Ethereum Alert: Analyst Warns of Potential Plunge to $2,850 - Here’s Why

Ethereum faces turbulent waters as technical analysis points toward significant downside risk.

The Bearish Case Emerges

Market analysts are flashing warning signals for ETH, predicting a potential retreat to the $2,850 level. This represents a substantial drop from current trading ranges, sparking concerns among traders and long-term holders alike.

Technical Breakdown

Chart patterns suggest weakening momentum and failed support levels. The $2,850 target emerges from Fibonacci retracement analysis and key historical support zones that previously served as launchpads for ETH rallies.

Market Context Matters

While the prediction sounds alarming, seasoned crypto veterans know these corrections often create buying opportunities. The same analysts who predict doom today will likely be chasing momentum tomorrow—typical Wall Street behavior, just with more volatile assets.

Ethereum's fundamentals remain strong despite short-term technical headwinds. The network continues to process millions of transactions while developers build the next generation of decentralized applications.

Key Price Levels For Ethereum Now

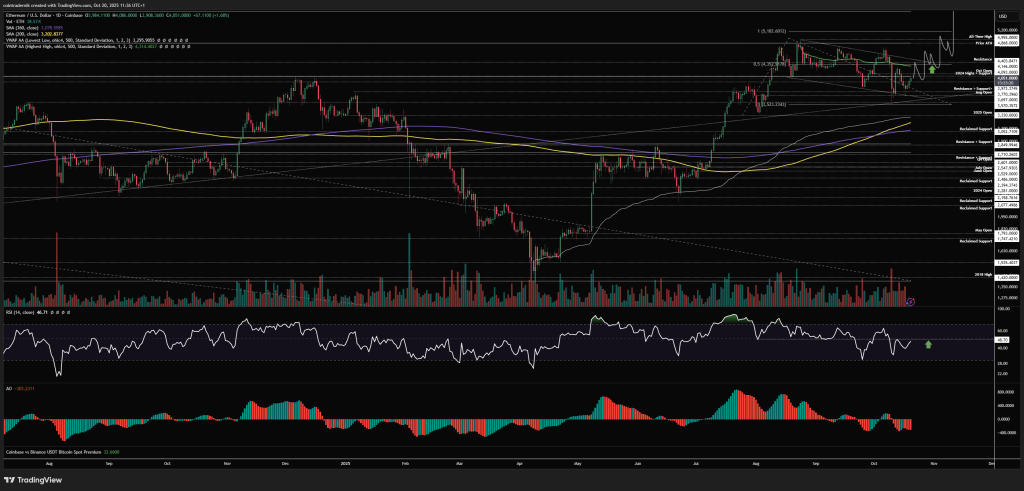

On the weekly ETH/USD chart, Patel said the market “wicked lower into the August open last week but held above the previous weekly low and trendline support,” resulting in an inside week that nevertheless closed “marginally below that major pivot.” The pivot is explicit: “We want to see this pivot at $4,093 reclaimed immediately and not flipped into resistance here on the lower timeframes, or else we could expect another flush of the lows towards that 2025 open.”

If buyers do force the reclaim, Patel expects last week’s action to stand as a quarterly low: “If we do reclaim $4,093 here, which is what I expect, we should have our quarterly low now in and I WOULD want to see $4,400 flipped into support for the move higher into all-time highs and beyond.”

He framed the weekly invalidation at $3,700, warning that a close below would put the yearly open on watch as “last-stand support” for the bullish structure; failure there risks “a much bigger unwind back into $2,850.” Patel’s base case remained constructive: “acceptance back above $4,093 into next week and then a close above $4,400 for October, leading to new highs through $5,000 in early November and a very strong month for ETH.”

The daily ETH/USD read connects that high-timeframe blueprint to momentum and market structure. Patel noted “momentum exhaustion into the lows” followed by a higher-low last week, a formation that now must be defended. He wants to see the sequence reassert itself with a drive above the mid-range and a subsequent higher-low above the weekly pivot: “we absolutely want to see this structure now protected and price to FORM a higher-high above the mid-range at $4,352 and then another higher-low above $4,093 before a breakout higher and a push towards fresh highs.”

For confirmation of an impulsive leg, he flagged a trendline break, a flip of the ATH-anchored VWAP into support, and an RSI regime shift: “If we get a trendline breakout and price flips that ATH VWAP into support with daily RSI above 50, I’d expect a MOVE into $4,950 very swiftly, followed by price discovery in November.” The daily invalidation mirrors the weekly logic: if $4,093 acts as resistance and the market pushes below $3,700—then closes beneath it—“we’re absolutely retesting the yearly open,” in his view.

ETH Vs. BTC

Against Bitcoin, Patel contends that the relative pair has likely printed its Q4 low. On the weekly ETH/BTC chart, price was rejected at trendline resistance, then retraced to the yearly open and held, closing “marginally green” while respecting trendline support off the 2025 lows.

“It is my view that the Q4 low for the pair has formed here,” he wrote, adding that a retest and break above the descending boundary into early November would set the stage for a measured expansion: “acceptance above 0.0417 opens up the next leg higher into 0.055.” He placed weekly invalidation at 0.0319.

The daily ETH/BTC map refines those signals into actionable levels. Price “marked out that low between 0.0319 and the yearly open before bouncing hard and reclaiming 0.036 as support.” Ideally, 0.036 now acts as a springboard; if not, Patel allows for a higher-low “above the 0.0319 level before continuation higher.”

The tactical tell would be a flip of nearby supply: “If we can flip 0.0379 as reclaimed support here, that would be promising for the view that a trendline breakout is imminent, following which I would expect 0.0417 to be taken out and price to head higher, with minor resistance above that at 0.049 before 0.055.” He also identified a confluence band below: “We have a confluence of support between 0.0293 and 0.0319, so flipping that range into resistance would be very bearish ETH/BTC.”

Taken together, Patel’s Oct. 10 blueprint hinges on three synchronizations: ETH/USD must swiftly reclaim and defend $4,093; $4,400 must convert from ceiling to floor to clear the runway toward prior highs and a potential $4,950 extension; and ETH/BTC should drive through 0.0379 and then 0.0417 to confirm relative-strength breadth beneath any dollar-denominated breakout.

The downside is equally crisp: failure to reclaim $4,093, a weekly close below $3,700, and a subsequent loss of the yearly open would validate the risk that, in Patel’s words, Ethereum could “unwind back into $2,850.”

At press time, ETH traded at $3,872.