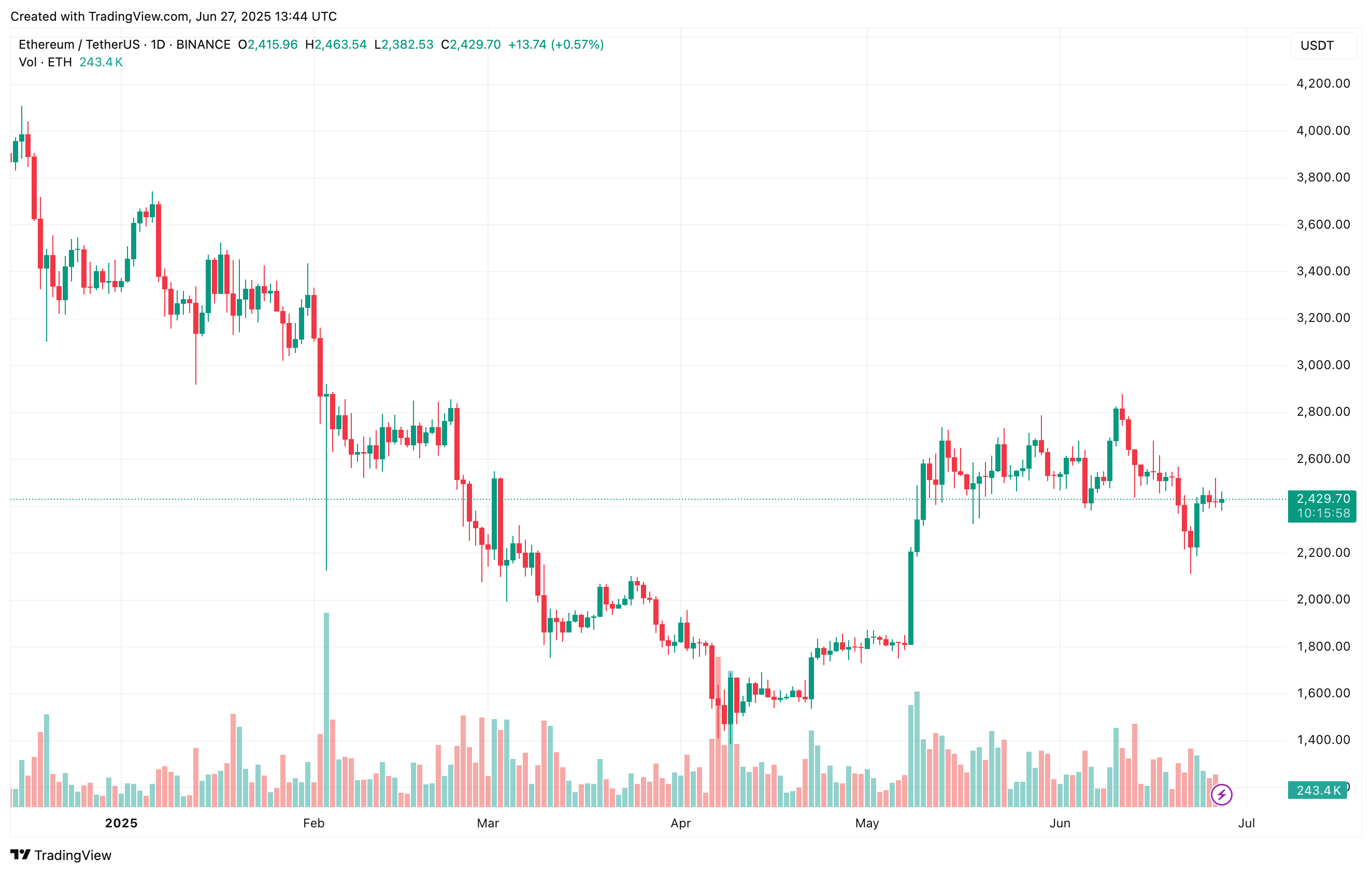

Ethereum Surges Past $2,500 in Short Squeeze Frenzy – Is This the Start of a New Bull Run?

Ethereum just blasted through $2,500 like a rocket—fueled by a brutal short squeeze and traders scrambling to cover. But here’s the real question: can ETH sustain this momentum, or is this another classic crypto fakeout?

Short sellers got wrecked—again. The market loves nothing more than punishing overconfident bears, and this rally was no exception. Liquidation cascades pushed ETH past key resistance, but now the real test begins.

Wall Street analysts are already spinning this as 'proof of institutional adoption'—because nothing says 'mature asset class' like violent 20% swings on leverage-induced squeezes. Meanwhile, degens are YOLO-ing into perpetual contracts like it’s 2021.

Will Ethereum hold $2,500? Check the funding rates. Check the macro mood. And maybe—just maybe—don’t bet against the second-largest crypto when it’s got this much momentum.

