Ethereum Analyst Predicts Explosive Rally – A Close Above $2,800 Could Trigger a Violent Breakout

Ethereum bulls are licking their chops as analysts spot a critical inflection point. The smart contract giant has been coiling below $2,800 for weeks—but that patience might soon pay off.

The make-or-break level: A high timeframe close above $2,800 isn't just another resistance test. Chartists warn this could unleash pent-up buying pressure from sidelined traders still bitter about missing Bitcoin's run.

Why it matters: Institutional money's been nibbling at ETH while retail obsesses over meme coins. A decisive breakout here could force the hand of underinvested funds—and leave bagholders of 'the next big thing' shitcoins in the dust.

Just remember: Wall Street's 'when in doubt, zoom out' approach works until it doesn't. Technicals look juicy, but crypto's favorite pastime is liquidating both sides before the real move begins.

Ethereum Prepares For Breakout as Market Awaits Confirmation

Ethereum remains over 60% below its 2024 high of $4,100, but the asset is showing signs of recovery after months of downward pressure and indecision. Bulls have struggled to regain control throughout the year, but recent price action indicates the start of a potential rally. This recovery, however, remains tentative and will require confirmation through a higher timeframe close above critical resistance levels, particularly the $2,800–$3,000 range.

The broader environment continues to weigh heavily on sentiment. Escalating geopolitical tensions in the Middle East, coupled with macroeconomic uncertainty—including rising U.S. Treasury yields and concerns about inflation—are creating headwinds for risk assets, Ethereum included. Despite this, ETH has managed to hold key support above the $2,500 level, a sign that bulls are defending their ground.

According to technical analysis shared by analyst Daan, Ethereum is currently trading within a very tight range, with price wicks on both sides being consistently absorbed. This type of compression typically signals an incoming surge in volatility. Daan notes that once one side gives in, the resulting MOVE often becomes explosive and sustained.

The current range-bound action reflects equilibrium between buyers and sellers, but that balance won’t last forever. Traders are watching closely for a decisive higher timeframe close above resistance—or below support—as confirmation of the next trend direction. With ETH positioned NEAR major technical zones, a breakout could lead to significant momentum, potentially bringing Ethereum closer to reclaiming the psychological $3,000 mark and reigniting a push toward cycle highs. Until then, the market remains in a wait-and-see mode.

Ethereum Continues Range-Bound Trading As Key Support Holds

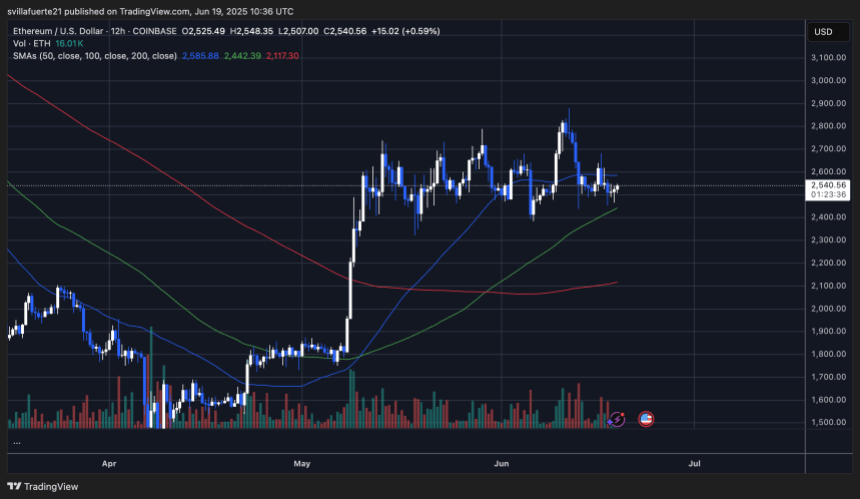

Ethereum (ETH) remains locked in a tight range between approximately $2,500 and $2,800, showing little directional clarity over the past several weeks. The chart above (12-hour timeframe) reflects persistent consolidation with multiple wicks on both ends of the candles, indicating absorption of both bullish and bearish momentum. This suggests that neither buyers nor sellers have taken firm control.

ETH currently trades near $2,540 and is holding above the 100-period simple moving average (SMA), which is acting as short-term support. The 50 SMA has flattened, further reinforcing the sideways nature of the price action. Volume has also tapered off, typical in compression phases that often precede strong breakouts or breakdowns.

If ETH fails to reclaim the $2,675–$2,800 resistance zone, the 200 SMA near $2,117 may become relevant as a deeper support target. However, as long as ETH maintains price action above $2,500, bulls are still in play.

The structure suggests that Ethereum is building energy for a decisive move. A higher timeframe close above $2,800 could trigger a new leg up toward $3,000 and beyond. Conversely, a break below $2,500 could lead to renewed bearish pressure. For now, traders are watching for breakout confirmation.

Featured image from Dall-E, chart from TradingView