Ethereum Whale Goes on $422M Buying Spree – Bullish Signal or Bubble Fuel?

A single Ethereum whale just vacuumed up $422 million worth of ETH in less than 30 days – triggering both excitement and eye-rolls across crypto Twitter.

The Mega-Wallet Move

While retail traders debate gas fees, this anonymous player deployed capital equivalent to a mid-sized hedge fund. The purchase timeframe suggests either algorithmic accumulation or a high-conviction bet on Ethereum's upcoming upgrades.

Market Ripple Effects

Such concentrated buying typically causes liquidity crunches. Exchanges saw ETH reserves dip as the whale's orders executed, creating short-term price pressure that likely squeezed late short sellers.

Wall Street's Crypto Envy

The move highlights how crypto whales operate with speed that'd give traditional fund managers paper hands. No committee meetings, no compliance hurdles – just a nine-figure bet placed faster than a Goldman Sachs lunch reservation.

Now watch as every crypto 'analyst' claims they predicted this – right after it happened.

Ethereum Surges As Ceasefire Ignites Market Optimism

Ethereum surged over 14% following reports of a ceasefire agreement between Israel and Iran, providing a much-needed relief rally after weeks of geopolitical tension and uncertainty. The news sparked a wave of bullish momentum across the market, with ETH rebounding sharply from recent lows NEAR $2,100 to trade firmly above the $2,400 mark. Bulls, who had lost control amid panic selling, are now showing signs of strength as the market prepares for its next decisive move.

Despite this rebound, caution remains. The broader macroeconomic environment continues to tighten, with rising concerns over a potential US recession, high Treasury yields, and sustained hawkishness from the Federal Reserve. These factors could weigh on risk assets in the weeks ahead, putting Ethereum’s rally to the test. Nonetheless, optimism is building, especially around the possibility of the long-awaited altseason—one that many believe will be led by Ethereum.

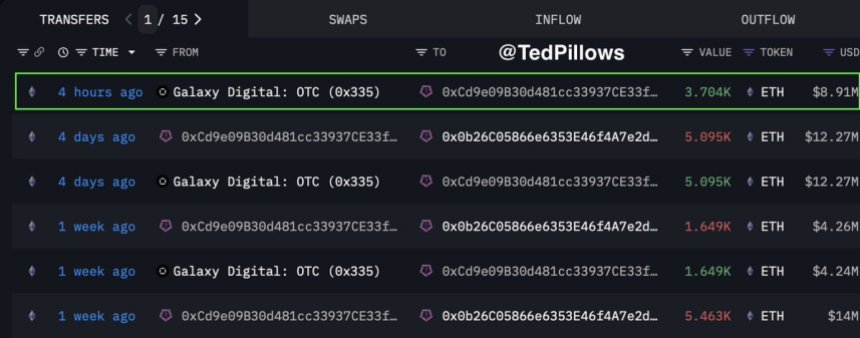

Adding fuel to this narrative is the growing trend of whale accumulation. According to insights shared by analyst Ted Pillows, a major whale or institutional entity has just acquired another $8.91 million worth of ETH. This purchase adds to a staggering $422 million in Ethereum accumulated over the past three weeks.

Such aggressive buying suggests that large players are positioning themselves for a major MOVE ahead, likely expecting Ethereum to be at the forefront of the next market cycle. As ETH consolidates above key levels, the accumulation trend could act as a foundational force supporting higher prices, especially if macro and geopolitical risks stabilize.

ETH Reclaims $2,400 Following Sharp Rebound

Ethereum has reclaimed the $2,400 level after a swift rebound from a breakdown near $2,100. The recent candle structure on the 3-day chart shows a strong wick to the downside, followed by a recovery, reflecting the impact of geopolitical developments, most notably the ceasefire between Iran and Israel. This bounce prevented a deeper selloff and has brought Ethereum back above a key psychological level.

Looking at the chart, ETH remains under pressure from the 100-day and 200-day moving averages, currently acting as resistance around the $2,638 and $2,779 zones. Price also recently broke a short-term descending trendline and is now attempting to consolidate above it. This suggests the potential for a trend reversal if bulls can sustain momentum and push through the moving average cluster.

Volume remains subdued but shows signs of recovery, signaling early interest returning after the fear-driven flush. A break and close above the $2,600 range WOULD likely open the path to retest the $2,800 zone, which was a major supply area in previous months.

Featured image from Dall-E, chart from TradingView