Bitcoin Maintains Market Supremacy in Q1 2025 as Altcoins Fail to Gain Traction

The first quarter of 2025 has solidified Bitcoin’s position as the dominant force in the cryptocurrency market, with altcoins struggling to mount any significant challenge to its supremacy. Market analysis reveals that despite occasional rallies from alternative cryptocurrencies, none have managed to sustain momentum or capture substantial market share from BTC. This trend contradicts previous predictions of an impending altcoin season, with Bitcoin continuing to attract the majority of institutional and retail investment flows. The persistent dominance suggests that investors currently favor Bitcoin’s established position and perceived stability over the higher-risk altcoin market. Experts point to several factors including Bitcoin’s strong institutional adoption, its role as a market benchmark, and its outperformance relative to altcoins during recent market fluctuations.

Bitcoin Rules Market While Others Decline

Bitcoin insulated itself reasonably from the turbulence in other cryptocurrencies so that its market share reached nearly 60%, the highest in four years. Bitcoin achieved peak valuation at $106,182 in January shortly after inauguration but plunged almost 12% to finish the quarter at $82,514.

Compared with Bitcoin during this period, gold and US Treasury bonds were traditional safe-haven investments with lower performance.

Compared to Ethereum, however, the situation was much worse. Its price fell by 45%, essentially wiping out all gains in 2024. Its market share dropped to almost 8%, the lowest it has been since the end of 2019.

As it has been observed by most analysts, this downturn is not something new since more and more activities have shifted toward “Layer 2” networks built atop Ethereum and not using the Ethereum main network.

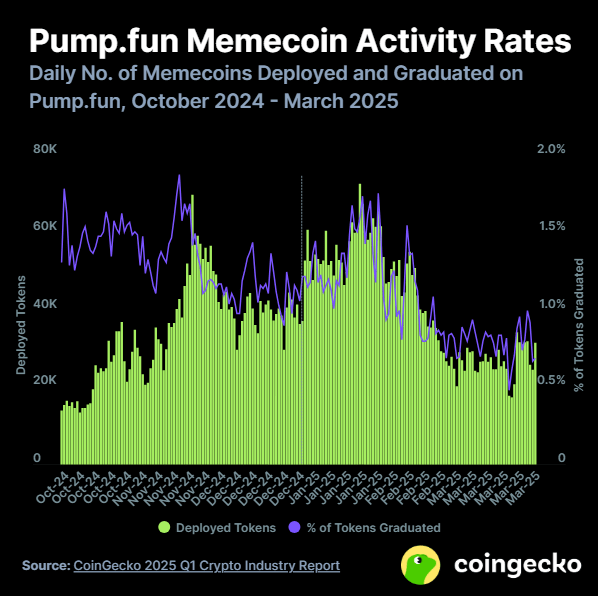

Meme Coins Crash After Major Scam

The previously red-hot meme coin space received a rude wake-up call in early 2025. Following a boom in Trump-themed tokens, the industry was severely hurt when the Libra token – introduced by Argentina’s President Javier Milei – proved to be a scam.

The project was abandoned by developers after they had taken investors’ funds, shattering confidence in such tokens. By late March, new token launches on the platform Pump.fun per day had dropped by over 50%.

Not even the decentralized finance (DeFi) industry was exempted. Overall money in DeFi projects dropped 27% to $48 billion during the first quarter. Ethereum’s dominance in the DeFi space declined to 56% by quarter-end.

Not everything was negative, though. Stablecoins such as Tether (USDT) and USD Coin (USDC) became more popular with investors seeking a safer bet as the market tanked.

Solana also remained in its leadership position, holding 39.6% of all decentralized exchange (DEX) trading during Q1, courtesy mostly of meme coin mania. Even Solana’s leadership, however, started to wane at the end of the period as the meme coin mania declined.

The dramatic shift in market sentiment shows how quickly cryptocurrency fortunes can change. After a promising end to 2024, the new year brought a harsh reality check for crypto investors, with nearly $1 trillion in market value disappearing in just three months.

Featured image from Pexels, chart from TradingView