XRP Breaks Critical Resistance—Analyst Says ’Sky’s the Limit’ for Price Surge

XRP just smashed through a make-or-break technical level—and one chart watcher claims the token’s primed for liftoff. Here’s what’s fueling the frenzy.

The breakout playbook

After weeks of consolidation, XRP’s weekly chart punched through a multi-year descending trendline. Traders are piling in, betting this is the start of a macro uptrend.

Liquidity avalanche incoming?

The last time XRP saw this setup was pre-2017 bull run. Of course, past performance doesn’t guarantee future results—but try telling that to crypto degens with leverage tabs open.

Wall Street’s watching (between martini lunches)

With Ripple’s legal overhang clearing, institutional money might finally stop pretending they ’never really liked XRP anyway.’ Price action this week could separate the true believers from the fairweather funds.

Massive XRP Breakout Coming?

Order-flow data backs the bulls’ case. Dom has been tracking aggregated net flows by trade size and finds that tickets of 10,000–50,000 XRP and 50 000+ XRP have flipped firmly positive over the past three days, while smaller clips (100–1,000 and 1,000–10,000 XRP) have turned net-negative. “Little fish have sold the rip and bigger money has been behind it,” he wrote, adding that the dataset cannot distinguish between retail and institutional wallets but “very unlikely” points to exchange internalisation.

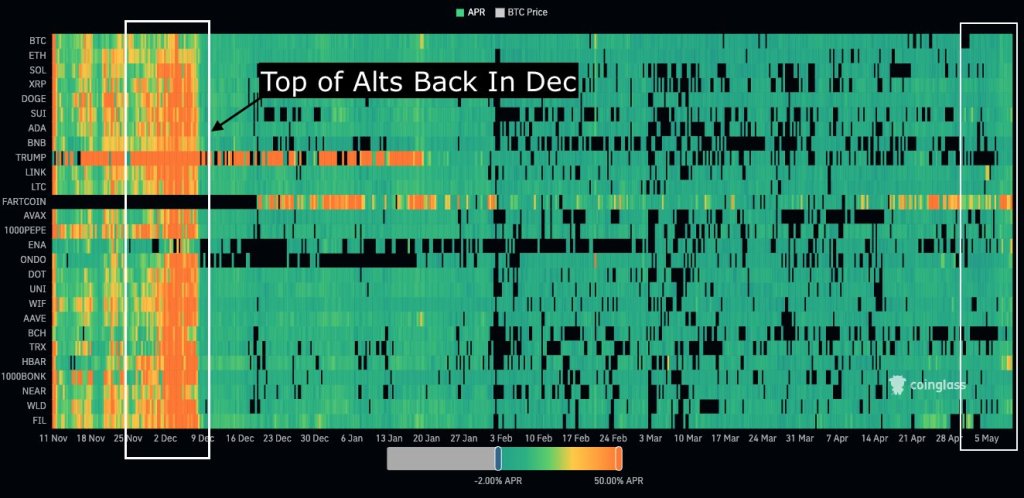

Broader market context corroborates the sense of a maturing impulse. A separate CoinGlass heat-map of perpetual-swap annualised funding rates that Dom shared plots twenty-seven large-capitalisation altcoins from November through May. The graphic highlights two periods – late November to 9 December and the first weeks of May.

The December cluster coincided with the “top of alts”, and he argues that the current cluster represents the most intense speculative pressure since that episode. “Strongest MOVE in the altcoin market since November and funding looks like this… I said it last week and I’ll say it again. Hated rally,” Dom argues.

Against that backdrop, the immediate technical roadmap remains binary. XRP must first defend the $2.30 quarterly VWAP, a level that has switched from resistance to support within the last forty-eight hours. Hold that shelf and traders will continue to probe the ATH VWAP ceiling. Lose it, and the path of least resistance swings back toward the mid-$2.00s congestion that defined most of April.

But should bulls finally force acceptance above the descending VWAP – a feat they have not achieved once this year – the analyst sees little in the way of overhead supply until the mid-$2.70s, the lower boundary of the late-January distribution block. As Dom concludes, “Acceptance above ATH VWAP opens the sky for a larger breakout.”

At press time, XRP traded at $2.46.