Ethereum Holders Dig In Despite Bloody Portfolios – Is This the Calm Before a Moon Mission?

ETH wallets cling to their bags even as red ink spreads across balance sheets—classic diamond-hand behavior or denial masquerading as conviction?

Key signals to watch: Exchange outflows tick up, staking queues lengthen, and that suspiciously cheerful ’buy the dip’ chorus from crypto influencers grows louder.

Meanwhile, traditional finance bros clutch their pearls and whisper ’irrational exuberance’—right before missing the next 10x.

Ethereum Holders Are Staying Put Despite Unrealized Loss

Since reaching its cycle high of $4,107 in December 2024, ETH has experienced a sharp pullback of over 50%, currently trading around the $1,800 mark. Despite this steep correction, long-term ETH holders – particularly those behind accumulation addresses – have not been deterred. Instead of exiting their positions, they continue to hold firm.

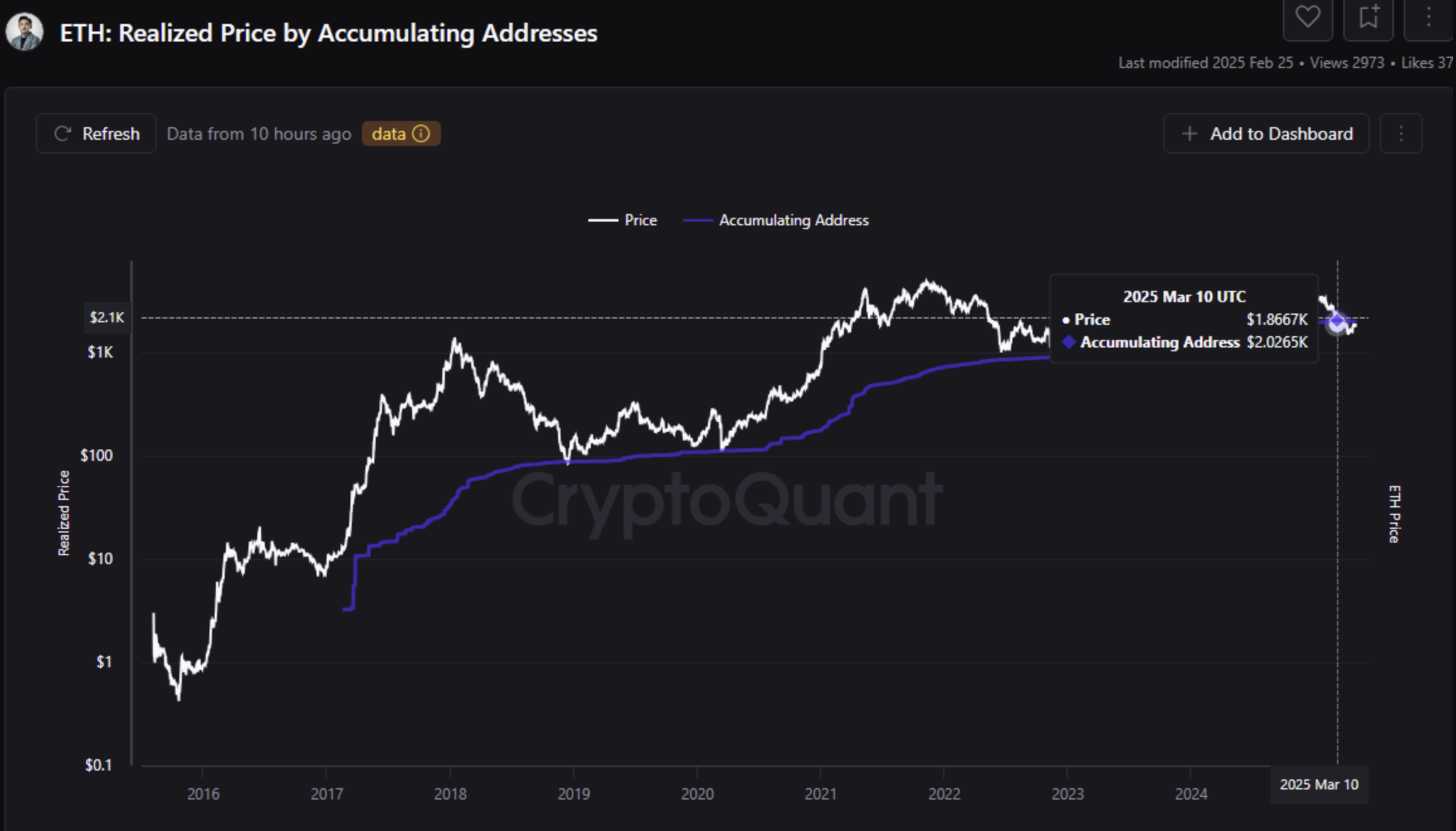

Interestingly, since March 10, on-chain data reveals that many of these accumulation addresses have entered unrealized loss territory. For context, ETH fell to a local low of $1,866 while its Realized Price stood at $2,026.

For the uninitiated, an accumulation address is a crypto wallet that steadily receives and holds a particular asset – like Ethereum – without sending it out. These addresses are typically long-term holders, ones who have held ETH for more than 155 days.

