidating over-leveraged retail traders who mistook 'buy the dip' for a financial plan.

History doesn't repeat, but it rhymes

Whether this becomes a springboard or quicksand depends on who blinks first: institutional buyers waiting for sub-$50k entries, or retail investors finally accepting their 'generational wealth' might need another generation to materialize.

Lower Profit Levels Than Previous Peaks

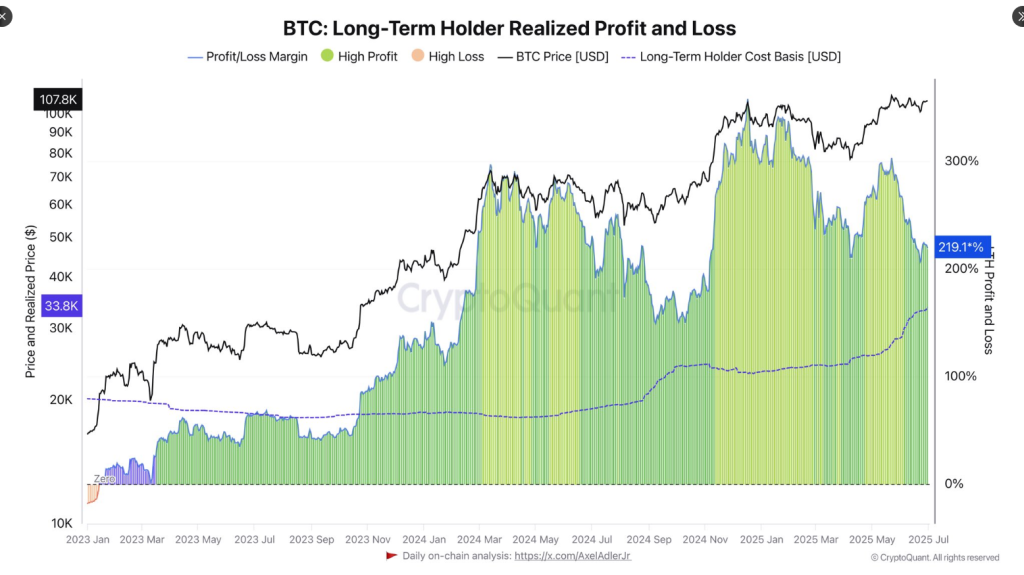

Darkfost used the MVRV ratio — market value relative to the average cost paid by long‑term holders — to track these shifts. In March 2024, when bitcoin pushed up to $74,500, MVRV hit 300%. Then in December 2024, at the $108,000 peak, it climbed to 350%. By contrast, today’s 220% gain reflects the fact that many long‑term holders bought in at much higher levels than earlier in the cycle.

Price Needs To Rise To Match Past Gains

Based on an average cost basis of $33,800, Bitcoin WOULD need to climb back to $135,200 just to restore that 300% profit level. If the market aimed to hit the 357% mark again, prices would have to reach roughly $154,400. Both figures track with what history tells us about investor behavior — people tend to sell when profits hit big round numbers.

![]() Unrealized profits of LTH continue to decline and are now approaching levels last seen during the October 2024 correction.

Unrealized profits of LTH continue to decline and are now approaching levels last seen during the October 2024 correction.

The average unrealized profit, based on the MVRV ratio, currently stands at around 220%.

That may seem high for BTC, but when compared to previous… pic.twitter.com/NeTCmXZVTY

— Darkfost (@Darkfost_Coc) July 1, 2025

Looking farther back shows how much room remains. In December 2017, at the $19,500 top, long‑term holders saw unrealized profits of 4,000%. Then during the 2020/2021 cycle, Bitcoin spiked to $63,000 in April 2021 and MVRV topped out at 1,230%. By November 2021, prices hit about $68,400 but unrealized gains for long‑term holders had already fallen to 340%.

An analyst’s recent outlook lines up with this math, first pegging a cycle top at $135,000 in October 2024. After reviewing new data in May 2025, they revised the target range to $120,000–$150,000 and suggested a likely peak between August and September 2025. That range overlaps with the price levels needed to bring MVRV back to earlier highs.

Room For More Upside, But Watch The RisksBased on latest figures, Bitcoin is trading at $106,750, roughly flat over the last 24 hours. Lower profit margins mean fewer long‑term holders are itching to sell right now, which could leave more fuel for higher prices. Still, on‑chain numbers don’t capture the whole picture. Spot-market flows, ETF moves and wider economic shifts can all trigger sharp reversals.

For now, the evidence points to a market that isn’t overheated. If Bitcoin follows past cycles, it may have farther to climb before long‑term holders lock in gains at levels seen in March or December 2024. But investors should balance these on‑chain metrics with real‑world signals — and be ready for whatever comes next.

Featured image from Imagen, chart from TradingView