Major Ethereum Holders Dump 143,000 ETH Within Seven Days – Is This the Start of a Sustained Sell-Off?

Significant Ethereum investors, often referred to as ’whales,’ have liquidated a substantial 143,000 ETH over the past week, sparking concerns about potential continued selling pressure in the market. This large-scale divestment raises questions about the future price trajectory of ETH and whether other major holders might follow suit. Market analysts are closely monitoring on-chain data and exchange flows to assess if this marks a temporary profit-taking move or the beginning of a broader market downturn. The timing of these transactions coincides with recent volatility in the crypto markets, adding another layer of complexity to interpreting whale behavior. Traders and investors are advised to watch key support levels and whale wallet movements for indications of future market direction.

Ethereum Faces Selling Pressure As Whales Exit

Ethereum is facing a critical test as price action continues to lack clarity, and support levels remain fragile. Despite brief attempts to rebound, ETH has failed to establish a clear bottom, and the downtrend structure remains intact. The market is struggling to define a strong demand zone, making it difficult for bulls to sustain upward momentum. As selling pressure mounts, analysts are warning that Ethereum may continue to slide toward lower demand levels in the absence of strong buying interest.

Broader macroeconomic conditions continue to weigh heavily on risk assets like Ethereum. Global trade tensions, particularly the unresolved tariff standoff between the United States and China, have created uncertainty across financial markets. Combined with fears of a slowing global economy and lack of coordinated fiscal support, crypto markets remain under pressure.

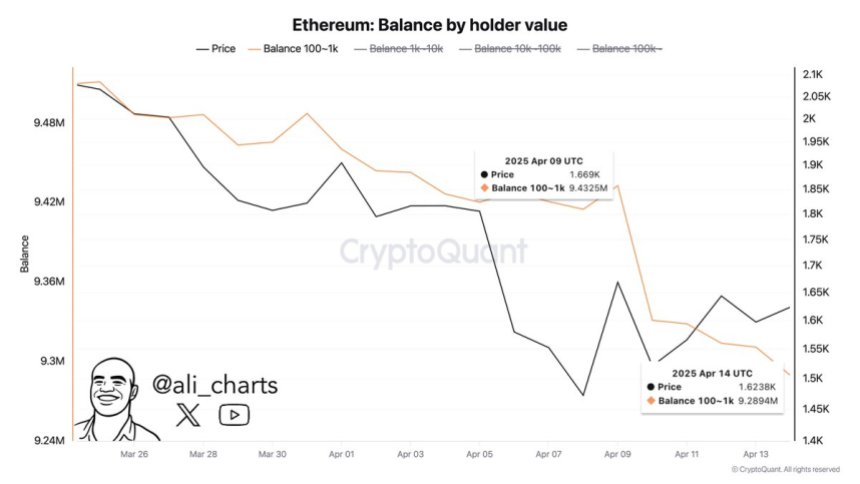

Adding to the bearish sentiment, top analyst Ali Martinez shared on-chain data revealing that whales have offloaded approximately 143,000 ETH over the past week. This large-scale distribution by influential holders has significantly weakened Ethereum’s outlook, reinforcing concerns that smart money is preparing for deeper downside.

Since late December, ETH has remained in a prolonged bearish trend, with every attempt at recovery being met by renewed selling. Unless bulls reclaim key technical levels and shift market sentiment, Ethereum may continue to slide further.

ETH Price Stuck In Volatile Range

Ethereum is currently trading at $1,600 after enduring days of massive volatility and macroeconomic-driven uncertainty. Despite brief relief bounces, ETH remains locked in a bearish structure, unable to generate sustained momentum. For bulls to regain control, reclaiming the $1,850 resistance level is critical. This level aligns with the 4-hour 200 MA and EMA around $1,800, making it a key zone to watch for confirmation of a short-term trend reversal.

Holding above these moving averages would signal renewed strength and possibly mark the beginning of a recovery rally. However, price action continues to struggle beneath them, and failure to push above these indicators would confirm persistent weakness. In that case, Ethereum may retest the $1,500 level or even dip below it if selling pressure intensifies.

The current environment is shaped by global tensions and macro uncertainty, with no clear catalysts to drive a breakout in either direction. As long as ETH remains below its key moving averages, the risk of another leg down remains elevated. Bulls must act swiftly to flip sentiment and avoid a deeper correction toward long-term demand levels.

Featured image from Dall-E, chart from TradingView