Bitcoin Smashes Through Resistance – $100K Beckons as Bulls Take Control

After weeks of sideways action, Bitcoin just bulldozed past critical technical levels—and the charts now scream upside potential.

Key levels reclaimed: The $65K resistance-turned-support zone held firm during last month’s shakeout, proving institutional buyers are accumulating on dips.

Liquidity flush complete: That brutal 22% correction in March? Just another ’risk management’ maneuver by futures traders (read: leveraged gamblers getting liquidated).

Next stop ATH: With the halving supply shock now fully priced in by the smart money—and Wall Street’s ETF circus bringing fresh capital—new all-time highs could land before summer.

Watch the skeptics: Same analysts who called $30K ’overbought’ are now quietly revising targets upward. Classic finance brain—always fighting the last war.

Bitcoin Reclaims Range Lows as Sentiment Turns Bullish

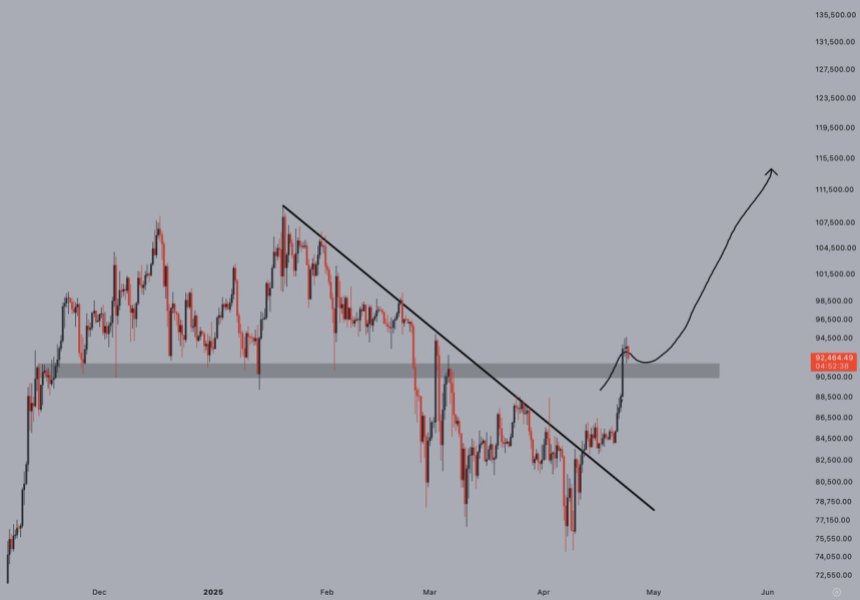

Bitcoin is now trading at critical levels after a sharp market impulse shifted sentiment nearly overnight. For months, BTC has been stuck in a downtrend that began in January, frustrating bulls and leading to calls for deeper corrections. But with the recent surge pushing BTC above $90,000, many analysts believe that this trend may have finally reversed.

However, caution still dominates the broader landscape. Global uncertainty, driven by escalating trade tensions between the US and China and unpredictable macroeconomic signals, continues to weigh on investor confidence. A single negative development—such as hawkish central bank policy or geopolitical instability—could shake the market back into risk-off mode.

Still, Optimism is returning, particularly among technical analysts. Jelle shared an update highlighting that Bitcoin has reclaimed the range lows and is holding them. “Exactly what you wanna see if truly bullish,” he noted, emphasizing that a shallow pullback followed by strength typically precedes further continuation to the upside.

This scenario would suggest that the time for easy entries is behind us. If this momentum holds, Bitcoin could be on track to break new all-time highs sooner than many expect. The breakout has reignited hopes for a major bull run, but the next few days will be key in confirming whether this move is sustainable or just another short-lived rally.

BTC Holds Above $90K After Reclaiming Key Moving Averages

Bitcoin is trading at $92,500 after a strong move above the psychological $90K level, confirming bullish momentum in the short term. This breakout also marked a decisive close above the 4-hour 200 MA and EMA, both of which had acted as stiff resistance since January. Reclaiming these technical levels signals a potential shift in trend after months of selling pressure and sideways action.

With bulls now firmly in control, the focus shifts to the $100K mark—an area that not only carries psychological weight but also serves as the next key resistance in the rally. A push above this level would likely attract new buyers and confirm a broader breakout, setting the stage for a potential all-time high run.

However, caution is still warranted. If Bitcoin fails to maintain momentum and drops below $88,500, it could trigger a consolidation phase or even a larger correction. The $88.5K zone, now a key support, must hold to preserve the bullish structure. As Bitcoin hovers NEAR these critical levels, the next move will likely define short-term direction for both BTC and the broader crypto market.

Featured image from Dall-E, chart from TradingView