Bitcoin Treasury Firms—The Next Big Bubble or Just Wall Street Cosplay?

Corporate treasuries loading up on BTC might be this cycle’s most dangerous game. Here’s why the smart money’s sweating.

The Gold Rush 2.0 Looks Familiar

Just like 2021’s SPAC frenzy—but with more laser eyes—companies are mortgaging balance sheets for volatile crypto. Tesla’s $1.5B flip was cute; now every CFO thinks they’re Michael Saylor.

Liquidity Crunch Coming?

When (not if) the Fed pivots, these ’HODL at all costs’ strategies could implode faster than a Celsius withdrawal queue. Remember: corporate BTC isn’t backed by FDIC—just hopium and 10-K footnotes.

The Cynic’s Take

Nothing screams ’mature asset class’ like executives gambling shareholder cash on digital Beanie Babies. But hey, at least they’re not buying commercial real estate.

The Bitcoin Treasury Copy-Cat Surge

But Stack Hodler wasn’t referring to MicroStrategy. “I’m talking about the copycats that are popping up at an accelerating pace,” he responded. “They’re trying to draft off MSTR’s success, similar to how shitcoins drafted off of BTC’s success.” He said he doesn’t deny that regulatory arbitrage might support a few of these firms in the short to medium term, but questioned the viability of companies whose primary activity appears to be printing shares and using the proceeds to buy Bitcoin. “I love seeing companies with real profitable businesses stack BTC. Fiat engineering seems shakier to me long-term.”

Scott Melker, host of “The Wolf of All Streets” podcast, added to the discussion: “I hate to even think this, because I’m a huge fan—but Bitcoin treasury companies raising debt to buy Bitcoin could be the next bubble.” Market structure analyst Dave Weisberger agreed that risk is present, but took a more measured stance. “Sure. But bubbles have to inflate before we worry about them… spoiler, Bitcoin is NOT NEAR bubble territory.”

Technical analyst FiboSwanny, a 25-year market veteran, focused on leverage and market structure. “If there’s a bubble forming, it’s likely in the financial instruments and leverage around Bitcoin,” he said, citing debt-funded treasury purchases, ETFs, and derivatives. “Not in actual Bitcoin itself.” Lark Davis took a more bearish tone: “This is our GBTC leverage this cycle that will have a horrific unwind with devastating consequences later. Especially the companies buying altcoins.”

Swan CEO Cory Klippsten didn’t mince words either. “Already jumped the shark,” he wrote. “Have been predicting it for a year, but it’s inevitable now.”

The current landscape includes dozens of public companies with direct Bitcoin holdings, some of which are drawing intense retail speculation. MicroStrategy remains the dominant force, with well over half a million Bitcoin on its books. Other names include Metaplanet in Japan, Semler Scientific, KULR Technology, and various new entrants who have reoriented their corporate missions entirely around Bitcoin accumulation. Many of these firms are now trading at multi-billion-dollar valuations, far above what their underlying business models WOULD suggest.

But the sustainability of the model remains in question. Most of these companies rely on issuing new equity at inflated valuations to finance further Bitcoin purchases, creating a reflexive cycle where rising BTC prices inflate share prices, which in turn enable more buying. That dynamic works beautifully in a bull market but can reverse quickly in a downturn.

The debate over how institutional exposure is structured becomes increasingly relevant. Stack Hodler framed it simply: “Bitcoin is and always will be the best risk-return asset to hold in this space. Part of successfully holding Bitcoin is being able to resist all the ‘better Bitcoins’ that inevitably arise during your journey.” Whether the new class of treasury companies represents innovation, opportunism, or simply a bubble waiting to burst, remains one of the key questions of this cycle.

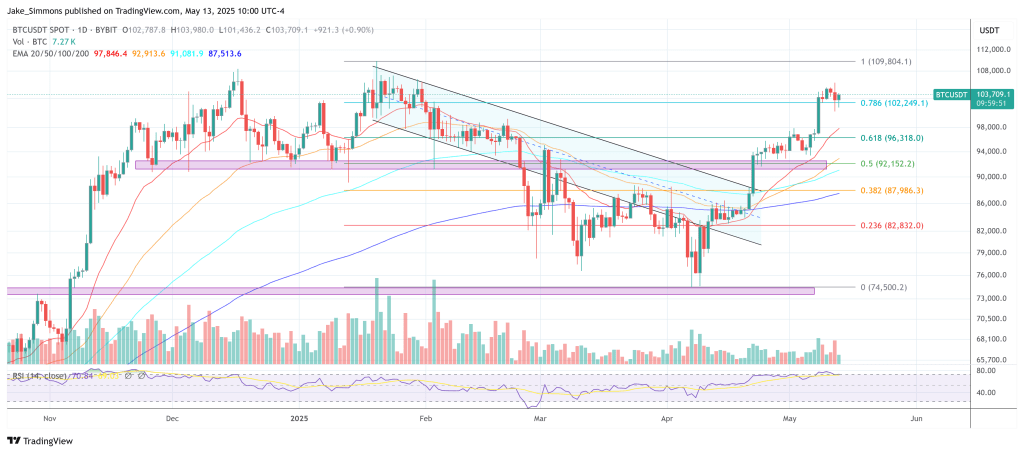

At press time, BTC traded at $103,709.