Solana Weathers Historic Liquidation Storm - Outshines Ethereum in Market Resilience Battle

Blockchain networks face their ultimate stress test as liquidation tsunamis reveal true structural integrity.

The Great Protocol Showdown

When markets convulse and leverage unravels, Solana's architecture demonstrates remarkable bounce-back capability that leaves Ethereum playing catch-up. The numbers don't lie - while both networks faced unprecedented selling pressure, recovery patterns tell completely different stories.

Architecture Under Fire

Transaction speeds, fee structures, and network congestion separate the contenders from the pretenders when billions in positions get liquidated. Solana's throughput advantages become glaringly obvious when Ethereum's gas fees spike to levels that would make a Wall Street banker blush - and that's saying something in an industry where overpriced middleware passes for innovation.

The Resilience Gap Widens

Market infrastructure isn't built for sunny days - it's forged in fire during catastrophic events. While Ethereum maintains its first-mover dominance, Solana's performance during extreme volatility suggests the scalability race might already be over. The real question isn't which chain leads today, but which ecosystem survives tomorrow's inevitable black swan.

Why Solana High-Performance Design Continues To Shine

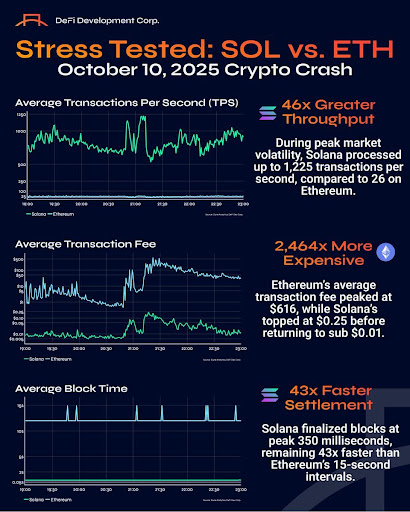

In an X post, the Nasdaq-listed go-to Solana Digital Asset Treasury (DAT), DefDevCorp, has revealed that when the largest liquidation event in crypto history hit last Friday, most of the market froze, and ethereum stumbled. However, Solana didn’t flinch, powering through one of the most chaotic trading sessions ever recorded.

At the peak of volatility, solana sustained 1,225 transactions per second, finalized blocks in just 350 milliseconds, and saw transaction fees briefly rise to $0.25 before normalizing below $0.01. Meanwhile, ETH’s infrastructure buckled under demand as the network struggled to process beyond 26 TPS. Its block times extended to 15 seconds, and saw average gas fees explode to $616, effectively locking out users and rendering the chain unusable during the crisis. ETH became unreliable, impractical, and effectively unusable during the chaos.

As DefiDevCorp noted, when users are priced out and transactions can’t clear, the network might as well be offline. In moments of high load, the Core promise of a blockchain to remain accessible, affordable, and reliable must hold. However, after nearly 20 months of uninterrupted uptime, weathering its busiest moments, it’s abundantly clear that SOL’s continued upgrades and optimizations have paid off dramatically.

DefiDevCorp concluded that no other chain currently comes close to handling global value transfer at this scale, under such extreme conditions, with the same level of performance. The takeaway from the firm’s post is that only SOL stays fast, cheap, and usable, even when global markets melt down.

Why SOL Price Doesn’t Match Its Reliability

A Researcher at alphapleaseHQ and Advisor at KaminoFinance, Aylo, has also mentioned that he had assets and Decentralized Finance (DeFi) positions open on both Solana and Ethereum when the crypto market collapsed last Friday. During this time, he had zero issues using the SOL network, while the ETH network was unusable due to the costs, which often led to market crashes, and the Rabby wallet also went down.

Aylo added that the ETH maxis should be much angrier about the performance of their L1. With this development, SOL continues to prove it’s the most performant and reliable blockchain under real-world pressure that we have in crypto. He pointed out that SOL’s valuation doesn’t reflect the resilience it is proving in the digital world.