BONK Eyes 77% Rebound After Testing Key Support—Solana Memecoin Defies Gravity

Solana’s rogue memecoin BONK isn’t done barking yet. After a retrace to the 200-day EMA—a critical technical level—traders are betting on a 77% corrective surge.

Market mechanics or hopium? The chart says recovery, but let’s see if this dog can hunt without another round of VC dumping. Classic crypto: where ’technical analysis’ often just means ’finding excuses to ape in.’

Bullish Market Structure Holds Firm For BONK

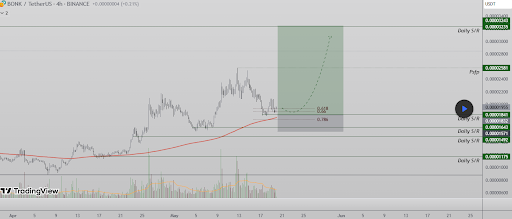

BONK’s price retracement has brought it directly into a zone of heavy technical interest. At the heart of this confluence lies the 200 EMA on the 4-hour timeframe, which could technically serve as the next support zone for the meme coin moving forward. In addition, the retracement aligns with the 0.618 Fibonacci level, which is commonly associated with bullish corrections. It also aligns with a daily support zone around $0.00001832 to $0.00001841 and a resistance zone around $0.00002034.

Interestingly, this movement has led to a consolidation between these levels since May 15, and according to the TradingView analyst, the price structure suggests buyers are stepping in to defend the trend. This, in turn, has led to the formation of a higher low.

From a volume standpoint, each upward impulse has shown rising volume since the first week of April. However, the recent decline occurred on diminishing volume, hinting at exhaustion from sellers.

77% Upside Move If BONK Breaks Above Resistance

Even with the current range, BONK is still within a bullish setup that could send it towards a new 2025 high and possibly towards its current all-time high levels. The important level to watch now is the point of control (POC) resistance at approximately $0.00001955. This level previously acted as the pivot point before the pullback and now serves as the threshold for bullish continuation.

A confirmed close above this region WOULD likely trigger a rapid expansion move toward the next resistance cluster around $0.00002581, before eventually reaching the predicted price target of $0.00003243, which would bring it close to its January 2025 open of $0.000035. As such, the projected target if this plays out will translate to a 77% rally. The price target also aligns with a previous swing high on January 15 and January 18.

At the time of writing, BONK is trading at $0.00001995, up by 1,6% in the past 24 hours. Its reaction here, just above the POC resistance, will be an important deciding factor. If buyers manage to maintain pressure and secure a decisive breakout, the stage could be set for a strong rally into the upper resistance band and a retest of BONK’s 2025 swing high.