Ethereum Exodus Accelerates: $380M Flees Exchanges as Make-or-Break Support Looms

Crypto whales are voting with their wallets—Ethereum’s exchange reserves just bled another $380M as traders brace for a pivotal price floor. The smart contract giant’s on-chain metrics now flash amber warnings for exchanges scrambling to maintain liquidity.

• Support or surrender: A cluster of whale wallets accumulated at $2,150 could either trigger a bounce or accelerate capitulation.

• Institutional déjà vu: The outflow pattern mirrors December 2023’s pre-rally accumulation—or June 2024’s pre-crash distribution. Take your pick.

Meanwhile, CEX operators insist ’this is fine’ while quietly adjusting their staking APYs downward. Because nothing says confidence like juicing yields when assets flee.

$380M In ETH Pulled From Exchanges As Accumulation Trend Increases

According to IntoTheBlock, the past week saw over $380 million worth of Ethereum withdrawn from centralized trading platforms. This net outflow shows an increasing wave of accumulation among crypto investors. These investors are moving their assets into self-custody, which is often a sign of long-term conviction.

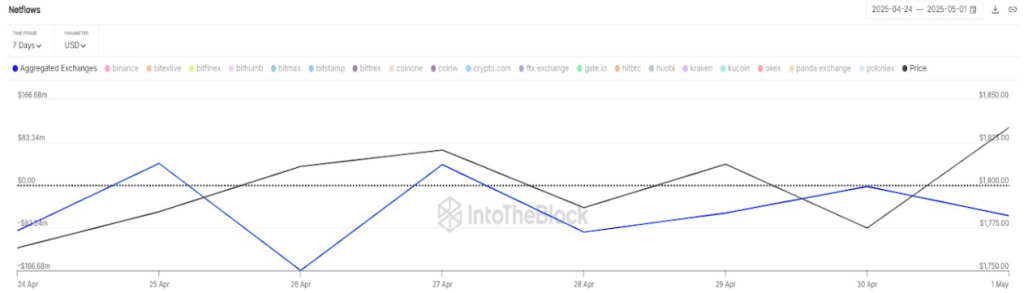

The accompanying data chart underscores this momentum, highlighting five consecutive days of negative exchange netflows across aggregated platforms spanning 19 crypto exchanges.

Notably, the last time these exchanges saw a positive inflow of Ethereum was on April 27, with $50 million worth of ETH. Interestingly, just 24 hours prior, these aggregated exchanges witnessed a negative 166.68 million worth of Ethereum flows. Such an exchange Flow dynamic brings forth the idea that Ethereum investors may be preparing for a rally.

Significant exchange outflows are known to precede notable bullish advances, and current the behavior mirrors previous price action where decreasing exchange balances acted as a precursor to sustained rallies. Notably, the current withdrawal trend coincides with the Ethereum price pushing back above the $1,800 mark.

Image From X: IntoTheBlock

Crucial Ethereum Support Zone At $1,770

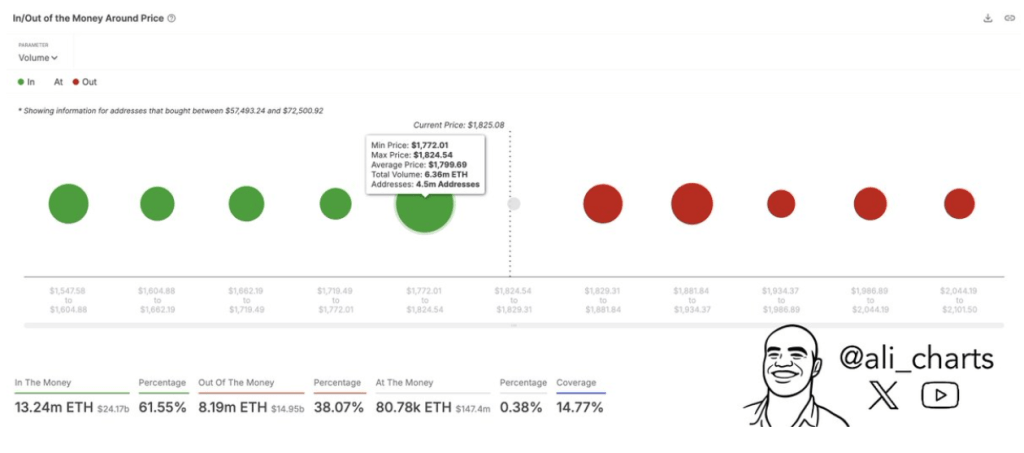

The ongoing accumulation is further supported by crypto analyst Ali Martinez, who recently pointed out a crucial Ethereum support level. According to Martinez, the $1,770 region is currently the most significant level for Ethereum in the short term, citing data from IntoTheBlock’s “In/Out of the Money Around Price” model.

The In/Out of the Money Around Price model shows a high concentration of wallets (roughly 4.5 million addresses) having acquired 6.36 million ETH between $1,772 and $1,824. These holders are now “in the money” following Ethereum’s return to $1,845, which makes this zone a psychological stronghold.

The implication of this support zone is clear. If Ethereum sustains above this demand cluster, the probability of further upward movement increases. However, any retracement below $1,770 could invalidate the current bullish structure and expose Ethereum to downside volatility.

Image From X: @ali_charts

For now, the net flows from exchanges indicate that Ethereum might be able to hold its ground around this $1,770 level. The less Ethereum available on exchanges, the less selling pressure. On the other hand, the next resistance cluster to get above in the short term is at $1,881.

At the time of writing, Ethereum is trading at $1,845, up by 1% in the past 24 hours.

Featured image from Unsplash, chart from TradingView