Bitcoin Shatters Resistance—$137K Target Now in Play as Analysts Spot Historic Breakout

BTC just punched through a critical price barrier unseen since November 2024, and traders are scrambling to adjust their targets. One market veteran claims this could be the launchpad for a 3x surge—if Wall Street doesn’t ’discover’ crypto again and ruin the party.

Key levels to watch: $72K (new support), $89K (mid-term resistance), and yes—that audacious $137K whisper number. Skeptics point to overleveraged longs, but the charts don’t lie... until they do.

Fun fact: This rally coincides with yet another ’institutional adoption’ press release from a hedge fund that still allocates 0.3% to digital assets. Progress!

Is BTC Following This Cup And Handle Pattern?

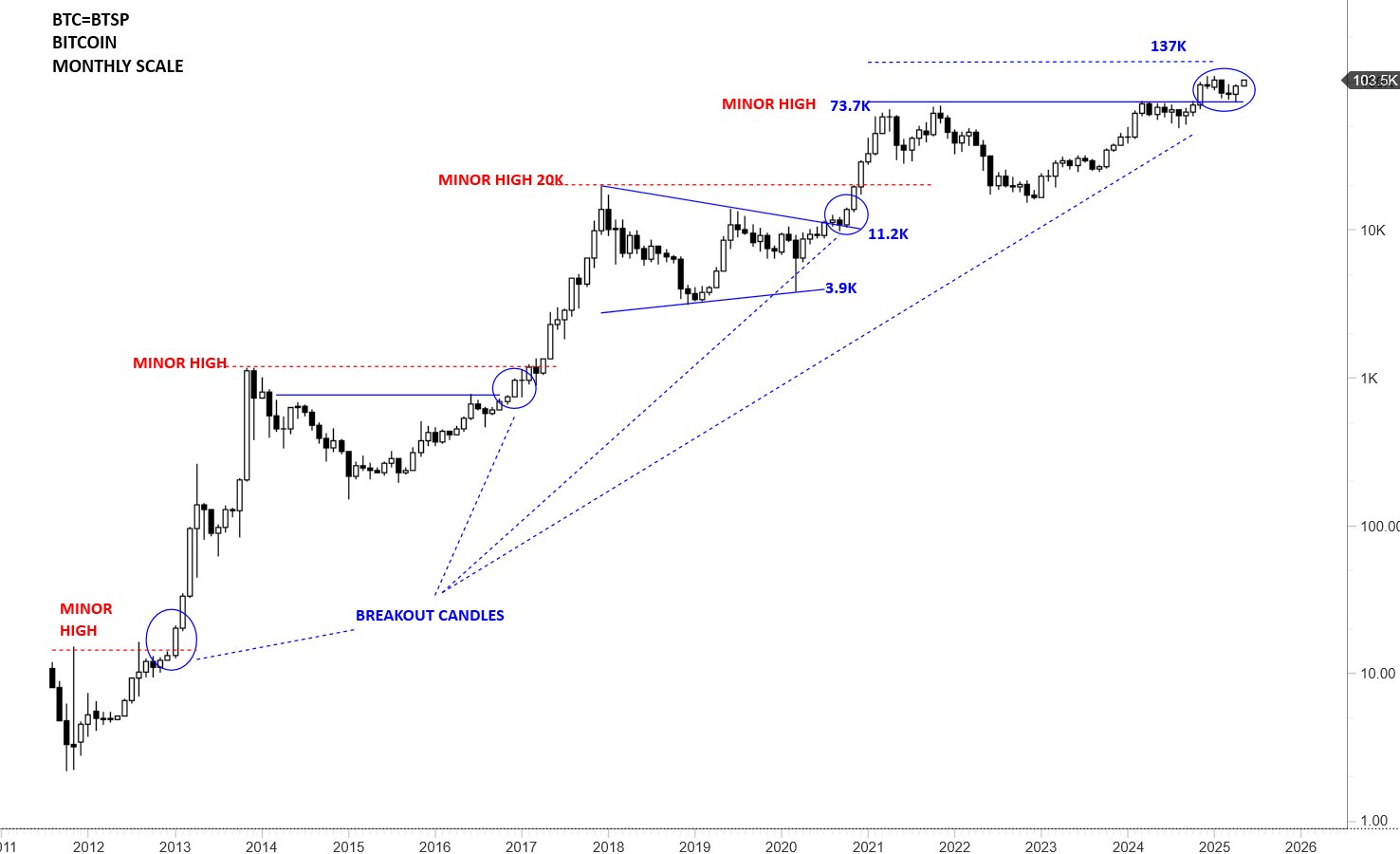

In a May 9 post on X, chartered market technician (CMT) Aksel Kibar shared an interesting update on his recent Bitcoin price analysis. The market expert revealed, in a late November 2024 post on the social media platform, a long-term breakout signal for the BTC price.

Following the election victory of Donald Trump as United States President, the Bitcoin and crypto markets witnessed a significant amount of bullish momentum. Kibar highlighted that BTC, as a result of the post-election rally, was breaking above a significant price level on a large (monthly) timeframe.

As shown in the chart above, the bitcoin price broke above its “minor high” around the former all-time high of $73,737 in November. Based on historical patterns, Kibar highlighted in his chart that the flagship cryptocurrency goes on a parabolic run whenever it surpasses the minor high in the cycle.

Interestingly, this November 2024 breakout has formed a cup and handle pattern, a technical analysis pattern that resembles a cup in the shape of the letter “u,” and the handle has a slight downward drift. The cup and handle is considered a bullish pattern, which signals the continuation of an upward trend.

In this particular iteration of this pattern, the price of BTC continued to rally after breaking the $73.737 till it reached a six-figure valuation. However, the bitcoin price witnessed a severe correction to around $74,000 after reaching its current all-time high in January.

However, it appears that Bitcoin only witnessed a minor pullback to the “minor high” before resuming its primary upward trend. In this scenario, Kibar put the cup and handle target for the market leader at around $137,000, which represents an over 33% rally from the current price point.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $103,071, reflecting a nearly 1% increase in the past 24 hours. According to data from CoinGecko, the market leader is up by more than 6% on the weekly timeframe.