Wall Street’s Newest Darling: Bitcoin ETFs Rake in $2.75B as FOMO Kicks In

Institutional money floods crypto—again. This time, it’s not just hype.

Bitcoin ETFs just bagged $2.75 billion in fresh capital as prices tear toward all-time highs. Traders are piling in, hedge funds are repositioning, and your average financial advisor is suddenly a ’blockchain expert.’

The twist? This rally isn’t driven by retail degenerates. It’s Wall Street playing catch-up after years of dismissing digital gold as a ’fraud.’ Now they’re paying premiums to get exposure—ironic, given they could’ve bought the asset itself at 80% off two years ago.

Will the momentum hold? Who knows. But for now, the suits have spoken: Bitcoin isn’t dead—it’s their newest revenue stream.

Spot Bitcoin ETF Inflows Surge

According to Farside data, spot bitcoin ETFs drew $2.75 billion this week, up sharply from $608 million the week before. That big jump came as Bitcoin pushed past its January all-time high of $109,000.

On May 21, investors added $607 million, the same day Bitcoin hit a new peak. Then, on May 22, the coin soared to $111,980. Those moves show money chasing fresh highs.

BlackRock’s IBIT Leads Flows

Based on reports, ETF flows on May 23 totaled just $212 million, but BlackRock’s IBIT was the only one in the green. It brought in $431 million all by itself, and that stretched its inflow streak to eight days straight.

Meanwhile, Grayscale’s GBTC saw $89 million leave, and ARK 21Shares’ ARKB lost $74 million. Investors seem to favor the low fees and wide reach of the biggest funds.

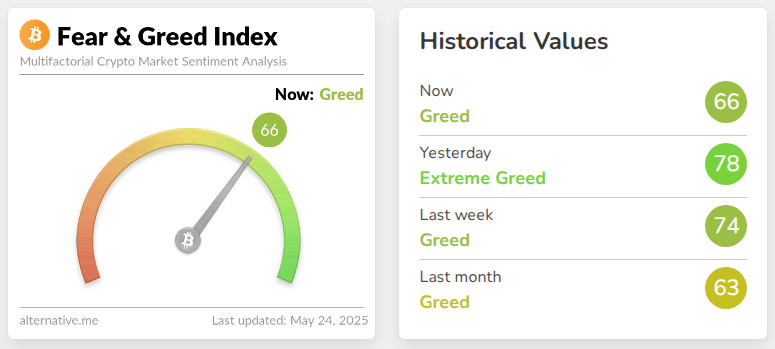

Bitcoin’s climb paused a bit after that. At publication, it traded near $108,150. The crypto Fear & Greed Index slid from an “Extreme Greed” reading of 78 down to 66, or “Greed.” That dip hints at some profit-taking.

CryptoQuant analyst Crypto Dan said on May 22 that “overheating indicators such as the funding rate and short-term capital inflow remain low compared to previous peaks, and profit-taking by short-term investors is limited.” His view is that this rally hasn’t been driven by risky bets.

Record Monthly Inflows In SightSo far in May, spot Bitcoin ETFs have pulled in about $5.40 billion. The previous monthly high came in November 2024, when ETFs took in $6.50 billion.

With five trading days left in May, inflows could set a new mark. That steady demand underlines how ETFs have become the go-to way for many to own Bitcoin without wrestling with wallets and private keys.

Demand for spot Bitcoin ETFs has grown fast. Investors like simple, regulated products. The big issuers, led by BlackRock, have the best chance to stay on top.

As for Bitcoin itself, if sentiment cools, prices might pull back some. But with institutional flows so strong, many see room to run higher.

Featured image from Gemini Imagen, chart from TradingView