Bitcoin UTXO Signal Nears 99% – Bull Run Fuel or Smart Money Cashing Out?

Bitcoin’s UTXO metric just flashed a 99% signal—historically a bullish indicator, but seasoned traders know even moon rockets need pit stops.

Is this the launchpad for the next leg up, or are whales quietly booking profits while retail piles in? The chart doesn’t lie, but Wall Street’s ’buy the rumor, sell the news’ playbook thrives in crypto too.

Either way, buckle up—when UTXOs get this extreme, volatility cuts both ways.

Bitcoin Thrives In Volatile Times As Market Nears 99% Profit Threshold

Bitcoin is showing remarkable strength as it flirts with new highs this week, trading just below $112,000. While global markets react to rising U.S. Treasury yields and persistent inflation, Bitcoin appears to be thriving in the chaos, solidifying its role as both a risk asset and a macro hedge. As traditional markets face pressure, BTC continues to lead with resilience, even as geopolitical and policy-related uncertainty clouds investor sentiment.

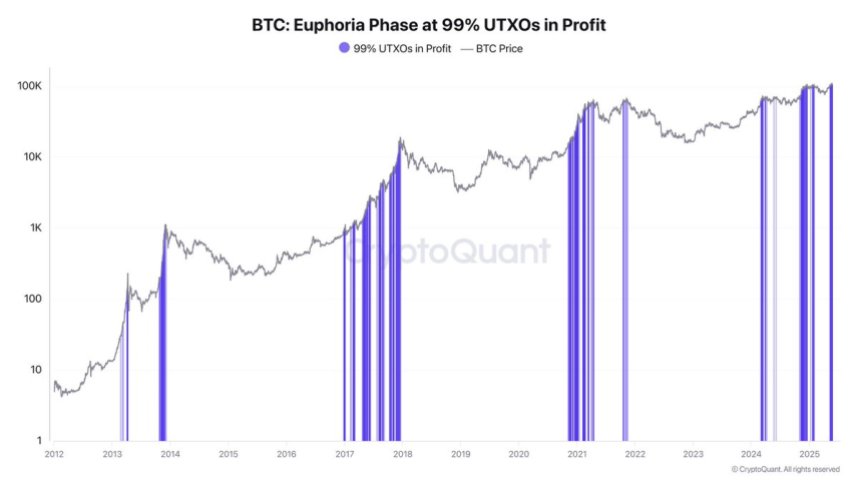

Top analyst Darkfost shared fresh insights on Bitcoin’s on-chain condition, focusing on the utility of UTXOs (Unspent Transaction Outputs). UTXOs are the technical mechanism that ensures a single BTC can only be spent once on the blockchain. But beyond that, they serve as a powerful tool for assessing unrealized profits across all held BTC.

One key metric derived from UTXOs is the percentage of BTC supply in profit. Currently, Bitcoin is approaching the critical 99% threshold, meaning nearly all coins are in unrealized gain territory. Historically, this level is associated with periods of market euphoria and sustained uptrends, but it also comes with a warning: elevated unrealized profits often precede spikes in profit-taking.

While BTC’s structure remains bullish, macro uncertainty—especially around the TRUMP administration’s policy direction—keeps risk-on conviction muted. As Darkfost notes, “We’re not fully euphoric yet, but we’re entering a zone where late buyers should be cautious.”

If the 99% profit signal drops, it may trigger a wave of selling as gains shrink and weaker hands capitulate. For now, though, Bitcoin remains strong, and the uptrend is intact. The market is watching closely because in times like these, BTC tends to MOVE first.

BTC Holds Steady Near Highs As Momentum Builds

Bitcoin is currently trading at $109,679 on the 4-hour chart, consolidating just below its all-time high after reclaiming short-term support. The price recently bounced off the 100 SMA ($105,586) and is now hovering above the 34 EMA ($108,280), signaling continued bullish momentum. All key moving averages are aligned to the upside, reflecting a strong and healthy trend.

Volume has remained relatively stable during the pullback and recovery, suggesting no major distribution phase is underway. The 50 SMA ($107,679) also acted as dynamic support during the recent dip, reinforcing the strength of the $107K–$108K zone.

The $103,600 level, previously a major resistance, continues to serve as solid structural support. As long as BTC remains above this zone, the broader uptrend remains intact. Short-term resistance now sits near the $110,200–$112,000 range. A breakout above this level WOULD likely trigger the next leg higher, potentially toward the $120,000 mark.

With Bitcoin holding above key EMAs and moving averages on the 4-hour timeframe, bulls remain in control. If price continues to build above $108K, the likelihood of retesting and surpassing all-time highs grows significantly in the coming sessions.

Featured image from Dall-E, chart from TradingView