Solana’s Near-Term Technical Indicators Flash Warning Signs – Temporary Pullback or Trend Reversal Ahead?

Recent market analysis of Solana (SOL) reveals concerning signals from short-term technical indicators, suggesting potential volatility in the coming trading sessions. Traders are closely monitoring key support levels to determine whether current price action represents a healthy consolidation or the early stages of a more significant corrective phase. The asset’s RSI and MACD readings currently hover in neutral territory, though momentum oscillators show early signs of bearish divergence. Market participants should watch for confirmation of either continuation patterns or reversal signals, particularly around psychologically important price levels. Volume analysis and order book depth will be crucial in assessing whether this represents institutional profit-taking or genuine trend exhaustion.

Solana Faces Key Resistance As Short-Term Pullback Signal Emerges

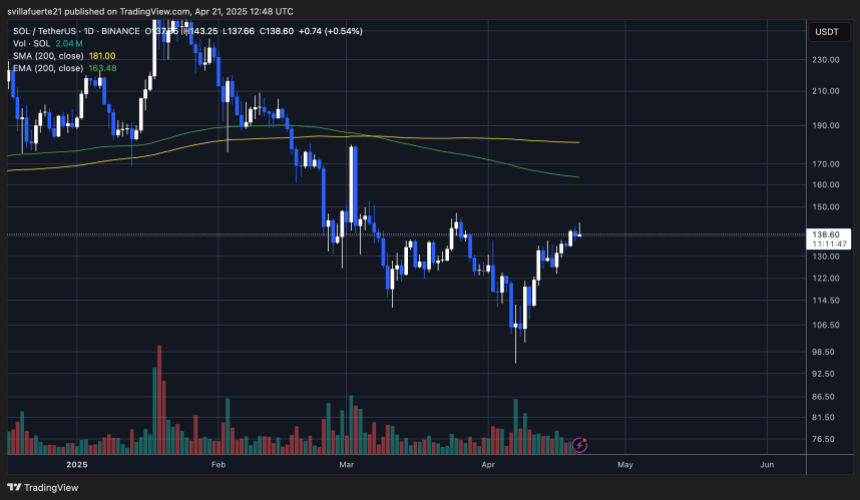

Solana has surged over 48% since April 7, signaling renewed momentum after a prolonged period of intense selling pressure. Bulls are now facing a critical test as price approaches the $150 level—a key resistance zone that has held back further advances in the past.

Despite the recent recovery, Solana remains one of the most affected assets during the 2025 downtrend, having lost more than 65% of its value since its January peak. This underscores the significance of the current move and the importance of holding higher levels to confirm a true reversal.

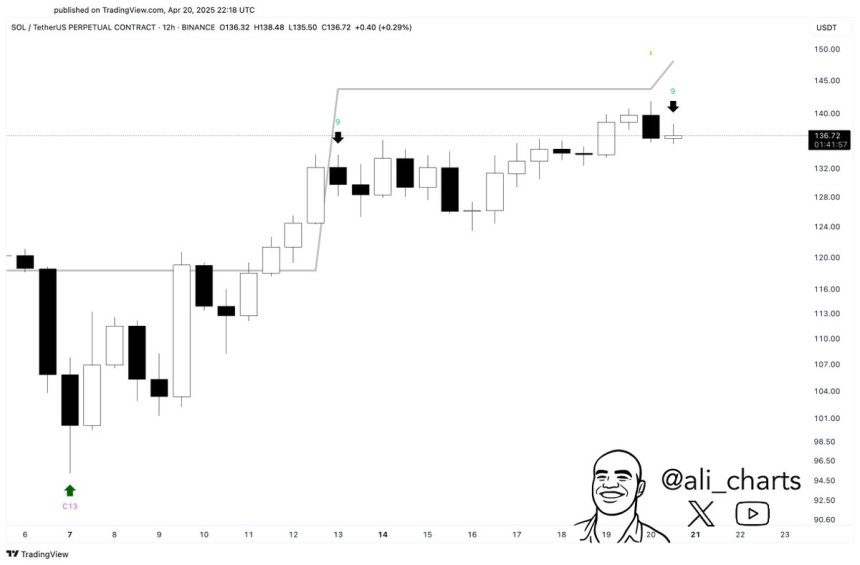

Still, caution is warranted. Martinez shared data on X highlighting a TD Sequential sell signal on the 12-hour chart—a technical indicator that often precedes short-term trend exhaustion or reversals. The TD Sequential works by identifying a sequence of price movements that can indicate overbought or oversold conditions. If the signal plays out, Solana could face a temporary pullback before any sustained upside continues.

Macroeconomic factors remain in play, with ongoing trade tensions between the US and China still shaping sentiment across global markets. However, hopes for a potential agreement between the two countries and expanding global liquidity are giving bulls some optimism, especially within the altcoin sector.

SOL Price Hovers At Pivotal Zone: What’s Next?

Solana (SOL) is currently trading at critical levels, testing the key $150 resistance zone after a sharp recovery from recent lows. Bulls must reclaim and hold above this level to confirm a breakout and validate the start of a sustained uptrend. A decisive move above $150 would likely trigger further buying momentum, possibly leading to a retest of higher targets not seen since early March.

However, if SOL fails to break above this barrier in the short term, a period of consolidation between the $130 and $120 levels could still signal strength. Holding this zone would suggest that bulls are building a base for continued upward price action and absorbing selling pressure without a significant retrace. Such consolidation phases are often considered healthy in bullish market structures, allowing momentum to rebuild before the next leg higher.

On the downside, failure to hold the $120 support level could expose SOL to deeper losses, with the $100 zone as the next significant area of demand. A break below this level would invalidate the current bullish outlook and possibly reignite a broader downtrend. For now, all eyes are on SOL’s reaction around the $150 mark.

Featured image from Dall-E, chart from TradingView