XRP Open Interest Explodes: $1B Floods In Amid Market Frenzy

XRP traders are doubling down—open interest rockets 41% in seven days as speculation hits fever pitch. The billion-dollar question: Are institutions positioning for a breakout, or just another round of crypto casino action?

Derivatives markets scream bullish: Over $1B in fresh bets poured into XRP futures this week. Liquidity surges as traders ignore SEC noise and chase the next narrative pump.

Cynic’s corner: Wall Street still won’t touch this with a 10-foot pole—unless they’re secretly frontrunning the retail crowd again.

XRP Leads With Strong Momentum And Rising Leverage

XRP is emerging as one of the strongest performers in the market, displaying remarkable resilience during recent downtrends and now showing clear strength in the current bullish environment. After consolidating through volatile conditions, XRP has surged above the $2.50 level, firmly positioning itself as a leader among large-cap altcoins. The price action remains tight, with bulls continuing to test the $2.60 zone while bears are unable to push the price below the new support levels formed NEAR $2.35.

This price compression, combined with broader market optimism, suggests that XRP may be gearing up for a major move. With Bitcoin consolidating near its all-time highs and Ethereum testing crucial resistance zones, analysts are paying close attention to XRP’s trajectory. The altcoin market is heating up, and XRP’s technical structure hints at a bullish expansion phase if current levels are maintained or reclaimed with volume.

Supporting this bullish outlook is recent data from Glassnode, showing that XRP Futures Open Interest has soared by over $1 billion in the past week. It jumped from $2.42 billion to $3.42 billion—a 41.6% increase—coinciding with a price rally from $2.14 to $2.48.

This surge in leverage underscores growing speculative interest and strong directional conviction among traders. Elevated open interest, particularly when paired with upward price movement, often signals sustained momentum and institutional participation. With XRP firmly above key support and showing signs of renewed investor confidence, the next few sessions could be pivotal for determining whether XRP will finally break out into a new macro trend.

Price Action Signals Strength Amid Market Momentum

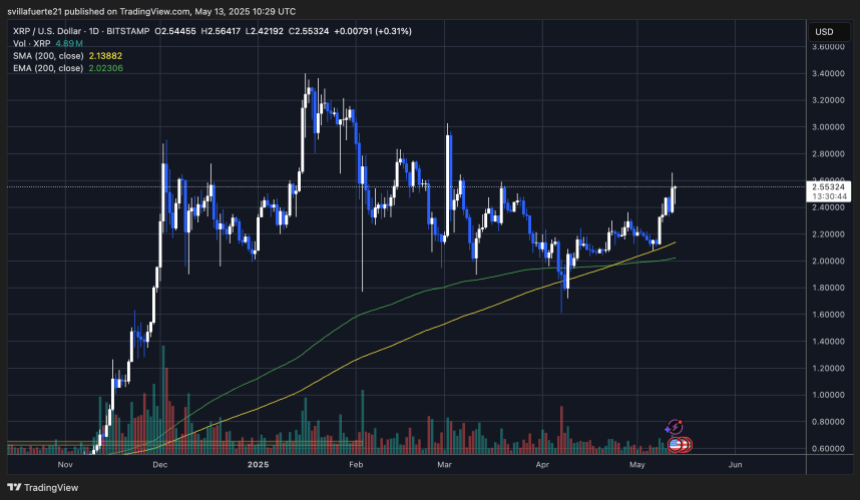

XRP is showing strong bullish momentum as it continues to trend higher, currently trading around $2.55. The chart reveals a well-established uptrend, with XRP recently breaking above key resistance levels and holding above both the 200-day Simple Moving Average (SMA) and Exponential Moving Average (EMA), currently at $2.13 and $2.02, respectively. This alignment of moving averages below the current price reinforces the bullish structure.

Over the past two weeks, XRP has surged more than 24%, confirming higher lows and higher highs in the process. After briefly stalling at $2.60, the price is now consolidating with low volatility just below that level—indicating potential for another breakout if buying pressure resumes. Volume also picked up significantly during the initial leg of this move, signaling strong interest from market participants.

The next resistance level to watch is near $2.80, which marked a major rejection zone earlier in the year. On the downside, the $2.35 zone has now turned into strong support and WOULD be a critical level for bulls to defend if momentum weakens.

Featured image from Dall-E, chart from TradingView