Ethereum Gears Up for $2.4K Retest – Here’s What Traders Are Watching

Ethereum bulls are back in the driver’s seat as ETH eyes a critical retest of the $2.4K resistance level. Analysts flag two make-or-break zones: a hold above $2.2K keeps momentum alive, while a dip below $2.1K could trigger panic selling—because nothing says ’decentralized future’ like traders sweating over 10% swings.

Key levels to watch? The $2.3K support floor (where institutional buyers lurk) and the $2.5K breakout target (where moonboys start screenshotting their portfolios). Meanwhile, Bitcoin’s sideways action leaves altcoins to steal the spotlight—until the next Fed meeting, anyway.

Ethereum’s Surge Faces a Crucial Retest Around $2.4K

Ethereum has surged more than 50% since last week, reclaiming momentum after months of heavy selling pressure. ETH is showing sustained strength for the first time since late December, fueling Optimism that the broader altcoin market could be next. Many analysts are calling for an altseason, and Ethereum’s breakout is seen as a potential catalyst for a larger move across altcoins that have severely underperformed in recent years.

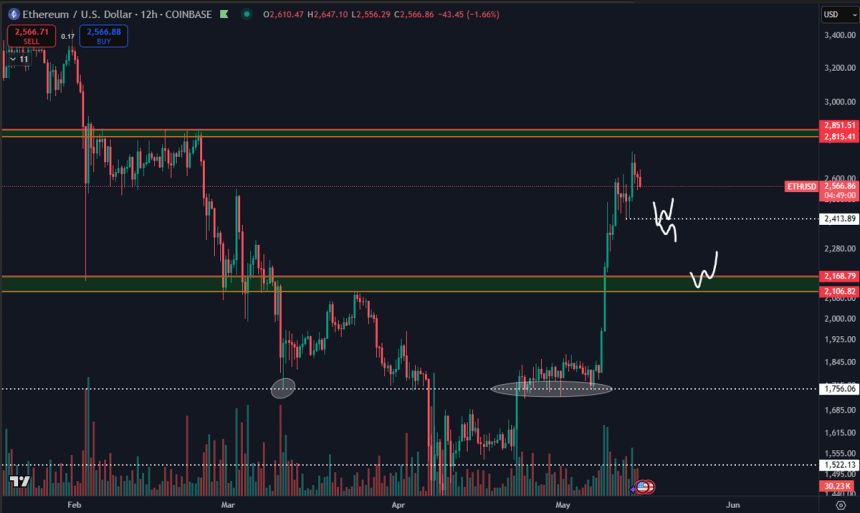

However, after such a sharp move, a period of consolidation or correction wouldn’t be unusual—and could even be healthy. According to Daan, the $2,400 level will be a key support zone to watch. He believes it makes sense for price to test this area before further continuation. Daan currently has no interest in entering long positions until some of the billions in Open Interest are flushed from the system. How Ethereum reacts around $2.4K will likely set the tone for the next phase.

If ETH sweeps $2.4K and quickly bounces, Daan expects a local range to FORM between $2.4K and $2.7K. However, if price loses that level decisively, the next major support lies at $2.1K. A slow bleed into that zone could signal weakness, while a quick flush might present a short-lived buying opportunity.

Despite short-term risks, Daan notes that even a pullback to $2.1K would still leave ETH up roughly 20% from the prior week. In his view, the larger trading range for now is between $2.1K and $2.8K—a zone that could define Ethereum’s next major trend if bulls can hold key levels and regain momentum. For now, the rally is alive, but the next test will be critical.

Price Consolidation Taking Place Amid Optimism

Ethereum (ETH) is currently trading around $2,565, following a sharp retracement from its recent local high NEAR $2,740. After a powerful rally that pushed ETH above both the 200-day exponential moving average (EMA) and simple moving average (SMA), the price is now consolidating just below the 200-day SMA at $2,702.93. This level has acted as resistance over the last few sessions, capping Ethereum’s attempt to continue its upward momentum.

Volume has declined slightly, reflecting market indecision after last week’s breakout. If bulls can defend the 200-day EMA near $2,437 and maintain higher lows above $2,500, the structure would remain bullish. However, a failure to hold these levels could lead to a deeper pullback, with $2,400 and $2,200 as potential supports.

The recent price action suggests Ethereum is forming a short-term range between $2,400 and $2,700, which could persist until a clear breakout above the 200-day SMA. Holding above $2,500 is crucial to maintaining bullish momentum, especially as the altcoin market eyes further gains.

If ETH can push above $2,700 with strong volume, it would confirm renewed strength and open the path toward the $3,000–$3,100 resistance zone. Until then, consolidation and caution dominate the short-term outlook.

Featured image from Dall-E, chart from TradingView