Bitcoin Encounters Pivotal Resistance Near $91K as Short-Term Investors Approach Break-Even Point

As of April 20, 2025, Bitcoin’s price action is testing a crucial resistance level at $91,000, with on-chain data indicating that short-term holders are currently positioned near their break-even price. This technical juncture could determine whether BTC continues its upward trajectory or faces rejection. Market analysts are closely monitoring trading volumes and liquidity conditions around this key level, as the behavior of short-term investors often serves as a sentiment indicator during such consolidation phases. The $91k resistance represents both a psychological and technical barrier that previously acted as support during the 2024 bull run, adding significance to its current role as a ceiling.

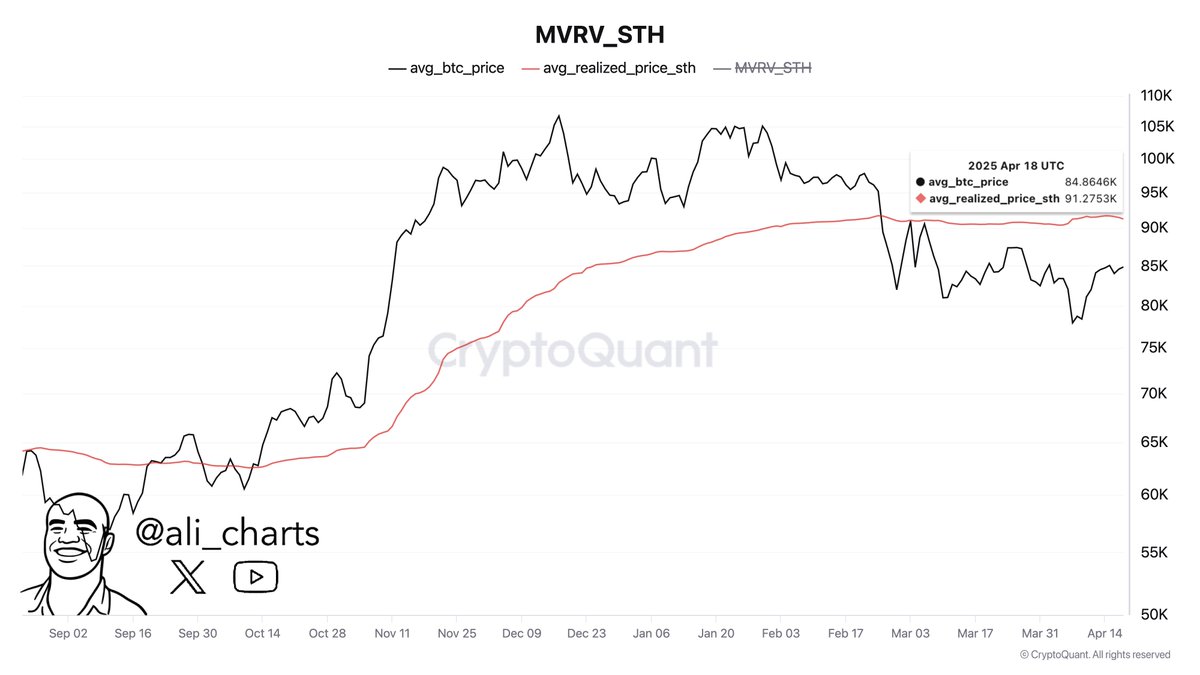

Bitcoin STH Realized Price At $91,000 Presents Major Make-Or-Break Moment

In a recent post on X, Martinez states that Bitcoin faces a key resistance level at the $91,275 following a price rebound in early April. Notably, the asset surged by 17.33% after reaching a price low of $75,000 on April 9. However, BTC has since entered a consolidation following this feat, producing no significant price movement in either direction.

Over the past week, the crypto market leader moved only between $84,000 to $86,000, forming a tight range-bound market. However, amidst these struggles, Martinez states that Bitcoin short-term holders realized the price lies at $91,275, indicating the pivotal resistance to the recent market resurgence lies ahead.

For context, the short-term holders’ realized price is the average price at which new buyers (i.e, new investors of Bitcoin over the past 155 days) acquired their BTC. It is an important technical indicator used to evaluate short-term market sentiment and behavior.

When a market price is above the STH realized price, it indicates a bullish momentum as recent buyers are in profit and are likely to hold. In this case, the STH realized price serves as a strong support level, with new market entrants often defending their entry zone.

However, when Bitcoin’s price is below the STH realized price as currently seen in the market, the realized price forms a significant psychological price resistance. This is because many short-term holders may choose to exit once the market breaks even, increasing the selling pressure around that zone.

Therefore, Bitcoin reclaiming $91,275 is essential to validate a sufficient bullish potential to fuel a complete price reversal.

Bitcoin Price Overview

At the time of writing, Bitcoin is trading at $84,872, reflecting a price growth of 0.14% in the last day. Meanwhile, the premier cryptocurrency is down by 1.34% on its monthly chart as bearish pressure continues to wane.

While a major market resistance lies at $91,000, Bitcoin faces an immediate opposition at the $86,000 price zone, breaking past which could spur a sharp price rise to $91,000. However, a price fall below the support at $84,500 could result in a further price slide to $84,000 with the potential to trade as low as $83,300.