SUI Nears Critical Support Level – Analyst Predicts $2.75 Retest Amid Market Volatility

SUI’s parabolic rally faces a reality check as technical indicators flash overbought signals. One prominent analyst warns of a 30% correction to $2.75—a level that would erase gains from the recent partnership frenzy.

The Layer 1 token now trades at a precarious junction: break through resistance and target new ATHs, or succumb to profit-taking from early investors who got in below $0.50. Market makers appear to be leaning bearish, with perpetual funding rates turning negative for the first time since January.

Meanwhile, the ’SUI-tans’ (as the community calls itself) continue stacking tokens, betting the dip will be shallower than predicted. After all, what’s another 30% drop in crypto? Just another Tuesday.

Elliott Wave Count Suggests Pullback Looms For SUI

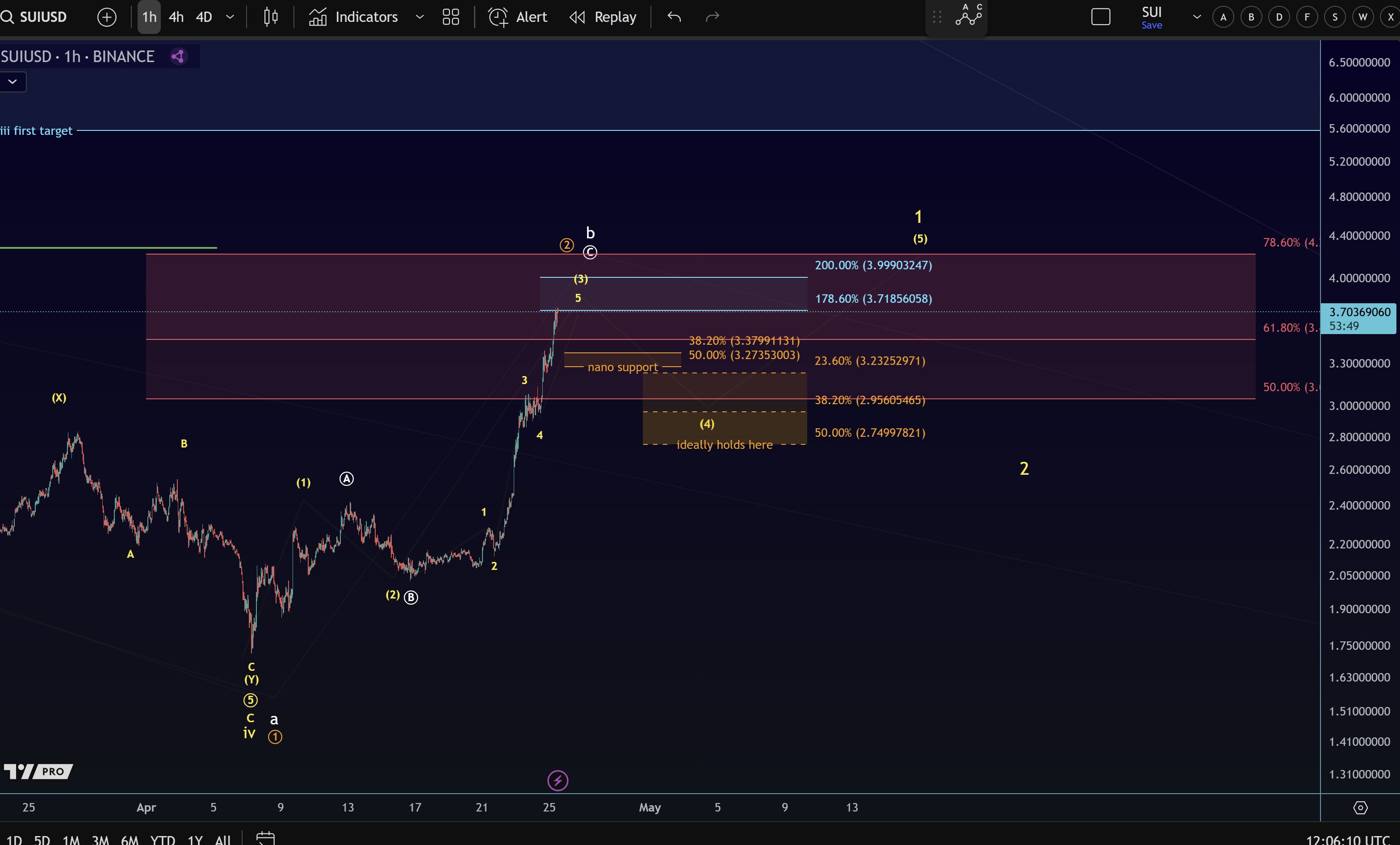

In an X post on Friday, X market analytics handle More Crypto Online shared an interesting analysis on the SUI market using the Elliott Wave theory — a technical tool that predicts future price trends by recognizing recurring wave-like patterns.

According to the analysts at More Crypto Online, SUI’s bullish performance in the past week means the altcoin has surged to the 178.6% Fibonacci extension level around $3.71. This specified Fibonacci level represents a major technical milestone as it is a classic target area in Wave 3 in the Elliott Wave analysis.

For context, the Elliott Wave theory postulates that price movements occur in five recurring wave patterns. Wave 3 is usually regarded as the strongest and longest wave in a bullish trend. It is a wave of confirmation indicating a robust market participation.

Based on the current wave count in the SUI market, the altcoin is completing the final stages of Wave 3, having surpassed the minimum Fibonacci extension level of 138%. As expected, signs of waning demand are beginning to set in, as indicated by a 5.7% price retracement in the past day.

More Crypto Online predicts Wave 4 — a corrective price phase may now be imminent. SUI is expected to experience a price pullback with initial support zone set at $3.27. Notably, a decisive price break below this level would confirm the end of Wave 3 and the beginning of Wave 4.

Furthermore, a deeper market support lies between $2.95 and $2.75, which represents the 38.2% – 50% Fibonacci retracement zone of the Wave 3 move. More Crypto Online views this price region as the support target zone for a healthy Wave 4 correction.

Therefore, market bulls must hold this price zone to retain SUI’s bullish structure and set the stage for a potential Wave 5 breakout.

SUI Price Outlook

At press time, SUI trades at $3.58 following an 8.85% overall gain in the past day. Meanwhile, the coin’s daily trading volume is up by 18.64% and valued at $3.44 billion.

If SUI’s price retracement continues, the altcoin is expected to trigger Wave 4 of its current wave cycle, indicating a potential 50% correction lies ahead. However, if bullish momentum remains intact, SUI could rise to around the 200% Fibonacci extension level, around $3.99, which represents the coin’s next major resistance.

Featured image from Adobe Stock, chart from Tradingview