Bitcoin’s $95K Showdown: 1.76 Million BTC Stacked in High-Stakes Resistance Zone

Bitcoin bulls and bears are locked in a brutal tug-of-war as a staggering 1.76 million BTC cluster between $94,125 and $99,150—a make-or-break level that could dictate the next major price move.

This massive liquidity wall represents the last real resistance before six figures. Break through, and we’re staring at a potential moonshot. Fail, and prepare for the usual Wall Street ’I told you so’ lectures about volatility.

All eyes on the order books as BTC dances on the knife’s edge between institutional FOMO and profit-taking panic.

Heavy Resistance Cluster Between $94,125 And $99,150

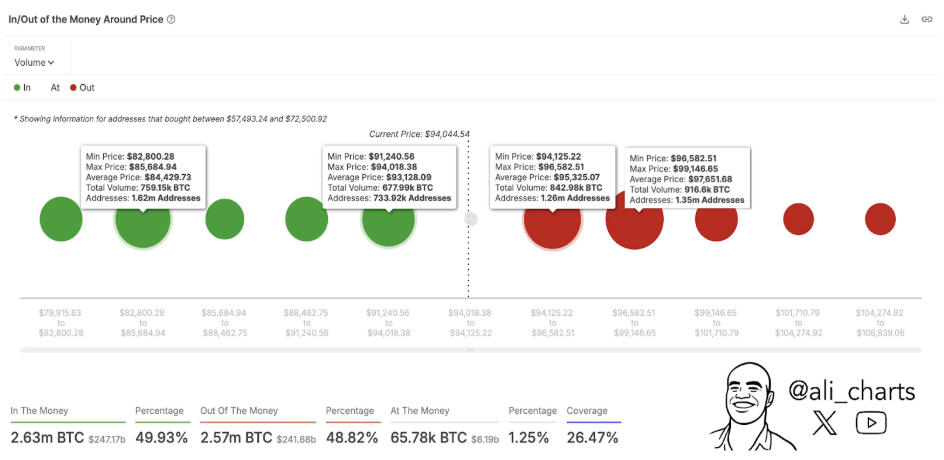

According to crypto analyst Ali Martinez, who shared insights from on-chain analytics platform IntoTheBlock, Bitcoin is encountering heavy resistance between the $94,125 and $99,150 price range.

Notably, his post on social media platform X shows that approximately 2.61 million wallet addresses have accumulated about 1.76 million BTC within this zone, making it one of the densest supply barriers Bitcoin has faced in its current market cycle.

As shown in the chart below, about 1.26 million addresses hold close to 843,000 BTC between $94,125 and $96,582, while another 1.35 million addresses are clustered between $96,582 and $99,146, holding roughly 917,000 BTC. This concentration of holders creates a formidable wall that Bitcoin must breach decisively if it is to continue its upward march into the next month.

A strong and decisive daily or weekly close above $96,600 could invalidate the overhead resistance here, placing the next target zone at $99,150. Ultimately, the buying momentum here would clear the path for the Bitcoin price to finally target $100,000 and beyond again.

Conversely, repeated failures at this zone could cause a retest of lower support levels around $93,000 and $84,000, which also have significant volumes of 678,000 BTC and 759,150 BTC, respectively.

Image From X: ali_charts

Bitcoin’s Bullish Structure Still Intact

Even as the $94,000 to $99,000 resistance zone poses a near-term challenge, technical patterns suggest that Bitcoin’s rally is just beginning. Another prominent crypto analyst, known as Titan of Crypto, reaffirmed that Bitcoin’s long-term price target of around $125,000 is still valid.

This target is derived from a massive Inverse Head and Shoulders (H&S) pattern identified on the Bitcoin monthly candlestick chart.

Image From X: Titan of Crypto

The chart shows a clear breakout above the neckline of the Inverse H&S formation earlier this year when Bitcoin pushed to its current all-time high around $108,790. Since then, the price action has been followed by a retest that is holding firm above a support trendline on the monthly timeframe.

According to the analyst, this technical structure shows that Bitcoin is well-positioned to rebound and reach a new all-time high of $125,000 very soon. Of course, this timeline will also depend on whether the current support zone around $85,000 to $87,000 holds steady.

At the time of writing, Bitcoin is trading at $94,147

Featured image from Unsplash, chart from TradingView