Bitcoin’s 2025 Price Explosion: Analyst Reveals the Path to New ATHs

Bitcoin isn't just knocking on the door of price discovery—it's booting it down. As institutional FOMO meets dwindling supply, one analyst's roadmap suggests we're not just revisiting old highs—we're rewriting the playbook.

Here's why 2025 could be the year BTC leaves 'expensive' in the dust.

Supply Shock Meets Institutional Greed

With ETFs hoarding coins like BlackRock hoards fees, available liquidity's tighter than a VC's post-bull-market budget. The halving's teeth are finally sinking in—miners capitulated, weak hands folded, and now? The stage is set.

Technical Breakout or Macro Catalyst?

The chartists see a 12-month ascending triangle (yawn), but the real juice comes from TradFi's slow-motion epiphany: 'Wait, this internet money thing... might actually be the reserve asset?' Cue the 'oh crap' buys from pension funds still stuck in 60/40 portfolios.

2025 Targets: Conservative vs. Delusional

Base case: $150K by December (boring). Wildcard? A Fed pivot meets spot ETF inflows meets some random El Salvador adoption headline—suddenly $250K looks 'reasonable.' Meanwhile, goldbugs sob into their physical bars.

Remember: Price predictions are horoscopes for finance bros. But this time? The stars might actually align.

Bitcoin Sees Transitional Period

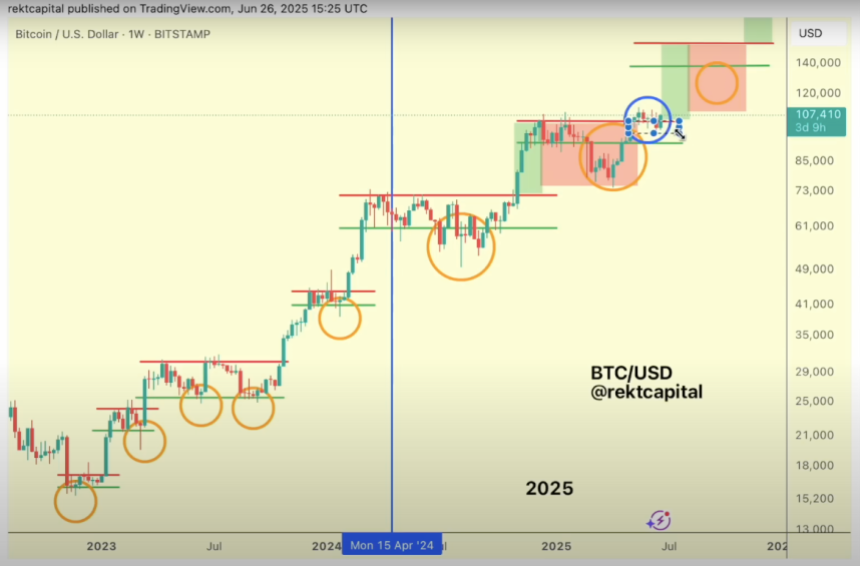

On Thursday, analyst Rekt Capital shared a roadmap for BTC for the rest of the year. He noted that this cycle has been “truly a cycle of re-accumulation ranges,” explaining that these have formed throughout the cycle since the end of 2022 and evolved since the bitcoin Halving last year.

In the pre-having period, BTC registered brief price deviations with downside wicks below the re-accumulation range lows in the weekly chart. Meanwhile, the post-halving period has seen Bitcoin deviations occur with multi-week clusters of full-bodied candles below the range lows.

For instance, after its first price discovery uptrend, which lasted around seven weeks, BTC moved within its re-accumulation range for about ten weeks. Then, it transitioned into the first Price Discovery Correction, recording a nine-week downside deviation below the range lows before breaking out and rallying past the range highs toward a new ATH last month.

Its past performances suggested that BTC was ready to enter its second Price Discovery Uptrend. But as Rekt Capital detailed, a transitional period has occurred for the first time, with price consolidating around the re-accumulation range high area.

According to the analyst, this is “perhaps the first time that we’re seeing a deviation occur below the range high,” making this area a crucial level to transition into a new uptrend.

We never really had to pull back substantially, maybe, until that final corrective period, which WOULD last multiple months, but each re-accumulation range would see quite a bit of upside, and that upside would be very quick and no real post-breakout retesting, no real pausing. What we’re seeing here is something very, very different.

Weekly Close Key For BTC’s Future

Based on its new transition period, the key level for Bitcoin to reclaim in the weekly timeframe is the $104,400 support, which it held for nearly seven weeks before the recent pullbacks. This level was lost after BTC closed last week below it and “should not become a resistance level.”

To the analyst, it’s key that this week’s close solidifies the price recovery as it would position the cryptocurrency for a retest and confirmation of $104,400 as support and continue the build the base around this area to transition into the next multi-week Price Discovery Uptrend.

Rekt Capital added that the timeline for BTC’s next uptrend will depend on the length of the new transitional period. However, he believes that it will take “a bit longer” to break out.

Additionally, he suggested that what comes after the upcoming uptrend will also depend on how long it takes, as it could lead to an extended cycle or a prolongation of this phase, which could push the cycle peak into deeper stages of 2025.

Nonetheless, the analyst affirmed that it’s crucial that the next corrective period, which could see Bitcoin drop between 25% to 33%, is short to potentially enjoy a third Price Discovery Uptrend before the bear market.

As of this writing, BTC is trading at $107,555, a 3.2% increase in the weekly timeframe.