Bitcoin Spot ETFs Rake In $1.81B—Wall Street Finally Wakes Up to Crypto

Another $1.81 billion floods Bitcoin spot ETFs as the market shakes off its bear-market hangover. Traders are piling back in—because nothing screams ’safe investment’ like volatile crypto wrapped in a Wall Street-approved package.

The inflows mark a stunning reversal from last year’s ETF skepticism. Suddenly, every institutional investor wants a slice of the Bitcoin pie—just in time for the next cycle’s peak, naturally.

Will this momentum hold? History says yes—until the suits panic-sell at the first 10% dip. Welcome to crypto’s institutional era: same volatility, fancier paperwork.

Bitcoin ETFs Drive Into May On Bullish Note

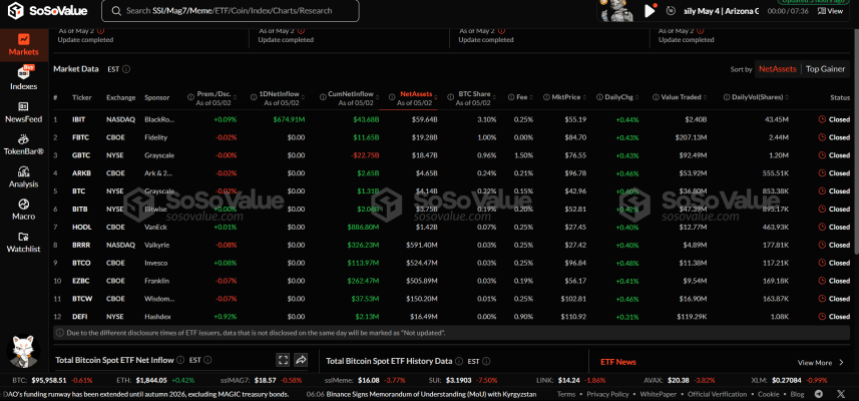

According to ETF tracking platform SoSoValue, the US Bitcoin Spot ETFs recorded $1.81 billion in net inflows as the market crossed into the month of May. This represents the third-largest weekly inflow in 2025 as institutional investors actively rotate their capital into the cryptocurrency and all related markets.

In a familiar tale, BlackRock’s IBIT attracted the largest investments with over $2.48 billion in net inflows. Interestingly, IBIT accounted for all deposits on Friday, May 2nd, valued at $674.91 million, demonstrating an unrivaled market dominance.

Other ETFs that experienced a net inflow include Grayscale’s BTC, VanEck’s HODL, and Invesco’s BTCO, with investments ranging from $10 million – $41 million. Meanwhile, Fidelity’s BTCO accounted for the largest weekly net outflow at $201.90 million in what proved a bearish week for the second-largest Bitcoin ETF.

Grayscale’s GBTC and Bitwise’s BITB also registered net withdrawals valued between $30 million – $60 million. While Franklin Templeton’s EZBC, Wisdom Tree’s BTCW, Hashdex’s DEFI, and Valkyrie’s BRRR have zero market flows. Following this bullish trading week, the US Bitcoin Spot ETFs boast of $40.24 billion in cumulative total net inflow. Meanwhile, their total net assets are now valued at $113.15 billion, representing 5.87% of Bitcoin’s market cap.

Ethereum ETFs Score $107 Million In Investments

Alongside the resurgence with their Bitcoin counterparts, Ethereum Spot ETFs are also experiencing a notable rebound, recording over $250 million in net inflows over the past two weeks. Specifically, these ETFs registered $106.75 million in inflows in the last trading week, with BlackRock’s ETHA accounting for the majority share.

Presently, these ETFs hold a cumulative total net inflow of $2.51 billion and total net assets of $6.40 billion, which represents 2.87% of the Ethereum market cap. At the time of writing, Ethereum continues to trade at $1,845 following a 0.49% decline in the past 24 hours. Meanwhile, Bitcoin remains valued at $95,514.