Bitcoin Enters Danger Zone as Sell-Side Pressure Mounts—Here’s What Analysts Fear

Bitcoin's bull run hits a turbulence patch as sell orders pile up. Is this the calm before the storm—or just another shakeout before the next leg up?

Warning lights flash for BTC

The crypto king shows vulnerability for the first time in months. Trading desks report increased sell liquidity hitting the market—just as institutional interest was supposed to save us all from volatility (spoiler: it never does).

Market mechanics at breaking point?

Order books show thinning buy support below current levels. Meanwhile, derivatives traders keep levering up like degenerate gamblers at a Vegas high-roller table. What could possibly go wrong?

One thing's certain: When the 'smart money' starts talking about 'caution zones,' it usually means they've already placed their short positions. Stay frosty out there.

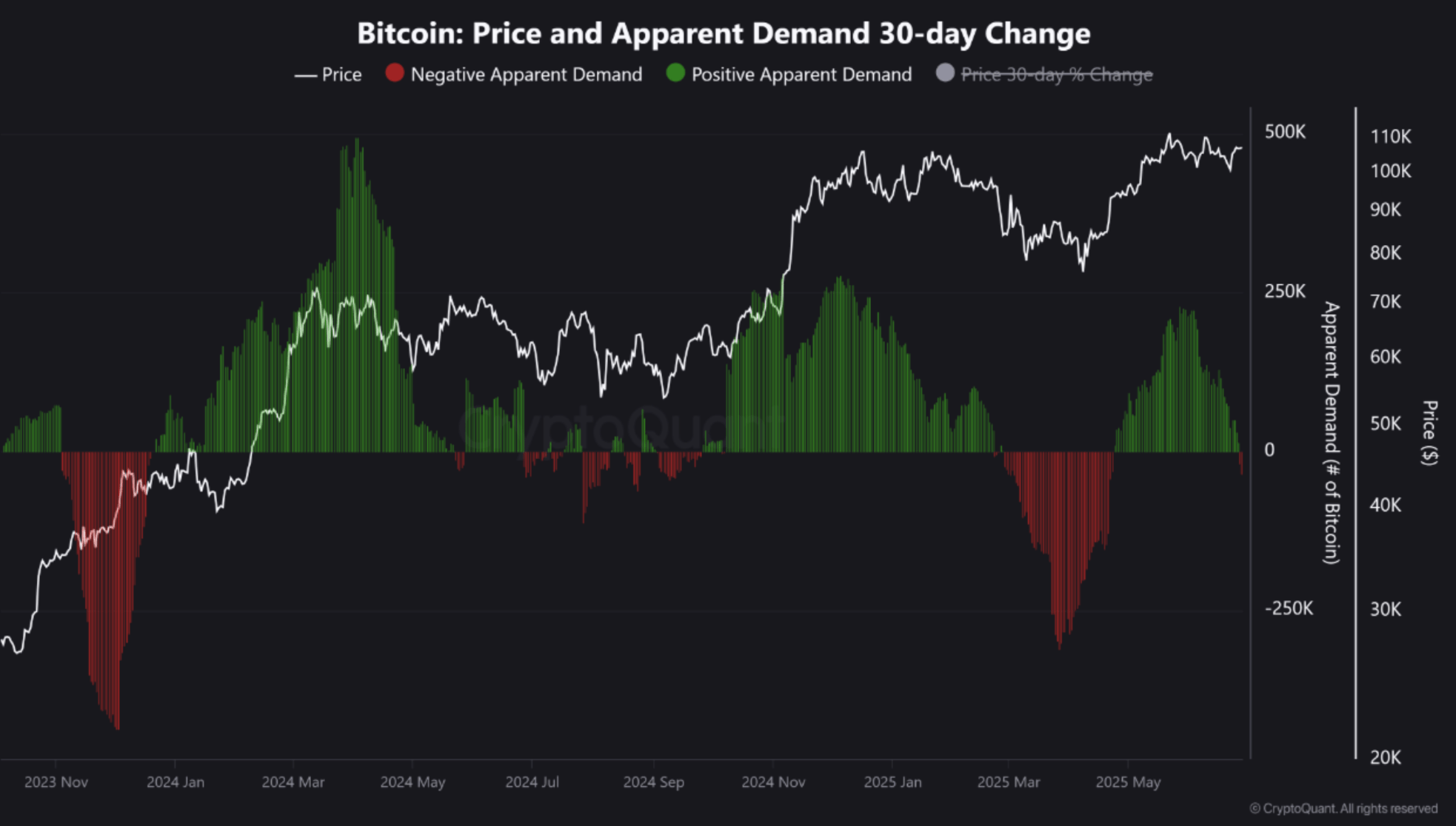

Bitcoin Apparent Demand Enters Negative Territory

According to a recent CryptoQuant Quicktake post by contributor Crazzyblockk, Bitcoin’s new buyer demand is failing to absorb the combined supply pressure from freshly mined BTC and selling from long-term holders (LTHs). As a result, BTC’s Apparent Demand has turned negative.

The analyst noted that the imbalance between buyer demand and excessive supply has created a high-risk environment for a near-term price correction. Notably, the $100,000 level remains an important support for the flagship digital asset.

For the uninitiated, Bitcoin’s Apparent Demand measures the balance between new buying interest and the supply of coins entering the market from miners and LTHs selling. When this metric turns negative, it means that the amount of BTC being sold exceeds new purchases, indicating potential market weakness and downward price pressure.

BTC entering negative Apparent Demand territory can be considered a bearish development for two key reasons. First, it directly increases the “for sale” BTC supply, exerting downward pressure on the cryptocurrency’s price.

Second, significant selling by LTHs – often considered seasoned and sophisticated investors – suggests that experienced players believe the crypto market has likely reached a local top and are exiting before a potential severe market downturn. The analyst added:

Consequently, the market is in a vulnerable state. Any price rallies from here will likely struggle to overcome this wave of available supply, and market support may be weaker than anticipated. While not a guarantee, this on-chain signal strongly suggests a period of caution is warranted until demand shows clear signs of recovery.

That said, recent on-chain analysis indicates a more optimistic outlook. According to fellow CryptoQuant analyst Avocado_onchain, the 30-day moving average (MA) of Bitcoin Binary Coin Days Destroyed (CDD) shows signs of healthy consolidation rather than a potential local top.

Some Positive Signs For BTC

While BTC’s Apparent Demand might be drying up, easing global geopolitical tensions could catalyze a rally in risk-on assets, including cryptocurrencies. Further positive macroeconomic developments may also benefit BTC, potentially leading to a cycle top much higher than currently anticipated.

Another indicator negating the possibility of a major price pullback is the steadily rising short-term holder (STH) floor price, which has surged to as high as $98,000 according to the latest on-chain data. At press time, BTC trades at $107,500, down 0.5% in the past 24 hours.