Chainlink Goes Global: Hong Kong–Australia Corridor Now Live for Cross-Border Payments

Chainlink''s oracle network just bulldozed another financial border—this time linking Hong Kong and Australia for seamless money movement. No more waiting days for SWIFT settlements or paying tribute to legacy banking fees.

How it works: The decentralized protocol taps real-world FX rates and settlement data to automate cross-border transactions. Banks hate this one trick.

The fine print: While the tech works, adoption still depends on whether institutions will actually use it—or just keep collecting fat margins on outdated systems. After all, why fix what isn''t broken (for them)?

Hong Kong And Australia Test Digital Cash

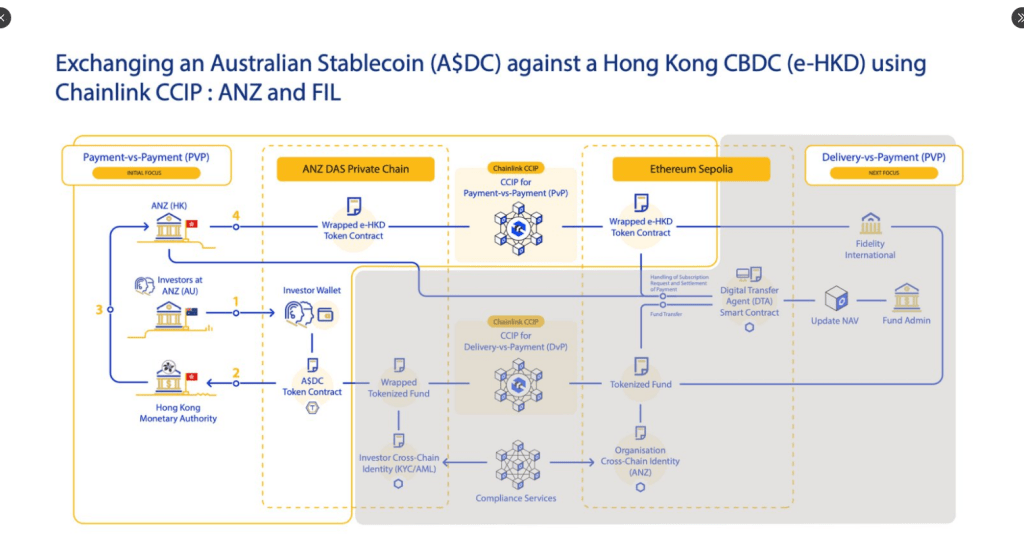

According to reports, the project will use Chainlink’s Cross-Chain Interoperability Protocol, or CCIP, to handle transfers. The goal is simple. MOVE money in real time and make sure both sides get what they expect.

Phase two kicks off with Hong Kong authorities and their counterparts in Australia. They will swap e-HKD for A$DC and aim for instant settlement. Based on reports, this setup could serve as a model for other central banks.

We’re excited to share that chainlink is facilitating the secure exchange of a Hong Kong CBDC and an Australian dollar stablecoin as part of an ongoing use case in Phase 2 of the e-HKD+ Pilot Program.

Congratulations to participants @Visa, ANZ, China AMC, and Fidelity… pic.twitter.com/ts2C6Vt4Ul

— Chainlink (@chainlink) June 9, 2025

Chainlink Tools In Use

Chainlink is not just a name in the mix. It brings two big pieces of tech to the table. CCIP handles the cross-chain messages, acting like a bridge between different blockchains.

The Digital Transfer Agent, or DTA, deals with compliance. It keeps track of who owns what token and makes sure rules in different countries are met. In May, World Liberty Financial tapped Chainlink for cross-chain stablecoin transfers covering USD1. That earlier deal hinted at what’s possible this time around.

Visa and ANZ are helping with payment processing for e-HKD and A$DC. Asset managers Fidelity International and ChinaAMC will also take part. Their job is to manage the tokenized funds on both sides.

This mix of banks, asset managers and tech firms shows the project is more than a small test. It has real money and real risks involved. Reports disclosed that those risks are managed by a Payment-versus-Payment model. This means funds are only released when both sides confirm they have received the other asset.

Market Moves And ReactionsLINK, the token for Chainlink, jumped by 6% after news of the pilot broke. It now trades at $14.70. That rise follows a wider market rally driven by hopes that Bitcoin may hit $110,000 before the week’s end.

According to market data, crypto traders often chase big targets. Short-term gains can be tempting. But they can also lead to quick sell-offs if the main story fades.

Despite the rally, bitcoin still tracks the equity swings rather closely. There is a mix of bulls and bears in futures data that suggests some people are not yet convinced this run will last.

High volatility can shake out weaker hands at the first sign of trouble. A sudden change in risk sentiment or a fresh macro shock can quickly reverse gains.

Featured image from Imagen, chart from TradingView