$15B Bitcoin Options Expiry Today: Is This the Rocket Fuel for BTC’s Next Bull Run?

Brace for impact—today's $15 billion Bitcoin options expiry could send shockwaves through crypto markets.

Will traders panic or pile in?

Market makers are sweating bullets as the biggest derivatives event of the quarter hits. Open interest at these levels hasn't been seen since the 2021 bull run—back when your Uber driver was giving ETH price targets.

The setup: Max pain sits just below current prices, creating textbook gamma squeeze conditions. If BTC holds $60K through the expiry, forced hedging could trigger violent upside.

Watch the flows: Whales have been accumulating OTM calls all week. Someone's betting big on volatility—either that or they've got a time machine set for 'new ATH.'

Reality check: Wall Street's 'risk management' algorithms will likely turn this into a choppy mess. But when has logic ever stopped crypto traders?

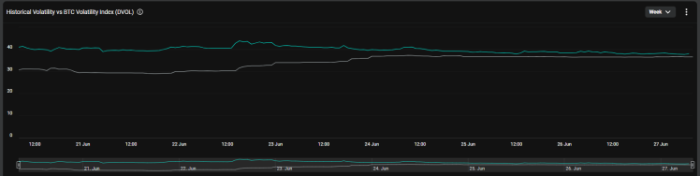

Narrowing Volatility Indicates Positive Outlook

The $BTC volatility index has narrowed in recent days, drawing more closely to the historical volatility and generally indicating that traders don’t expect dramatic price moves either way – up or down.

That was supported by Deribit Chief Commercial Officer Jean-David Péquignot, who stated:

‘Low open interest in perps and fairly depressed Bitcoin implied volatility and skew are indicative of limited expectations for sharp price movements…’

Where does that leave Bitcoin? Still looking bullish. Crypto treasury strategies are still expanding, adding thousands of $BTC tokens to long-term reserves and increasing demand. Metaplanet just added 1,234 $BTC, bringing its total portfolio north of 12K $BTC.

And it isn’t just direct Bitcoin purchases; the ecosystem around the world’s leading crypto continues to fuel demand.

ETFs Notch 13 Days Consecutive Inflows, Bitcoin Overtakes Google

Bitcoin ETFs are building on a 13-day stretch of positive inflows. Monday to Thursday, daily cumulative inflows amounted to:

- $350M

- $588M

- $547M

- $226M

Positive inflows point to long-term interest from retail and institutional investors, rather than short-term traders, and contribute to underlying buying pressure.

And with the largest Bitcoin ETF, BlackRock’s iShares Bitcoin Trust, holding over $70B in total assets, Bitcoin took advantage of weakening Alphabet stock to overthrow Google as the world’s sixth-largest asset.

It’s a combination of fundamentally positive factors, reinforcing a bullish case for $BTC – and the meme coin built on that case.

BTC Bull Token ($BTCBULL) – Meme Coin Trusting $BTC to Hit $250K and Beyond

BTC Bull Token ($BTCBULL) is confident that Bitcoin will one day reach $250K and more – so confident that the project is built around key Bitcoin price milestones.

- Bitcoin $125K: The project burns $BTCBULL tokens to exert deflationary pressure on the price.

- Bitcoin $150K: BTC Bull token investors who hold their tokens in the Best Wallet app receive a free $BTC airdrop.

- Bitcoin $175K: Another $BTCBULL token burn.

- Bitcoin $200K: Another $BTC airdrop!

- Bitcoin $225K: A final $BTCBULL burn.

- Bitcoin $250K: A massive $BTCBULL airdrop.

The combination of token burns and airdrops encourages positive momentum for BTC Bull Token, following Bitcoin’s upward trajectory.

BTC Options Expire, But Outlook Is Bullish for Bitcoin

With $15B in Bitcoin options expiring, narrowing volatility, and consistent ETF inflows, Bitcoin’s foundation looks stronger than ever.

For investors looking to capitalize on Bitcoin’s momentum, BTC Bull Token offers a bold, milestone-based roadmap aligned with $BTC’s rise to $250K. But be warned – there’s mere days left in the presale, so the window to join is closing fast.

Always do your own research. This is not financial advice.