Ethereum Rally Marked By Shift In Dynamics

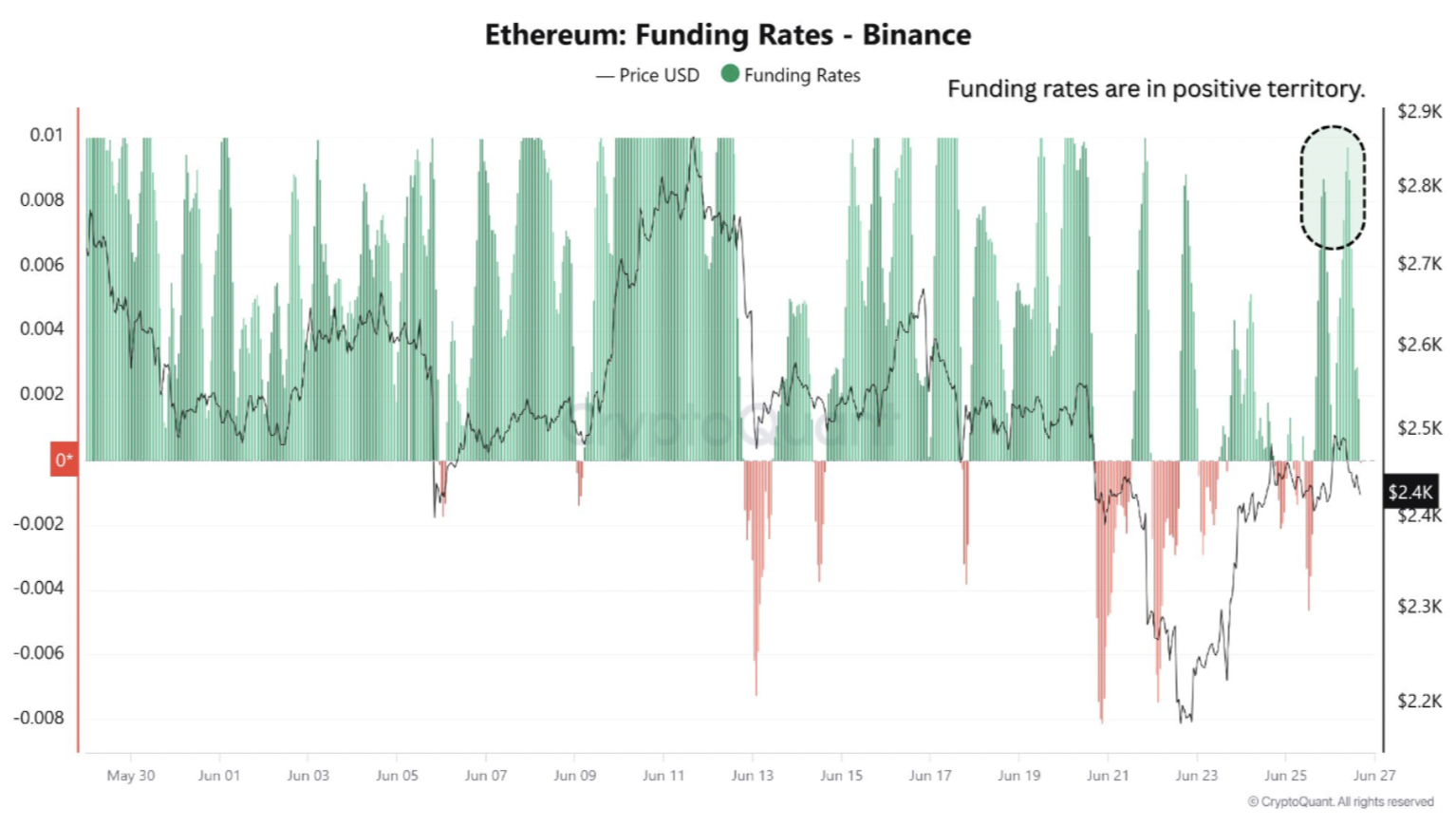

According to a recent CryptoQuant Quicktake post by contributor Amr Taha, Ethereum’s latest rally has been accompanied by a notable shift in market dynamics – including a flip to positive funding rates, a potential short squeeze, and a rise in ETH inflows to Binance crypto exchange.

Recent data from Binance reveals a significant shift in ETH funding rates from negative to positive. Positive funding rates typically indicate that traders are opening or holding Leveraged long positions, reflecting expectations of further upside.

However, rising funding rates may also raise the risk of a short-term price pullback if long positions become overextended. Data from CoinGlass shows that 68.15% of liquidations over the past 24 hours were long positions – highlighting this risk.

Taha also emphasized the role of a short squeeze in Ethereum’s recent price surge and the increase in funding rates. As ETH’s price climbed, it retested the previous short-squeeze zone around $2,500. He explained:

In that earlier event, short positions were forcibly closed by initiating aggressive market buy orders to cover their exposure, triggering a cascading effect known as a short squeeze. This dynamic occurs when traders who had bet against ETH (shorts) are forced to close their positions by aggressively buying back the asset to limit losses.

Meanwhile, ETH inflows to Binance have also spiked. On-chain exchange data suggests that 177,000 ETH was deposited into Binance over a three-day period – an unusually high volume.

Such a surge typically signals increased selling pressure or large-scale repositioning by major holders. Large transfers of ETH to exchanges often precede either potential sell-offs or liquidity provisioning.

In conclusion, Taha noted that while a short-term correction may be likely, ETH’s breakout above $2,500 underscores the aggressive speculative activity driving its recent price action. Traders are advised to closely monitor funding rates and exchange flows for signs of an impending retracement.

ETH Bulls Take The Charge

Recent technical analysis suggests ETH may be gearing up for a breakout above the $2,800 resistance level. The asset also recently formed a golden cross on the daily chart, fuelling speculation that a new all-time high (ATH) could be within reach.

That said, ETH is not entirely in the clear. Technical analyst Crypto Wave recently predicted that the cryptocurrency may revisit lower levels in the $1,700 to $1,950 range. At press time, ETH trades at $2,429, down 0.4% over the past 24 hours.