Cardano Whales Dump 180 Million ADA Within a Week – Strategic Exit or Market Timing?

Large-scale Cardano (ADA) holders, often referred to as ’whales,’ have reportedly liquidated approximately 180 million ADA tokens over the past five days. This significant sell-off has sparked discussions within the crypto community about whether these investors are capitalizing on recent price movements to secure profits or anticipating a broader market correction. The timing of these transactions coincides with fluctuating market conditions, raising questions about the underlying strategy behind the disposals. Analysts are closely monitoring the impact of these whale activities on ADA’s liquidity and price stability, as such large-volume movements can often signal shifting sentiment among major stakeholders.

Cardano Whale Activity Sparks Debate Over Trend Direction

Cardano is now testing a critical demand zone that may determine whether the recent recovery is sustainable or simply a temporary pause in a larger downtrend. After a steady decline that began in early March, ADA is attempting to establish support as global macroeconomic tensions continue to pressure financial markets.

With investors growing increasingly risk-averse, many have chosen to offload both altcoins and Bitcoin to shield their portfolios from escalating volatility and negative sentiment surrounding trade conflicts, inflation, and regulatory uncertainty.

Despite these headwinds, some analysts believe a potential breakout could emerge once current economic pressures begin to ease. But recent whale behavior has raised concerns. According to top analyst Ali Martinez, whales took advantage of ADA’s recent price upswing by offloading over 180 million tokens in just the past five days. This move has sparked debate over whether whales are simply securing profits before further uncertainty—or signaling a deeper continuation of the downtrend.

If Cardano manages to hold its current support levels and attract renewed buying interest, a short-term rally may still be in play. However, failure to defend this zone could confirm bearish continuation, pushing ADA into lower territory. With market sentiment split and high-stakes developments unfolding globally, ADA’s next move could set the tone for its performance throughout the quarter.

ADA Stalls Below Resistance As Bulls Face Critical Test

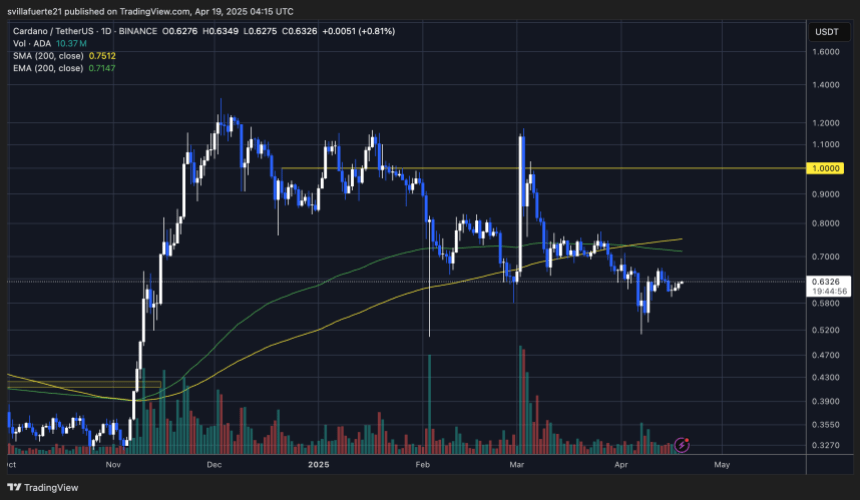

Cardano (ADA) is currently trading at $0.63 after several days of sideways movement and failed attempts to break above the $0.66 resistance zone. This level has capped recent upside momentum, signaling that bulls are struggling to gain control in the current environment of macroeconomic uncertainty and risk-off investor sentiment.

To confirm a true bullish reversal and break the broader downtrend, ADA must reclaim the $0.75 level, which is aligned with the 200-day moving average. A decisive move above this mark would reestablish long-term strength and could open the door to a sustained recovery rally. Until then, ADA remains in a vulnerable position, caught between key resistance and fragile support.

On the downside, losing the $0.60 level could trigger another wave of selling pressure. Such a move would likely push the price back toward the $0.50 support zone, a level not seen since earlier this year. As global markets remain on edge amid geopolitical tensions and investor uncertainty, ADA’s next move will depend on whether bulls can generate enough momentum to flip key resistance or risk further downside if sellers take over.

Featured image from Dall-E, chart from TradingView