When accumulation addresses continue to acquire assets in the face of declining prices, it often signals that investors expect a bullish reversal in the NEAR future. These wallets essentially represent “strong hands” in the market.

Similarly, Realized Price is the average price at which all coins in a cryptocurrency network were last moved, calculated by dividing the total realized market cap by the circulating supply. It reflects the aggregate cost basis of holders and is often used to assess whether the market is in profit or loss.

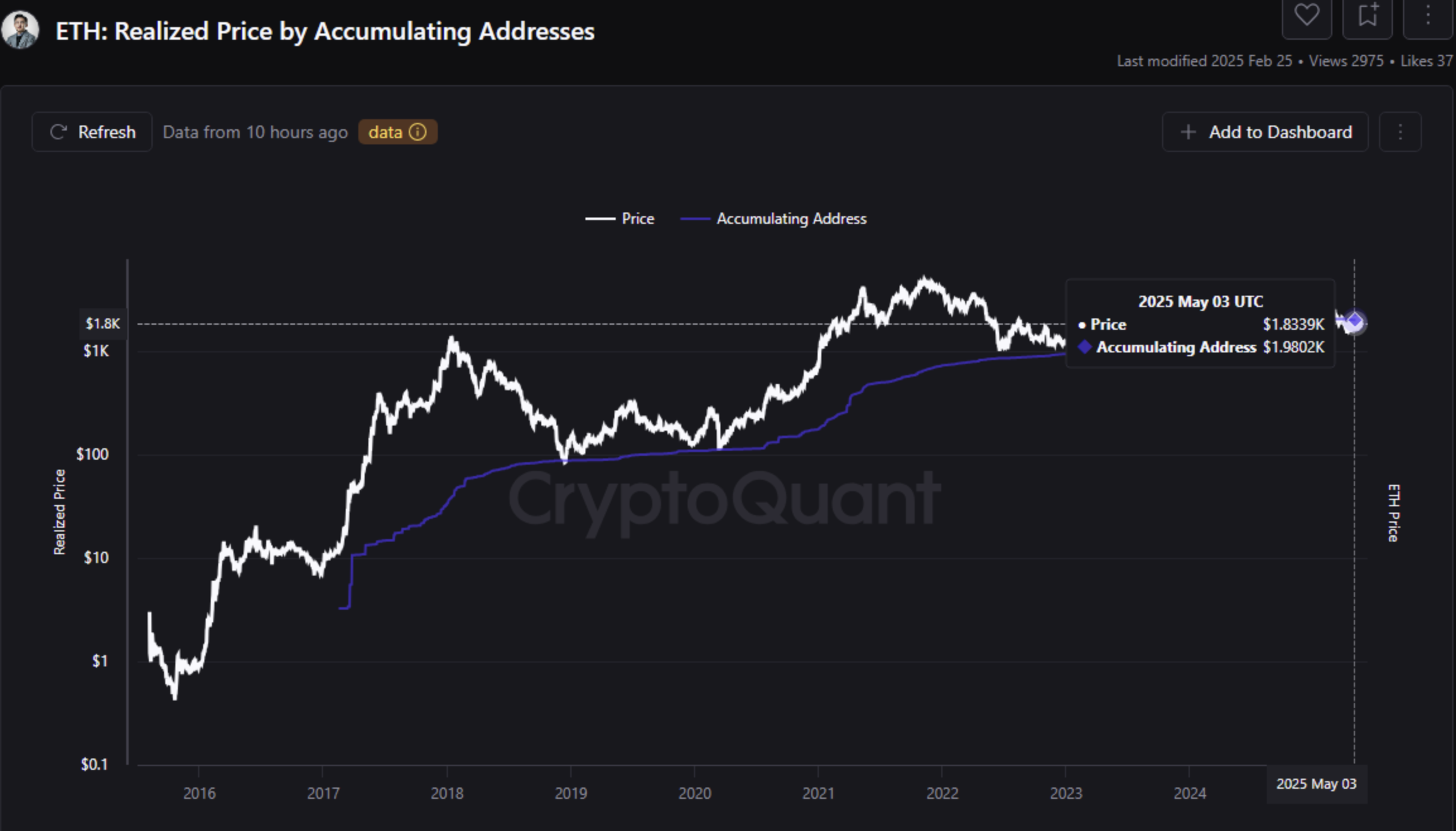

Since March 10, the Realized Price for these addresses has dropped by 2.32%, from $2,026 to $1,980 as of May 3. Yet, rather than scaling back, these addresses have increased their ETH holdings significantly. Aleman adds:

Despite the continued downtrend, and even while in unrealized losses, accumulating addresses have not abandoned their strategy. Instead, they increased their ETH exposure: on March 10 they held 15.5356M ETH, and by May 3 this ROSE to 19.0378M ETH, a 22.54% increase, as seen in the ETH Cohort analysis and Balance on Accumulation Addresses.

Has ETH Hit Market Bottom?

While some analysts warn that ETH could fall further – possibly to as low as $1,200 – others believe that the second-largest cryptocurrency by market cap may have already bottomed out for this cycle.

Adding to the optimism, ETH recently formed a golden cross on the daily chart, a bullish technical signal that typically precedes upward momentum. As press time, ETH is trading at $1,801, down 1.4% in the past 24 hours.