Cardano Whales Gobble 410M ADA in April – Is a Mega Rally Brewing?

Cardano’s deep-pocketed investors just staged a 410 million ADA buying spree—the kind of move that typically precedes fireworks. Are we looking at the calm before a 30% surge, or just another ’whale watch’ distraction while traditional finance laughs behind its spreadsheets?

Key details: The accumulation happened quietly throughout April, with whales snapping up ADA at prices between $0.45-$0.55. This brings their total holdings to a staggering 32% of circulating supply.

Why it matters: When whales move this much weight, exchanges see supply crunches. The last time holdings hit these levels, ADA ripped 150% in 90 days. But with staking yields dropping and ’institutional-grade blockchain’ becoming the new ’web3’, will retail traders get left holding the bag again?

Cardano Gathers Strength As Whales Drive Accumulation

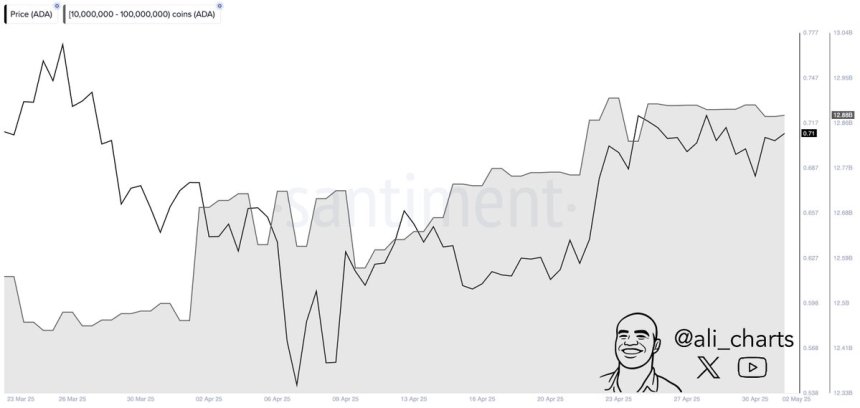

Cardano has quietly gained over 40% in value since its early April lows, reclaiming a key place in the spotlight as bullish momentum builds. Currently consolidating below the $0.75 resistance, ADA has shown resilience amid broader market uncertainty and macroeconomic headwinds. While financial markets remain on edge due to trade tensions and recession fears, the crypto space has found renewed energy, and Cardano appears to be one of the beneficiaries.

For ADA, the key lies in holding current support levels and making a clean push above resistance. A breakout above the $0.75–$0.80 range could open the door to a strong rally, potentially targeting psychological levels like $1.00 if the broader market cooperates. This bullish outlook is reinforced by compelling on-chain data.

Martinez shared data revealing that whales accumulated over 410 million ADA in April alone, a clear sign of growing confidence among large holders. Historically, such accumulation patterns have preceded strong upward movements for Cardano. The scale of buying in recent weeks signals that influential players are positioning for a continuation of the rally.

As Bitcoin and Ethereum push into higher levels, altcoins like ADA are poised to follow. If Cardano can reclaim higher ground and sustain momentum, it could soon emerge as a leader in the next phase of the market cycle.

ADA Price Holds Steady As Bulls Eye Key Resistance

Cardano is currently trading at $0.69 after several days of tight consolidation between the $0.67 support and the $0.75 resistance zone. Despite market-wide volatility, ADA has managed to maintain its footing above the key $0.66 level — a support that continues to preserve the bullish structure in the short term.

To confirm a full-fledged rally, bulls must reclaim the 200-day moving average (MA) around $0.77. This technical level has acted as a ceiling since the last major pullback and now serves as the primary upside hurdle. A successful break above it could ignite fresh buying momentum and open the path toward the $0.85–$0.90 range.

Until then, ADA remains in a neutral-to-bullish zone. The $0.66 support is critical — a breakdown below it could flip short-term sentiment and invite deeper corrections toward the $0.60 region. However, holding this level would maintain a higher-low structure and signal underlying strength.

With the broader crypto market showing signs of recovery, Cardano’s ability to hold support while gradually pressing against resistance could set the stage for a breakout. Traders are closely watching volume and price reaction NEAR the $0.75–$0.77 zone to confirm the next major move.

Featured image from Dall-E, chart from TradingView