TRON Energy Demand Rockets 108% as Smart Contracts Go Into Hyperdrive

TRON’s energy consumption isn’t just climbing—it’s mooning. A 108% surge in power draw signals one thing: the network’s smart contract engine is firing on all cylinders.

What’s driving the frenzy? Developers are flocking to TRON’s low-fee environment, deploying contracts at a pace that’s turning energy metrics into a vertical line. The chain’s efficiency pitch is being stress-tested in real time—just as Wall Street starts another round of ‘blockchain is a solution looking for a problem’ hand-wringing.

Watch the watts. They never lie.

Tron Trades Near Key Demand Amid Broader Market Pullback

Tron is currently testing key demand levels after a 9% correction from its recent high near $0.295. The price had briefly surged on Monday after the announcement of Tron’s plans to go public through a deal with Nasdaq-listed SRM Entertainment. However, the excitement was short-lived. As macroeconomic uncertainty deepens and Middle East conflicts escalate, the entire crypto market has entered a retracement phase, dragging TRX below the levels it traded at prior to the news.

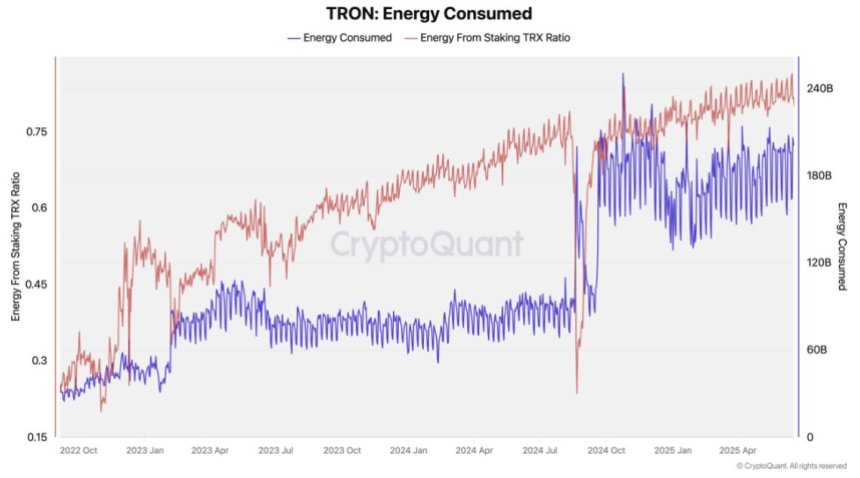

Despite the challenging conditions, on-chain fundamentals paint a much more resilient picture. CryptoQuant data shows that Tron’s network activity remains robust, with energy consumption—used to execute smart contracts—up 108% year-over-year. Total daily energy usage now exceeds 200 billion units, compared to just 77 billion at the same time last year.

This surge in energy use signals growing demand for on-chain operations and smart contract execution. Importantly, about 80% of this energy demand comes from staked TRX, pointing to strong user commitment to the network and increased participation in decentralized applications.

The divergence between TRX’s on-chain strength and its current price performance suggests that the recent pullback may be more about broader market stress than any deterioration in Tron’s fundamentals. If volatility stabilizes, these robust activity metrics could help position TRON for a strong recovery.

TRX Price Holds Trendline Support Despite Volatile Reversal

Tron is currently trading at $0.2730, showing a modest 9% pullback from the $0.295 high reached earlier this week following the announcement of a deal involving SRM Entertainment. Price action in the chart reflects this volatile reaction—after spiking, TRX retraced sharply and is now consolidating just above the 50-day moving average (blue line), which has acted as dynamic support over the past two months.

Despite this pullback, the structure remains bullish. TRX continues to respect the long-term ascending trendline formed since early March, with higher lows being maintained. Volume surged during the initial rally on the announcement but has since returned to pre-news levels, indicating fading short-term HYPE and a return to fundamentals.

Looking at the broader setup, the 100-day and 200-day moving averages (green and red lines) remain sloped upward, reflecting sustained long-term momentum. The $0.269–$0.253 support band, defined by these MAs, will be key if further downside pressure materializes.

A break above $0.295 WOULD invalidate this short-term pullback and potentially ignite a move toward $0.32. Conversely, failure to hold the trendline could trigger a deeper retracement. For now, TRX holds structure—yet caution remains warranted given broader market uncertainty.

Featured image from Dall-E, chart from TradingView