Tron Bulls Charge Back: On-Chain Metrics Signal Renewed Accumulation

TRX buyers are back in the driver’s seat—blockchain data reveals surging demand as traders pile in.

The comeback kids

After weeks of sideways action, Tron’s network activity shows whales and retail alike snapping up TRX. Wallet inflows spiked, exchange reserves dropped—classic accumulation patterns even your MBA-trained hedge fund manager couldn’t ignore (though they’ll still call it ’speculative’).

Pressure building

With shorts getting squeezed and open interest climbing, this rally’s got legs. Just don’t expect Wall Street to notice until they’ve missed the first 30% move—as usual.

Tron Holds Strong As Bullish Momentum Rebuilds

Tron (TRX), one of the most resilient altcoins in recent years, continues to show strength despite a challenging environment for most non-Bitcoin assets. Since late 2022, TRX has followed a steady uptrend, defying broader market corrections and maintaining strong on-chain fundamentals. Now, the asset consolidates NEAR critical technical levels, preparing for what could be its next leg upward.

Although bitcoin has clearly led the current cycle—hitting new all-time highs and attracting the majority of capital—many altcoins like Tron are still lagging. This divergence has led several analysts to question whether an altseason is still on the table. Most believe this is a Bitcoin-dominant cycle, especially given the inflow to BTC ETFs and macroeconomic uncertainty. However, hope remains for a rotation into altcoins.

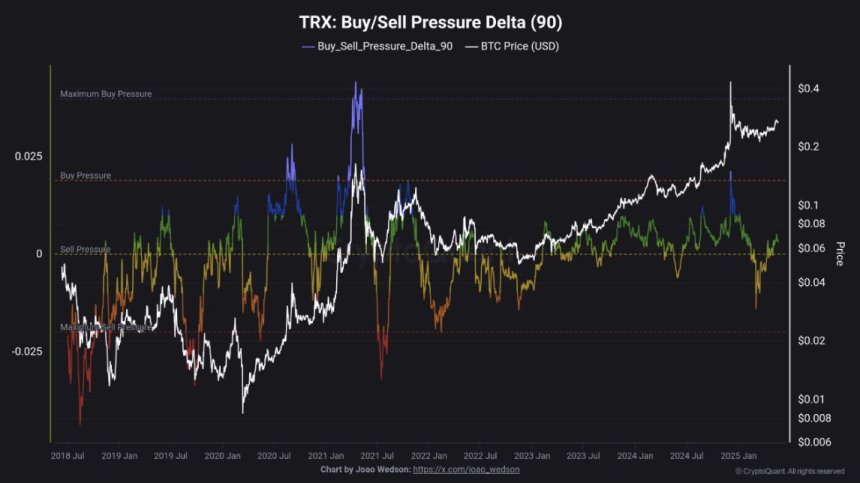

Supporting that optimism, CryptoQuant insights reveal that TRX has returned to a buying pressure zone. The Buy/Sell Pressure Delta shows a clear transition out of the selling pressure area. Demand is once again exceeding supply, favoring bulls.

Importantly, TRX has not yet reached the historical thresholds that typically precede price tops. This suggests that there is still room for growth before caution sets in. If the broader market supports a rotation, tron could emerge as a standout Layer-1 performer once again, especially as traders search for strong setups beyond Bitcoin.

Technical Analysis: Bulls Defend Higher Lows Above Support

The daily chart for Tron shows that the asset is consolidating after a strong push toward the $0.28 resistance zone. Price action has maintained a clear bullish structure since early April, with higher lows forming consistently along the 34-day EMA ($0.26), which now acts as dynamic support. The 50, 100, and 200 SMAs are all trending upward and tightly aligned beneath the current price, signaling long-term bullish alignment.

TRX remains in a short-term consolidation range between approximately $0.26 and $0.28. The price recently tested this upper boundary twice but failed to break through with strong momentum. However, support at $0.26 has held firmly, suggesting buyers are still in control.

To confirm a breakout, bulls must decisively push the price above $0.28 with higher volume, which could open the door to a move toward $0.30 and potentially retest December’s highs near $0.36. On the downside, losing $0.26 WOULD weaken this setup and likely trigger a drop toward the $0.2430 region, where the 100 SMA currently sits.

Featured image from Dall-E, chart from TradingView