Bitcoin Smashes Through Resistance—Weekly Close Defies $107K Plunge as Bulls Dig In

Bitcoin just pulled off a magic trick: crashing violently from $107,000 only to stage a defiant weekly close above critical resistance. Here’s why the bulls aren’t just surviving—they’re thriving.

The Setup: A Classic Shakeout

That 20% nosedive from six figures? Textbook whale games. Weak hands got liquidated while institutional buyers scooped up discounted coins faster than a Wall Street intern grabbing free conference sandwiches.

Technical Edge: The Numbers Don’t Lie

Weekly charts show BTC hasn’t just reclaimed its range high—it’s holding it as support. Open interest remains elevated, funding rates neutral. This isn’t hopium; it’s hedge fund-level positioning.

The Cynic’s Corner

Sure, traditional finance pundits will call it ’irrational.’ Meanwhile, their 2% bond portfolios are getting eaten alive by inflation—but do go on about volatility.

Bottom Line: Until key levels break, every dip remains a buying opportunity. The market’s voting with its wallet, and right now, it’s all in on orange.

Bitcoin Weekly Closes Above Range – First Bullish Step

Current Bitcoin price action shows that bullish investors and buyers are still controlling the momentum behind the largest cryptocurrency and, in essence, the rest of the crypto market. Notably, Bitcoin initially experienced a brief surge to nearly $107,000 over the weekend before retreating.

This price movement was followed by a dip to around $102,000, with the back-and-forth most likely being influenced by factors such as Moody’s downgrade of U.S. debt and investor reactions to potential interest rate cuts by the Federal Reserve.

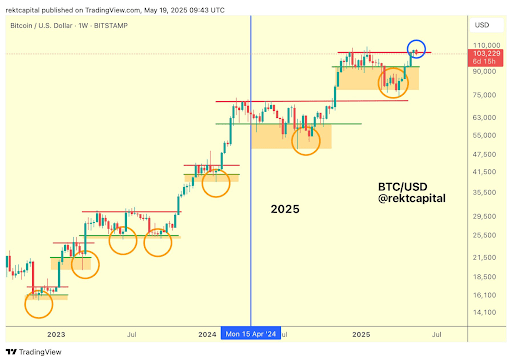

However, in an interesting note, the BTC price managed to close above the $103,000 range during this first move to $107,000, which is very important in terms of technical analysis going forward. This sentiment is echoed by crypto analyst Rekt Capital on social media platform X, who pointed out the next step that might play out for Bitcoin.

Post-Breakout Retest Underway, Says Rekt Capital

The $104,000 price level had previously acted as a stubborn ceiling throughout much of the recent Bitcoin price consolidation between $102,000 and $104,000 since May 9. However, since breaking above this level, the ensuing price action has seen the Bitcoin price retracing towards this level after another rejection at $107,000.

According to crypto analyst Rekt Capital, the dip following the $107,000 rejection isn’t necessarily bearish. Instead, it could be part of a post-breakout retest, a pattern often seen in strong bullish structures.

If this retest successfully confirms the former resistance as new support, BTC could set the stage for a breakout into fresh all-time highs. As shown in the 1W bitcoin price chart above, the red resistance level is very close to Bitcoin’s January 2025 all-time high around $108,780.

Furthermore, the chart shows that the recent breakout above the $90,000–$103,000 zone appears to mirror a pattern of Bitcoin’s breakout after a consolidation move, after another bounce from a low. In this case, the bounce occurred at the $75,000 low in early April.

If bitcoin does rebound with enough trading volume around $104,000, this could provide the much-needed momentum for a move above $107,000 and finally above $108,700 again. At the time of writing, Bitcoin is trading at $105,555, up by 2.9% in the past 24 hours.