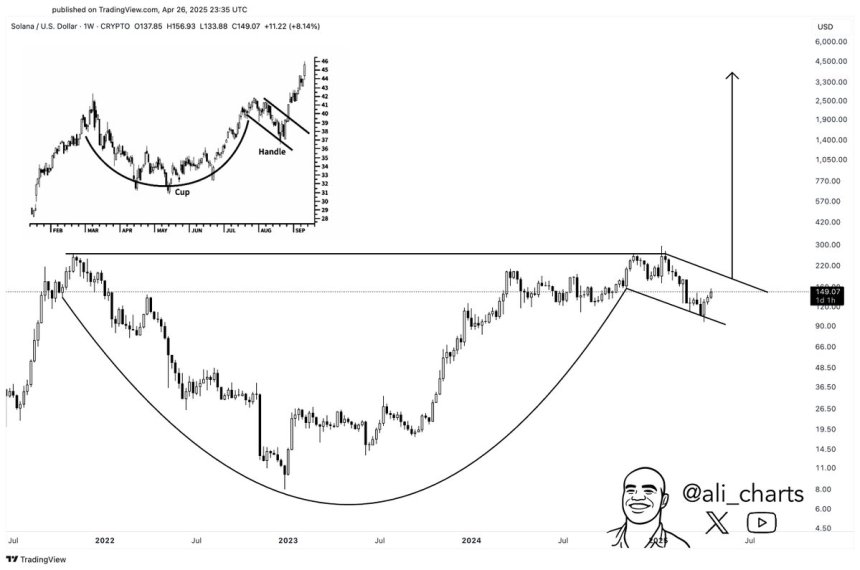

Solana’s Cup and Handle Formation Signals Potential Mega Rally – Time to Buy?

Solana’s price chart has etched a textbook cup-and-handle pattern—a bullish technical formation that historically precedes explosive breakouts. Traders are now watching the $180 resistance level like hawks; a confirmed breakout could trigger a FOMO-driven surge toward new all-time highs.

Meanwhile, Ethereum maxis are quietly sweating as SOL continues to outperform ETH in both transaction speed and meme coin activity. The network’s 90-day uptime streak (yes, we’re counting) is making even traditional finance analysts reconsider their "blockchain trilemma" skepticism.

Of course, this could all be another crypto fakeout—Wall Street’s algos love nothing more than liquidating overleveraged retail traders. But with Solana’s institutional inflows hitting $120M last week alone, the smart money appears to be placing its bets.

Solana Shows Strength Amid Shifting Market Dynamics

Solana is up 58% since early April, showing impressive recovery momentum as market dynamics start to shift. After months of weakness and selling pressure, Solana is now emerging as one of the stronger performers among major altcoins. Analysts are closely watching the $160 level, with many calling for a decisive breakout that could unlock further gains. However, risks remain elevated. The broader macroeconomic environment remains unstable, with global trade conflicts and financial market volatility weighing on investor sentiment.

Solana has been particularly sensitive to this uncertainty. Since January, SOL lost over 65% of its value, highlighting the growing selling pressure and speculative behavior that dominated the market during the first quarter of 2025. Despite this, the recent surge has shifted short-term momentum back in favor of the bulls, offering hope for a broader recovery if key levels are reclaimed.

Martinez’s analysis supports a bullish outlook for Solana. He points out that zooming out reveals Solana is forming a textbook-perfect cup and handle pattern. This classic technical structure often precedes strong upward movements, especially when accompanied by growing volume and supportive macro conditions. If confirmed, this setup could mark the beginning of a major rally for SOL in the weeks ahead.

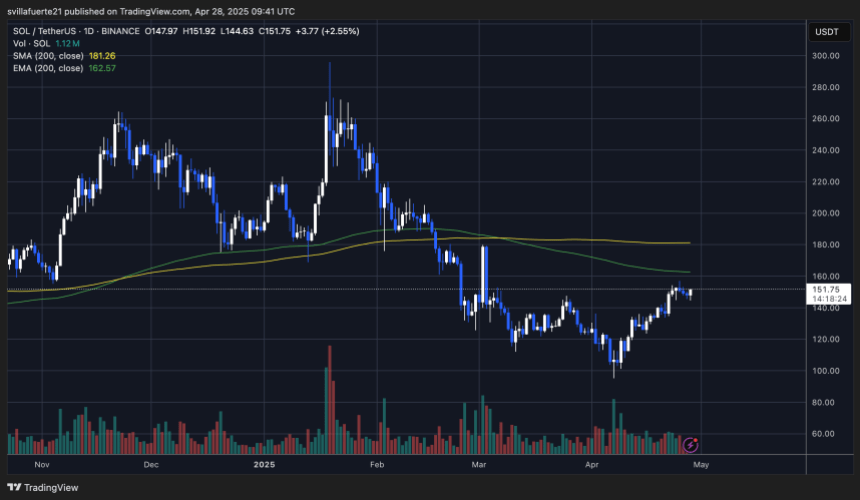

SOL Price Action Remains Tight Below Key Resistance

Solana (SOL) is trading at $151 after several days of consolidation below the crucial $160 resistance zone. Bulls have managed to defend recent gains, but momentum has slowed as the price struggles to push higher. Reclaiming the $160 level is essential for bulls to regain full control and continue the recovery. A clean breakout above $160 could trigger a rally toward the $180 mark, which aligns with the 200-day moving average (MA) — a critical technical barrier that, if flipped into support, would confirm a strong trend reversal.

However, risks remain elevated if bulls fail to reclaim the $160 resistance soon. A failure at this zone could expose SOL to a deeper correction, potentially dragging the price back toward the $120–$100 support area. This would not only erase recent gains but could also damage market sentiment, slowing Solana’s recovery efforts.

For now, consolidation just below resistance suggests that buyers are attempting to build strength. However, the next few days will be critical to determine whether SOL can break higher or enter another corrective phase. All eyes remain on the $160 breakout level as the battle between bulls and bears intensifies.

Featured image from Dall-E, chart from TradingView