Chainlink Defies Gravity: Ascending Channel Suggests Bull Run Isn’t Done Yet

Chainlink’s price action paints a textbook bullish pattern—traders are betting the oracle giant’s rally has legs. Here’s why the charts scream ’buy.’

Technical breakout: LINK’s price carves a clean rising channel, bouncing off support like a crypto kangaroo on espresso. Each higher low whispers ’accumulation season’ to anyone watching the 4-hour candles.

Market irony alert: While traditional finance still debates blockchain use cases, Chainlink’s 30% monthly gain quietly mocks the skeptics. The oracle network now feeds data to more DeFi protocols than some banks have clients.

Word to the wise: This isn’t financial advice—but ignoring an ascending channel in crypto is like dismissing a bullhorn at a library. Volume confirms the trend, and smart money’s already positioning.

Chainlink Breaks Above 200 MA: Bullish Momentum Builds On M30

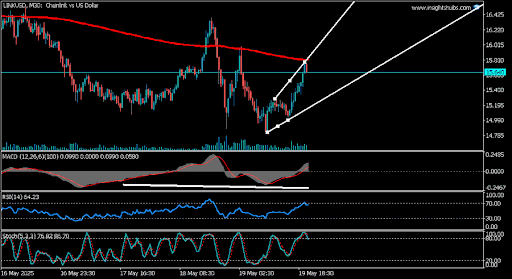

In an X post, crypto analyst Thomas Anderson highlighted that chainlink is exhibiting notable bullish momentum on the 30-minute (M30) timeframe. According to Anderson, LINK has successfully broken above the 200-day moving average (marked in red on the chart), a significant technical milestone that often signals a shift in market sentiment. At the time of his post, LINK was trading around $15.560 and was actively forming an ascending channel, a bullish price pattern characterized by consistently higher lows and higher highs.

Anderson noted that the current price structure reflects sustained buying interest, with the Relative Strength Index (RSI) sitting comfortably at 64.23 just below overbought territory, indicating healthy momentum. Additionally, the MACD (Moving Average Convergence Divergence) indicator is in positive territory, further reinforcing the strength of the ongoing uptrend.

However, he cautioned traders to remain vigilant as the price approaches the upper boundary of the ascending channel. This zone could act as a short-term resistance level, triggering a pullback or consolidation phase before further upside. Overall, the outlook for Chainlink on the M30 chart remains bullish.

LINK Flips Bearish Structure On Daily Timeframe

A crypto analyst @Whales_Crypto_Trading shared a bullish outlook on LINK, noting that the asset is currently breaking out of a descending channel on the daily timeframe. This long-standing pattern had previously kept LINK locked in a downward trajectory, but the recent price action suggests that momentum is shifting in favor of the bulls. A breakout from this structure is typically seen as a strong technical signal, indicating the potential for a significant trend reversal.

According to the analyst, a complete descending channel pattern suggests that Chainlink is no longer confined in a bearish trend and may now be positioned for a substantial upside move. With market sentiment showing early signs of turning positive, the breakout could mark the beginning of a new bullish phase for LINK, supported by improved technical indicators and increasing volume.

He concluded by stating that this breakout sets the stage for a massive rally, with $28 identified as the next major target. Reaching this level WOULD represent a strong recovery and a clear signal that bulls have regained control.