Is ’The Big Short’ Brewing for Bitcoin? Why $110K Is Just the Starting Line

Wall Street’s favorite horror story—the 2008 subprime collapse—might be getting a crypto remake. But this time, Bitcoin’s writing its own script.

Here’s why the smart money is betting against the skeptics:

• Supply shock meets institutional FOMO: With 90% of BTC already mined, BlackRock’s ETF inflows could turn scarcity into frenzy.

• Macro tailwinds: Every rate cut whispers ’hard assets’—and BTC’s got the hardest resume in the room.

• Technical breakout: The 2024 halving was Bitcoin’s warm-up lap. Now it’s eyeing the $110K ATH like a sprinter spotting the finish line.

Sure, some hedge fund manager in a bespoke suit will call it a bubble between sips of $200 bourbon. But remember—these are the same geniuses who needed a bailout in ’08 while Satoshi coded the antidote.

Why The Bitcoin Price Will Hit $110,000

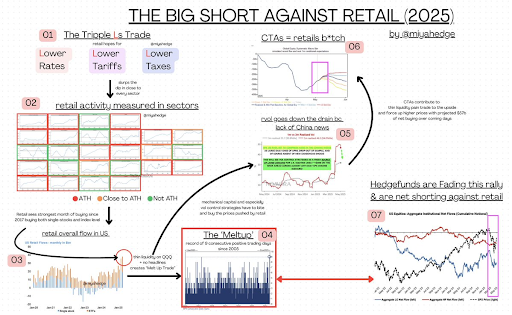

In an analysis titled ‘The Big Short against Retail,’ Miya predicted the Bitcoin price to reach $110,000 by the end of the year. At the same time, the expert expects the S&P 500 to drop to 4,700. She opined that the stock market is heading towards a bad summer, which is why she expects a lower low on the SPX but a “pristine” Bitcoin.

Basically, Miya expects the Bitcoin price to benefit from any potential downtrend in the stock market, with investors viewing it as a flight to safety. She remarked that the market is heading towards a terrible macro situation, which could cause stocks to crash. These predictions came as the expert commented on the nine consecutive green days that stocks have enjoyed and why she believes it won’t last long.

The market commentator noted that Donald Trump has made three main promises to the market: lower rates, tariffs, and taxes. These promises are expected to be kept, and she claims that the market is pricing them in as a sure thing. Traders are currently betting on a rate cut in June, while the US and China are set to meet to agree on a lower tariff. Lower taxes could come following a successful tariff policy.

Thanks to this, the stock market has been on a nine-day-long uptrend, while retail traders have made profits by buying the dip. However, Miya has warned that the market isn’t as strong as it looks and could soon blow up, with the Bitcoin price benefiting when this projected crash happens.

Why The Stock Market Is Bound To Crash

The expert noted that this false idea of up-only gives retail investors the illusion of complacency, as they do right now with their $57 billion bid on top of retail accumulated shares. However, she remarked that eventually, this will unfold with the “containership recession trade” hitting the US in five days. BTC is expected to be a hedge against this macro situation, which would lead to a Bitcoin price surge.

Miya explained that all the ‘Magnificent 7’ earnings in the last season have been massively skewed and were “useless information,” meaning they cannot be relied on to show a strong market. She added that TMT firms that manufacture physical hardware usually manufacture in waves, so the actual impacts will show up in their H2 capex over Q1 results, meaning the impact of tariffs hasn’t exactly started kicking in.

At the time of writing, the Bitcoin price is trading at around $96,500, up over 2% in the last 24 hours, according to data from CoinMarketCap.