Bitcoin Smashes Through $90K—$92K in Sight as Bulls Charge

Bitcoin’s relentless rally breaches $90,000, fueling speculation of an imminent assault on $92,000. Traders now debate whether this is sustainable growth or another bubble inflated by loose monetary policy and crypto hype cycles. Key resistance levels loom as derivatives markets flash overheated signals—because what’s a new ATH without a side of reckless leverage?

Why Is Bitcoin Up?

Capital continues to migrate toward classic safe havens. Spot gold blasted through $3,400 an ounce on Monday—its fourth record in as many weeks—lifting the metal’s market value above $20 trillion for the first time. The yellow metal has added roughly $6 trillion in market cap year‑to‑date, three times Bitcoin’s value at its own January peak.

Bitcoin’s latest leg higher has been greased by a burst of institutional demand. US spot‑Bitcoin ETFs absorbed a net $381 million on Monday, the largest single‑day haul since February and a sharp reversal from the net outflows that dogged the complex in March and early April.

A lively debate is raging on X over what, exactly, is powering Bitcoin’s outperformance versus risk assets. Hedge‑fund manager Benn Eifert argues the answer is largely arithmetic: “Bitcoin is NASDAQ denominated in a basket of global currencies, not USD, and USD is collapsing.”

Macro commentator TXMC contests the popular narrative that an upswing in global money supply is the dominant driver. In a thread rebutting “Global M2” overlays, he agreed with Eifert: “This is quite an accurate way of thinking about BTC’s performance. And it’s the same reason people’s Global M2 models have appeared to be skyrocketing even though the M2 data is 1-2 months old- because they’re overreacting to currency moves and don’t understand their models.”

Where Is BTC Headed Next?

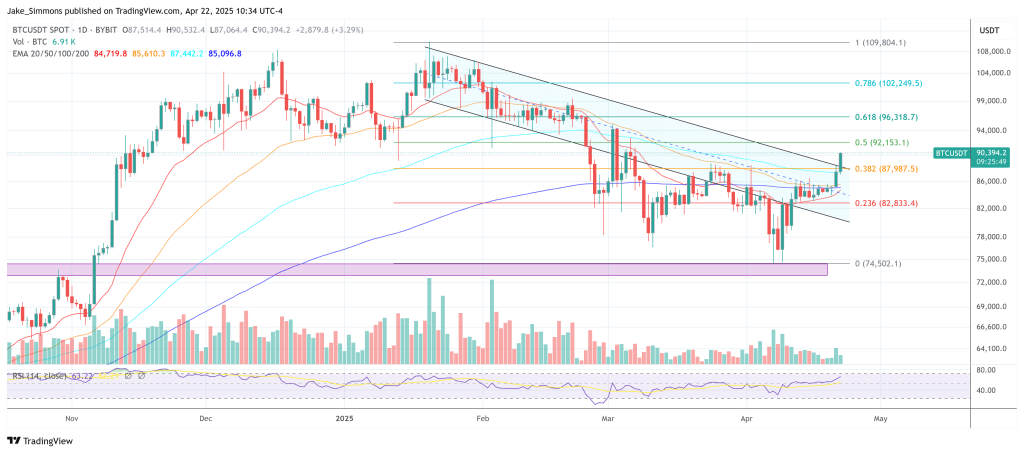

Short‑term traders are fixated on a narrow resistance shelf that has capped every rally since late February. Analyst Jelle calls the area the “main event,” adding: “Reclaim $92,000 and #Bitcoin sends higher. A lot higher.”

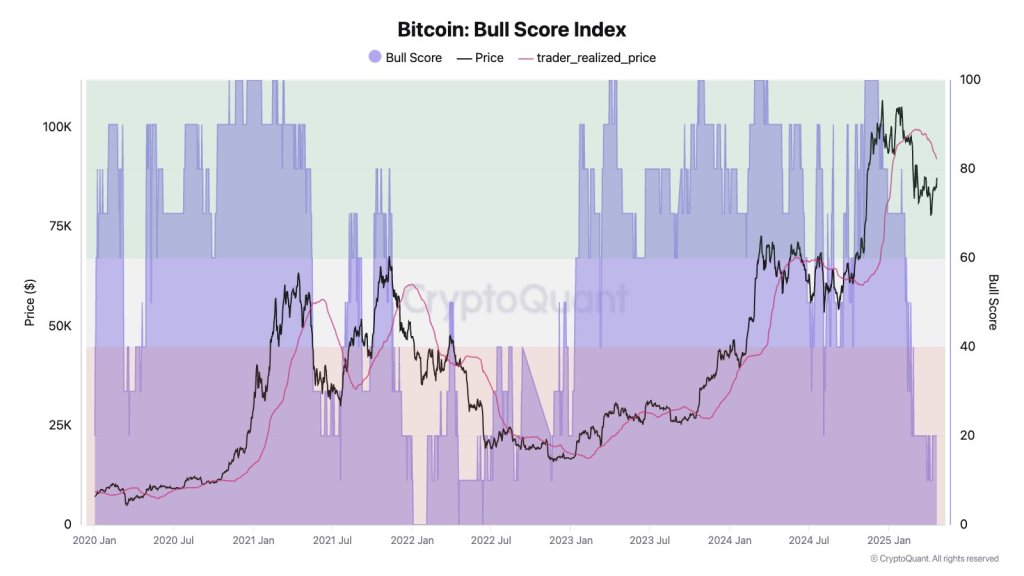

On‑chain metrics paint a similar picture. Julio Moreno, head of research at CryptoQuant, notes that Bitcoin is pressing into the Traders’ Realised Price band at roughly $91k–$92k. “The trader’s Realized Price acts as support when market conditions are bullish (green area, bull score >= 60), and as resistance when market conditions are bearish (red area, bull score

Momentum gauges have begun to thaw. Cold Blooded Shiller flagged a “first RSI 50 crossover on BTC in 3 months,” adding “if we’ve got counter-trend juice, this is where it ramps up.”

That Optimism is tempered by structural hurdles. Daan Crypto Trades reminds followers that Bitcoin is “closing in on the big $90k–$91k horizontal area which acted as the previous range low… This is also where the Daily 200MA is located.” A decisive push a “few percent” higher would, in his view, leave the chart “pretty great. Bulls know what to do.”

At press time, BTC traded at $90,394.