Standard Chartered’s Bold Call: Binance’s BNB Could Surge to $2,775 by 2028

Binance’s native token, BNB, might just be the dark horse of crypto—if Standard Chartered’s latest prediction holds. The bank’s analysts project a staggering $2,775 price target by 2028, a figure that’d make even Bitcoin bulls blink.

Why the optimism? Binance’s ecosystem keeps expanding, and BNB’s utility burns brighter than ever. From trading fee discounts to powering decentralized apps, it’s the Swiss Army knife of crypto tokens.

But let’s not ignore the elephant in the room: regulatory headwinds. Binance’s dance with global watchdogs could turn this rocket ship into a bumper car. Still, if the exchange keeps its act together, BNB might just laugh all the way to the bank—assuming the bank hasn’t been ‘de-banked’ by then.

BNB Could Spike By 360%

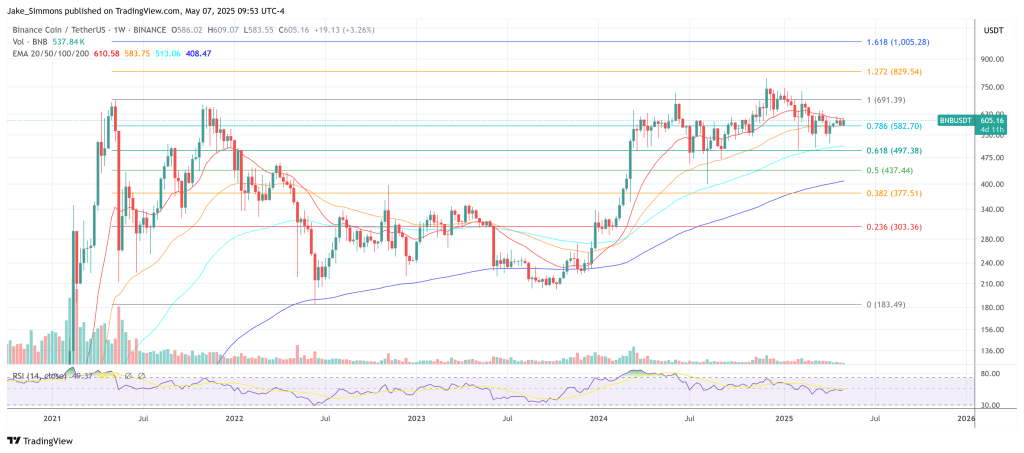

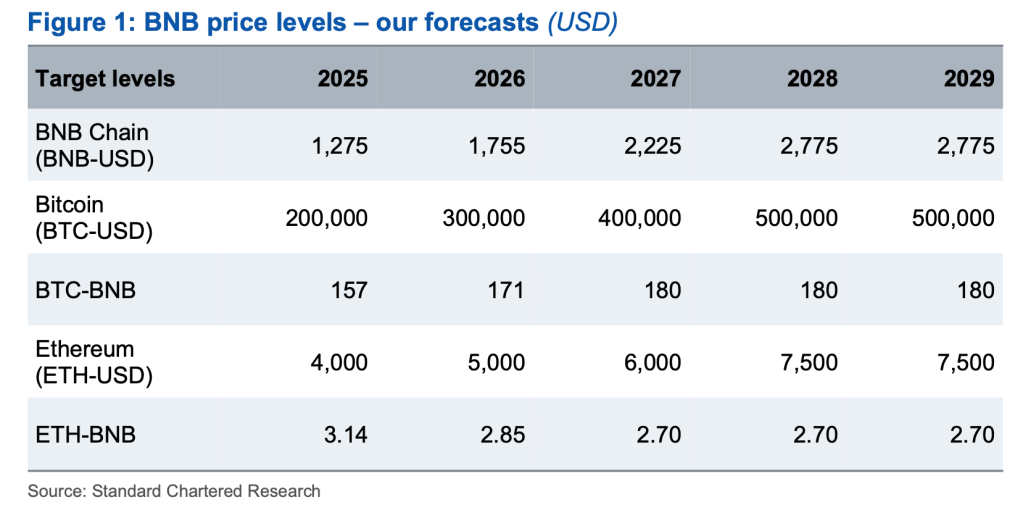

The path implies a gain of more than 360% from current levels and, crucially, situates the token in what Kendrick calls “a benchmark-like role” inside the wider crypto capital structure. “BNB has traded almost exactly in line with an unweighted basket of Bitcoin and Ethereum since May 2021 in terms of both returns and volatility,” Kendrick wrote. “We expect this relationship to continue to hold, driving the price from around $600 currently to $2,775 by end-2028.”

Standard Chartered’s broader outlook is unabashedly bullish on the majors: Bitcoin is projected to reach $200,000 in 2025 and $500,000 in 2028, while Ethereum is pencilled in at $4,000 and $7,500 over the same horizons. When those forecasts are translated into cross-asset ratios, they reveal subtle shifts in market share.

The BTC-BNB ratio—how many BNB one Bitcoin can buy—is expected to tick up from 157 in 2025 to 180 by 2027, then hold steady, implying that Bitcoin’s dollar appreciation is likely to outrun BNB’s. By contrast, the ETH-BNB ratio is seen slipping from 3.14 in 2025 to 2.70 in 2027, signalling that Ethereum may outperform BNB, but more gently than Bitcoin will.

Kendrick acknowledges that BNB “may underperform Bitcoin and Ether both in real terms and as measured by market cap in circulation,” yet he contends that its deflationary tokenomics and deep linkage to the world’s largest centralized exchange “support its long-term value.”

The research note scrutinises BNB Chain’s architecture. Its “proof-of-staked authority” model rotates just 45 validators every 24 hours—a sharp contrast to Ethereum’s million-plus validator set. Kendrick describes BNB Chain as “highly centralised relative to other chains,” adding that its developer activity has “stagnated” since the 2021 DeFi surge and now trails networks such as Avalanche and Ethereum.

Even so, forthcoming technical milestones are expected to expand the ecosystem’s resilience. Kendrick cites the recently completed Pascal hard fork and the looming Maxwell upgrade, due in June, as examples of “incremental but meaningful” incentives for developers.

On the demand side, the token’s fortunes remain tethered to Binance’s trading engine. Holders receive tiered fee discounts calculated on their token balance and 30-day volume—a mechanically enforced use-case that has so far “helped the BNB Chain retain activity even as competition from other ecosystems like Solana grows,” Kendrick notes. PancakeSwap, the dominant decentralised exchange on BNB Chain, amplifies that liquidity loop.

Meanwhile, regular token burns, coupled with the fixed-limit supply, underpin a structural deflation that Standard Chartered says justifies the premium BNB commands on its market-cap-to-GDP valuation screen—currently “rich” by the bank’s preferred metric.

At press time, BNB traded at $605.