Solana Defies Gravity at $166 After $183 Rejection – Bulls or Bears Taking Control?

Solana’s price action just gave traders whiplash—bouncing off $166 support after a sharp rejection from $183 resistance. The crypto’s volatility is either a ’healthy correction’ or ’the start of a deeper pullback,’ depending on which permabull or doomscroller you ask.

Key levels to watch: A clean break above $183 could signal a retest of May’s highs, while losing $166 might trigger a cascade toward $150. Meanwhile, Bitcoin’s sideways chop isn’t helping—typical ’store of value’ behavior, right?

Pro tip: Watch the SOL/BTC pair. If Solana starts outperforming the king coin, even the most cynical traders might have to admit this isn’t just another shitcoin rally.

$166 Support Holds Repeated Tests, Break Above $177 Or $183 Will Be Bullish

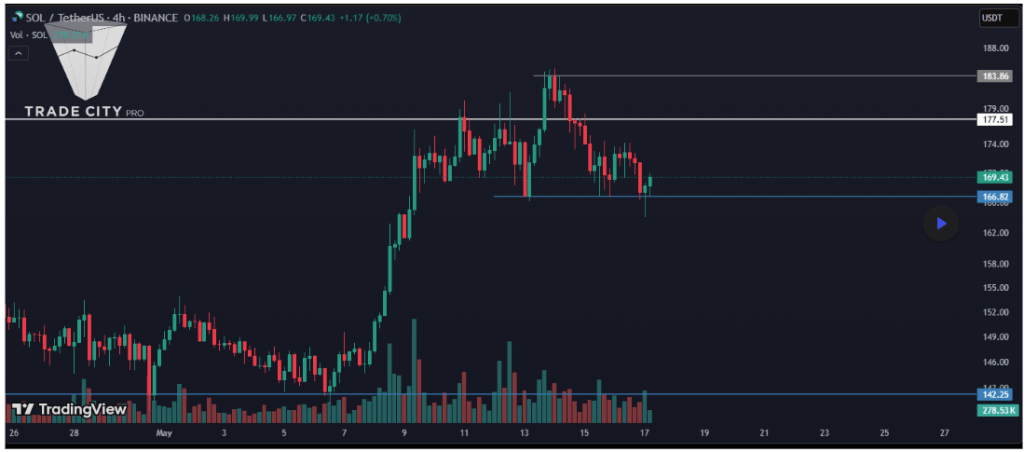

According to a recent analysis posted by TradeCityPro on TradingView, the $166.82 level is serving as a key short-term pivot for Solana. After a bullish leg that began at $142.25 and extended to $177.51, the asset experienced a fake breakout attempt beyond that resistance and was swiftly rejected at $183.86.

This rejection brought the price back below $177.51 and into a retest of the $166.82 region. Notably, this support level has been tested twice so far and has held firm. The 4-hour chart is showing strong bullish candles forming around $166, which is an indication of a strong buying interest at this price level.

Keeping this in mind, a breakout above either the $177.51 or $183.86 resistance WOULD be the go ahead for a long position, especially if accompanied by the formation of a higher low and higher high beforehand.

Until such a breakout occurs, the current setup is one of indecision. A successful breach and daily close above $177 backed by rising volume would likely set the stage for another MOVE toward the $190 to $200 region for Solana.

Chart Image From TradingView

Short Trade Also Valid Below $166 Support Zone

Market volume, however, has declined from last week’s levels. At the time of writing, Solana’s 24-hour trading volume is $2.3 billion, a 36.15% decrease from the previous 24-hour timeframe. As such, a new wave of momentum will be required to drive Solana through the resistance levels at $177 and $183.

For now, the Solana price is consolidating tightly above $166, and failure to hold this level could open the door for a retest of the deeper $142.25 support.

If bears gain control and push the price lower, the next significant demand zone lies back at $142.25, which is the origin point of the previous bullish move. Given how the price reacted from this level earlier on April 30 and on May 6, it is expected to act as a strong support again if tested.

At the time of writing, Solana is trading at $171. up by 1.6% in the past 24 hours.

Featured image from Unsplash, chart from TradingView