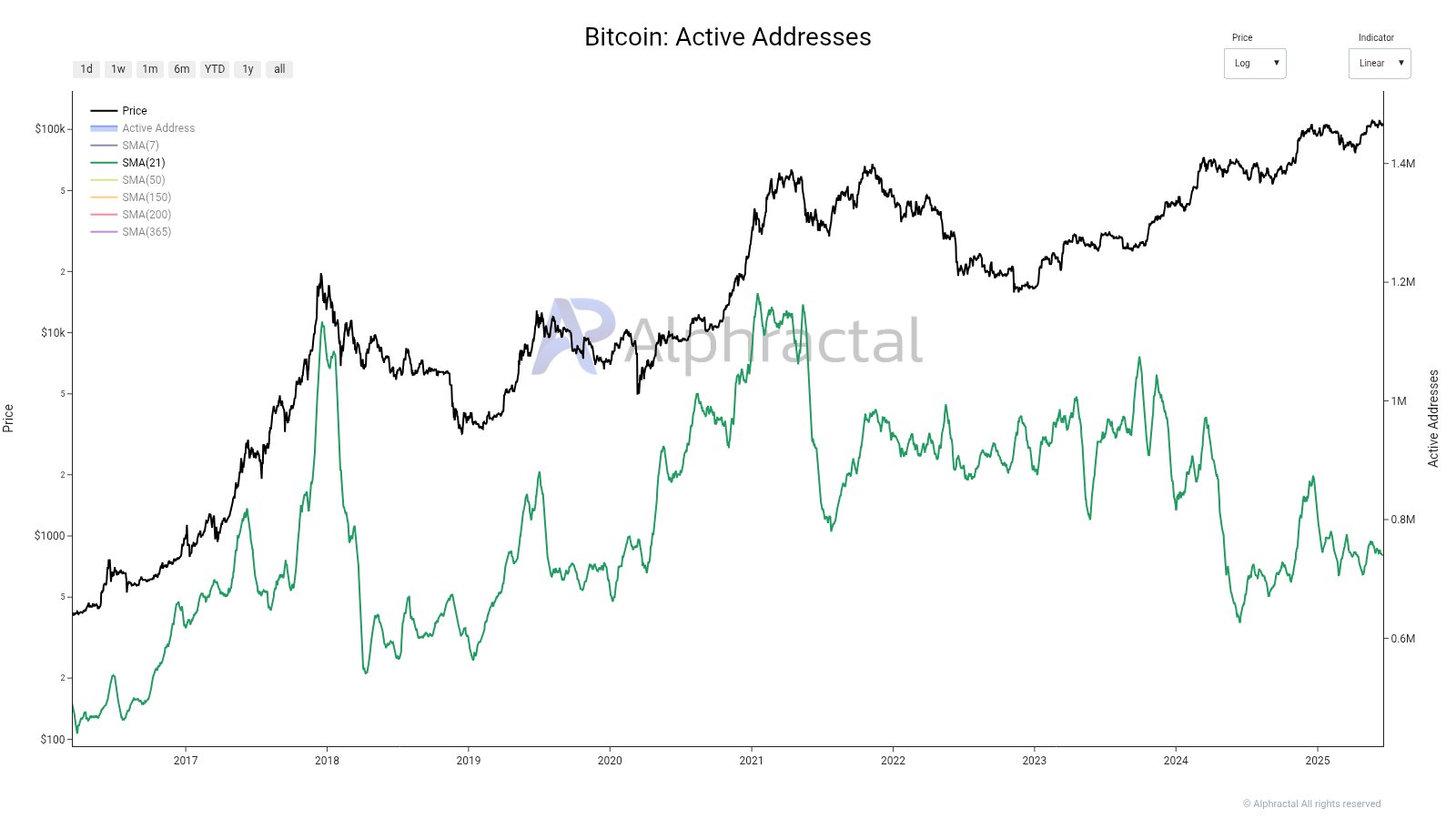

Bitcoin Active Addresses Crash to 2020 Levels – Is This the Calm Before the Storm?

Bitcoin's network activity just flashed a warning sign—active addresses have plummeted to levels not seen since the pre-bull market days of 2020. What gives?

Network health check: On-chain data shows a startling retreat in user engagement. The last time addresses were this quiet, BTC was trading below $10K. Now? The market's playing a very different game.

Bull vs. bear tug-of-war: Some analysts see this as distribution before the next leg up. Others warn it's retail throwing in the towel. Meanwhile, Wall Street's still charging 2% management fees to 'hodl' your BTC in a shiny ETF wrapper.

Wake-up call: When network activity diverges from price action this dramatically, someone's about to get caught on the wrong side of the trade. The only question—who's getting squeezed?

Active Addresses Mirror 2020 Levels

In a June 20 post on social media platform X, on-chain analytics firm Alphractal published its recent findings on the Bitcoin active addresses, revealing that the flagship cryptocurrency does not show an indication of market euphoria.

The relevant on-chain indicator here is the Active Addresses metric, which measures the number of unique addresses that are active on the bitcoin network within a specific timeframe. To be clear, an address is “active” if it is receiving and sending Bitcoin during a particular period.

The chart shared by Alphractal shows that active addresses are at the same level as in 2020. The analytics firm pointed out that as of 2020, the market was facing political uncertainty, dealing with a global pandemic, and widespread social fear, as the effects on market engagement are what is currently being witnessed.

In the post on X, Alphractal highlighted two possible reasons for this seeming lack of enthusiasm seen in investors. Firstly, the market intelligence firm noted that investors might have become disillusioned with all that is currently happening in the crypto market, regardless of Bitcoin’s value comfortably being above $100,000.

On the other hand, Alphractal put forward the possibility that this relative inactivity could be a result of a strong long-term conviction in the flagship cryptocurrency as a store of value. However, this second reasoning was immediately put down by Alphractal as readings from two other indicators — the on-chain volume and spot volume — are both low, indicating little global interest in the cryptocurrency.

As Bitcoin still prevails above $100,000, this could be a strong indication, Alphractal explained, “that only the most resilient are taking advantage of the long-awaited $100k per BTC.”

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at about $103,290, reflecting an over 1% price decline in the past 24 hours. According to data from CoinGecko, the price of BTC has fallen by about 2.4% in value over the past seven days.